Domestic silver price

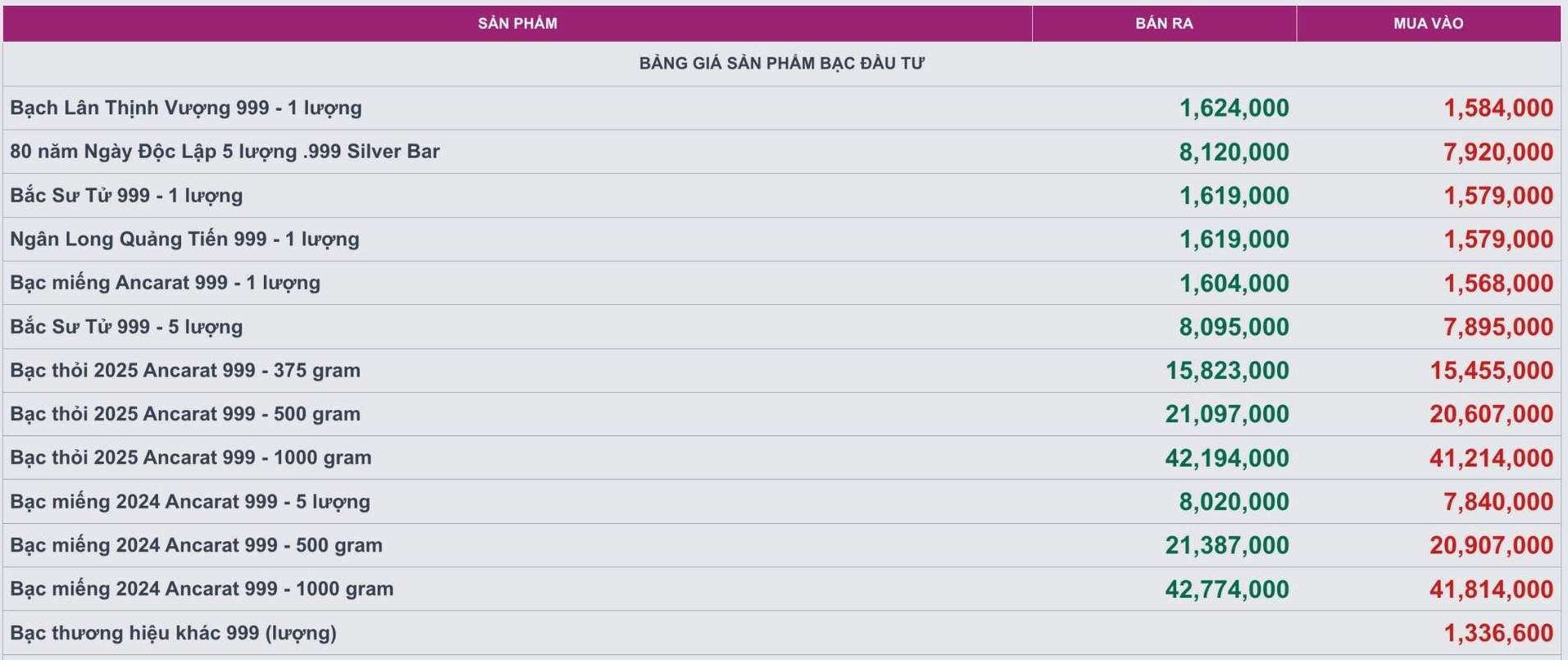

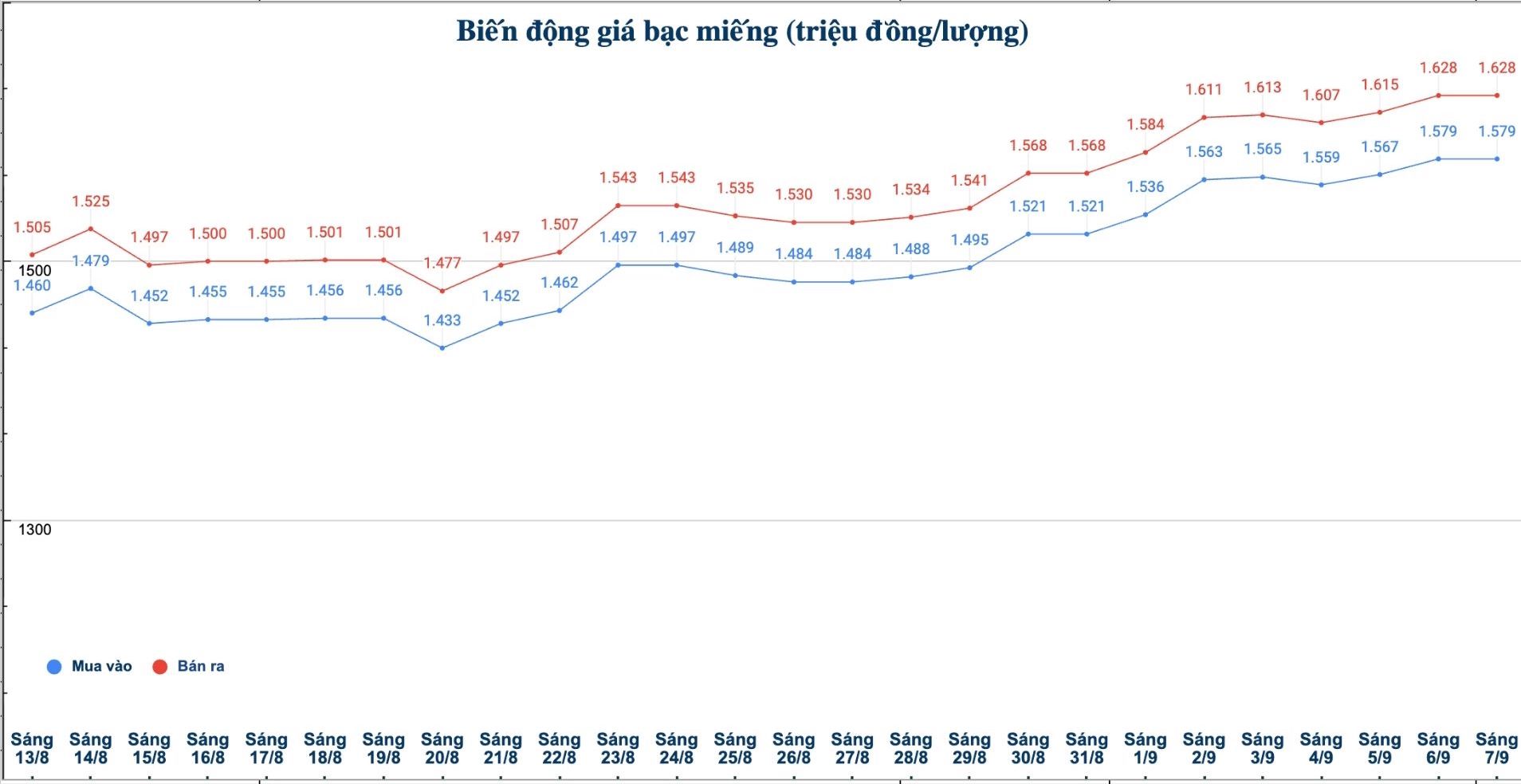

As of 9:45 a.m. on September 7, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at 1.568 - 1.604 million VND/tael (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 41.814 - 42.774 million VND/kg (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 41.214 - 42.194 million VND/kg (buy - sell).

In the previous trading session (morning of August 7, 2025), the price of 999 Ancarat 999 (1kg) was listed by Ancarat Ngoai Quy Company at 37.543 - 38.533 million VND/kg (buy - sell).

Thus, if buying 999 999 (1kg) Ancarat 2025 silver bars of Ancarat Petrochemical Company in the session of August 7 and selling them in this morning's session (September 7), buyers will make a profit of VND 2.681 million/kg.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.579 - 1.628 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 taels of silver (1 tael) at Phu Quy Jewelry Group was listed at 1.579 - 1.628 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 42.106 - 43.413 million VND/kg (buy - sell); unchanged in both directions compared to yesterday morning.

In the previous trading session (morning of August 7, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 38.693 - 39.893 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on August 7 and selling it this morning (September 7), buyers will make a profit of VND 2.213 million/kg.

World silver price

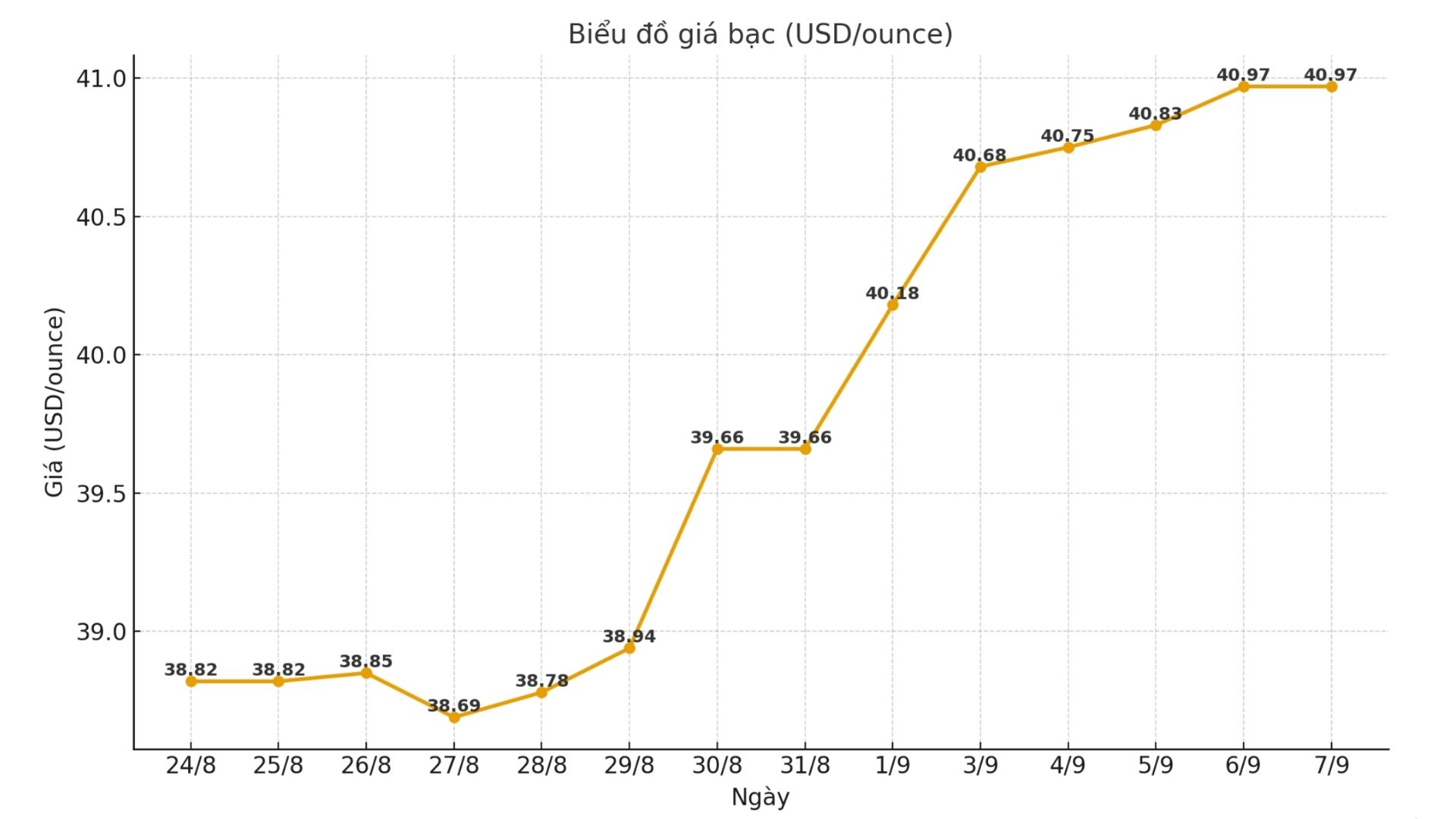

On the world market, as of 9:45 a.m. on September 7 (Vietnam time), the world silver price was listed at 40.97 USD/ounce.

Causes and predictions

Silver prices ended the week up but did not break out as strongly as gold. According to analyst James Hyerczyk, the reason for the negative US jobs report is market sentiment: Declining US interest rates and the US dollar (USD) are often in the favor of the precious metal, but concerns about slowing growth have caused silver - the capital associated with industrial demand - to lose some of its appeal.

He said that in August, the US economy created only 22,000 more jobs, far below the expectation of 75,000, the unemployment rate increased to 4.3%. The ADP report also disappointed, raising expectations that the US Federal Reserve (FED) will cut interest rates at its meeting on September 17, with the possibility of almost certain a 25 basis point cut.

"The US dollar and bond yields both plummeted. This often supports silver, but the fear of recession has kept the increase in check," said James Hyerczyk.

The expert added that the market is also concerned about the risk of inflation, causing demand for industrial silver to decrease.

Technically, James Hyerczyk believes that silver is still in an uptrend, with resistance at 41.47 USD/ounce and a further target of 44.22 USD/ounce. Support is close to 39.78 USD/ounce and stronger at 38.20 USD/ounce.

"The outlook is still leaning towards price increases, but investors need to be cautious about weak economic signals" - James Hyerczyk commented.

See more news related to silver prices HERE...