The comex silver contract in December this week recorded its highest level in 14 years, reaching 42.29 USD/ounce. Safety-haven demand amid market uncertainty is boosting the precious metal.

Gold prices today continue to set a new record, thereby reinforcing the view that silver prices are also on track to do the same.

The all-time record for the most recent Comex silver contract was 50.36 USD/ounce, set in January 1980. Silver prices have more than doubled in the past three years, thanks to increased geopolitical risks, including disruptions to global trade due to US tariffs.

The main factor increasing the current price of silver is the prospect of US interest rates falling this year, starting from the September meeting of the Federal Open Market Committee (FOMC).

The market is widely expected to see a 0.25 percentage point decline. After today's US unps up jobs report, it is forecasted that there will be three total cuts of 0.25% this year.

Another positive factor for silver is the global bond market is fluctuating. Global bond yields have risen ( decreased), mainly due to concerns about inflation, government bond issuances and fiscal discipline.

In addition, uncertainty about the independence of the US Federal Reserve (FED) is putting more pressure on the bond market as well as increasing investors' concerns.

History shows that September and October are often a difficult period for securities, finance and currency. September was the worst month on the US stock market. This is creating a hesitant mentality in the stock market, thereby supporting silver as a safe-haven asset.

Notably, there is no strong technical signal that silver is approaching its peak. That means the main trend of prices will continue to move sideways until there are clear signs on the chart warning of the possibility of a peak.

December silver futures are currently leaning towards the overall short-term technical advantage for buyers. The next bullish target is the closing price exceeding the solid technical resistance level at $45/ounce. In contrast, the next bearish target for the bears is the closing price below the solid support level at $38/ounce.

The first resistance level seen at the peak this week was 42.29 USD/ounce, then 43 USD/ounce. The next support level was seen at $41/ounce and then the low this week at $40.555/ounce.

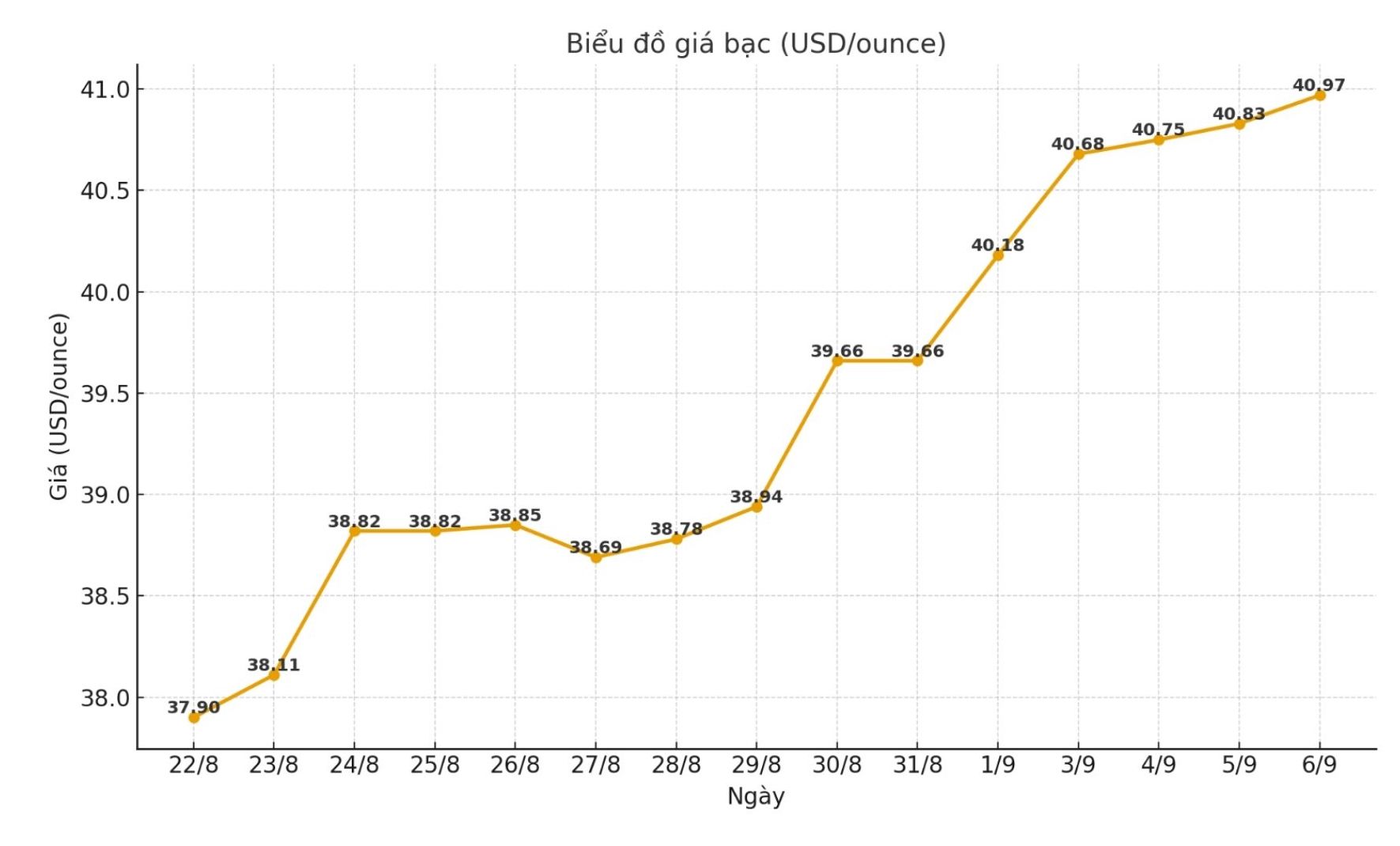

Update on domestic silver prices

As of 9:25 a.m. on September 6, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at 1.568 - 1.604 million VND/tael (buy - sell). The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 41.214 - 42.194 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 41.814 - 42.774 million VND/kg (buy - sell).

As of 10:50 on September 6, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.579 - 1.628 million VND/tael (buy - sell); an increase of 12,000 VND/tael for buying and an increase of 13,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 42.106 - 43.413 million VND/kg (buy - sell); an increase of 320,000 VND/kg for buying and an increase of 347,000 VND/kg for selling compared to yesterday morning.