Domestic silver price

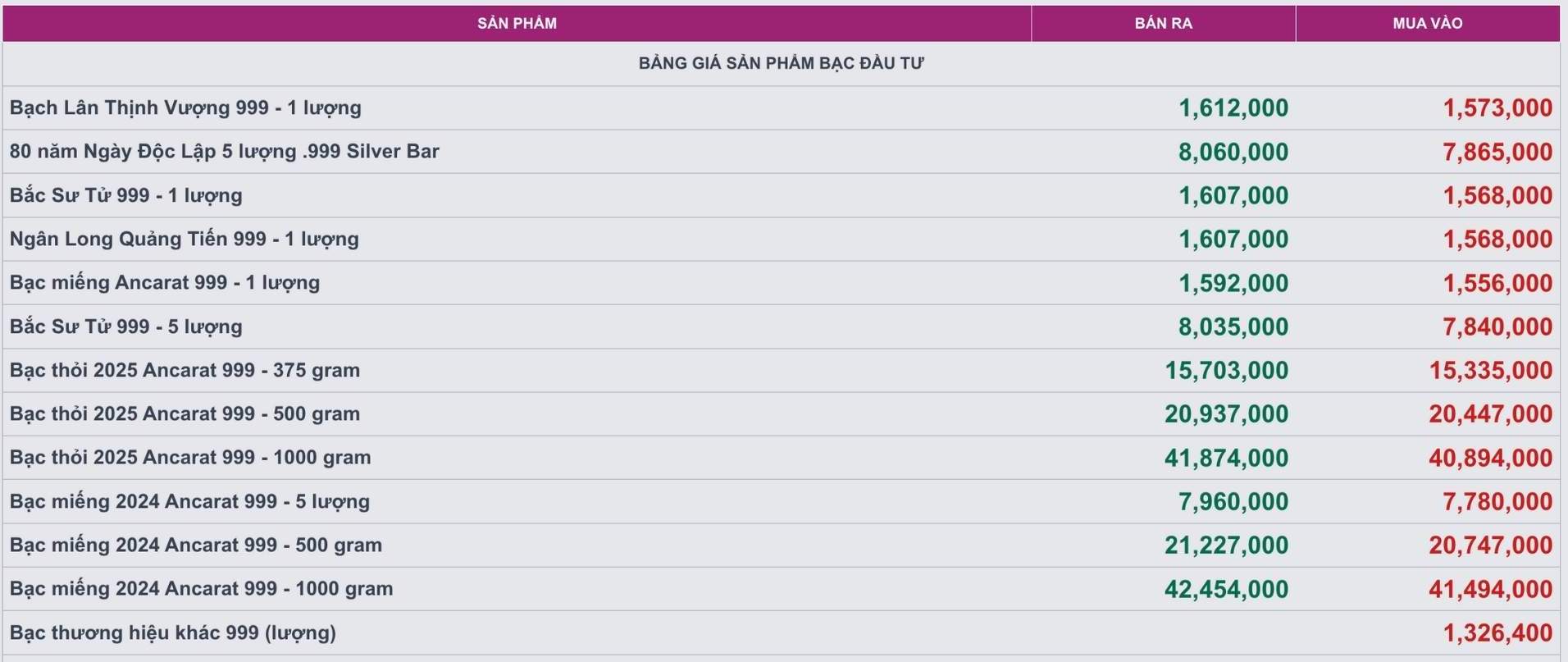

As of 10:00 on September 5, the price of 999 999 coins (1 tael) at Ancarat Metallurgy Company was listed at VND 1.556 - 1.592 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 40.894 - 41.874 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 41.494 - 42.454 million VND/kg (buy - sell).

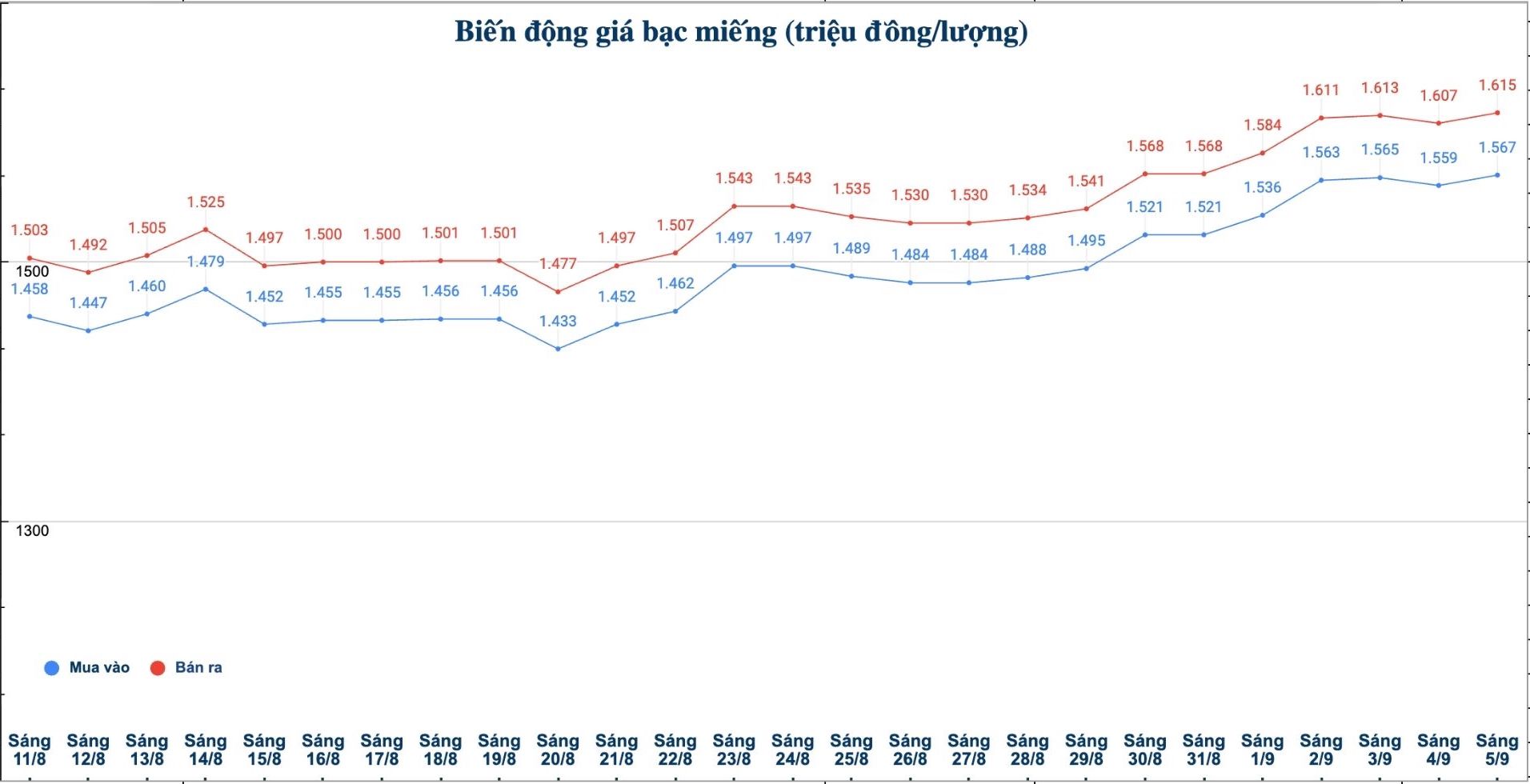

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.567 - 1.615 million VND/tael (buy - sell); an increase of 8,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.567 - 1.615 million VND/tael (buy - sell); an increase of 8,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars (1kg) at Phu Quy Jewelry Group was listed at 41.786 - 43.066 million VND/kg (buy - sell); an increase of 213,000 VND/kg in both buying and selling directions compared to yesterday morning.

World silver price

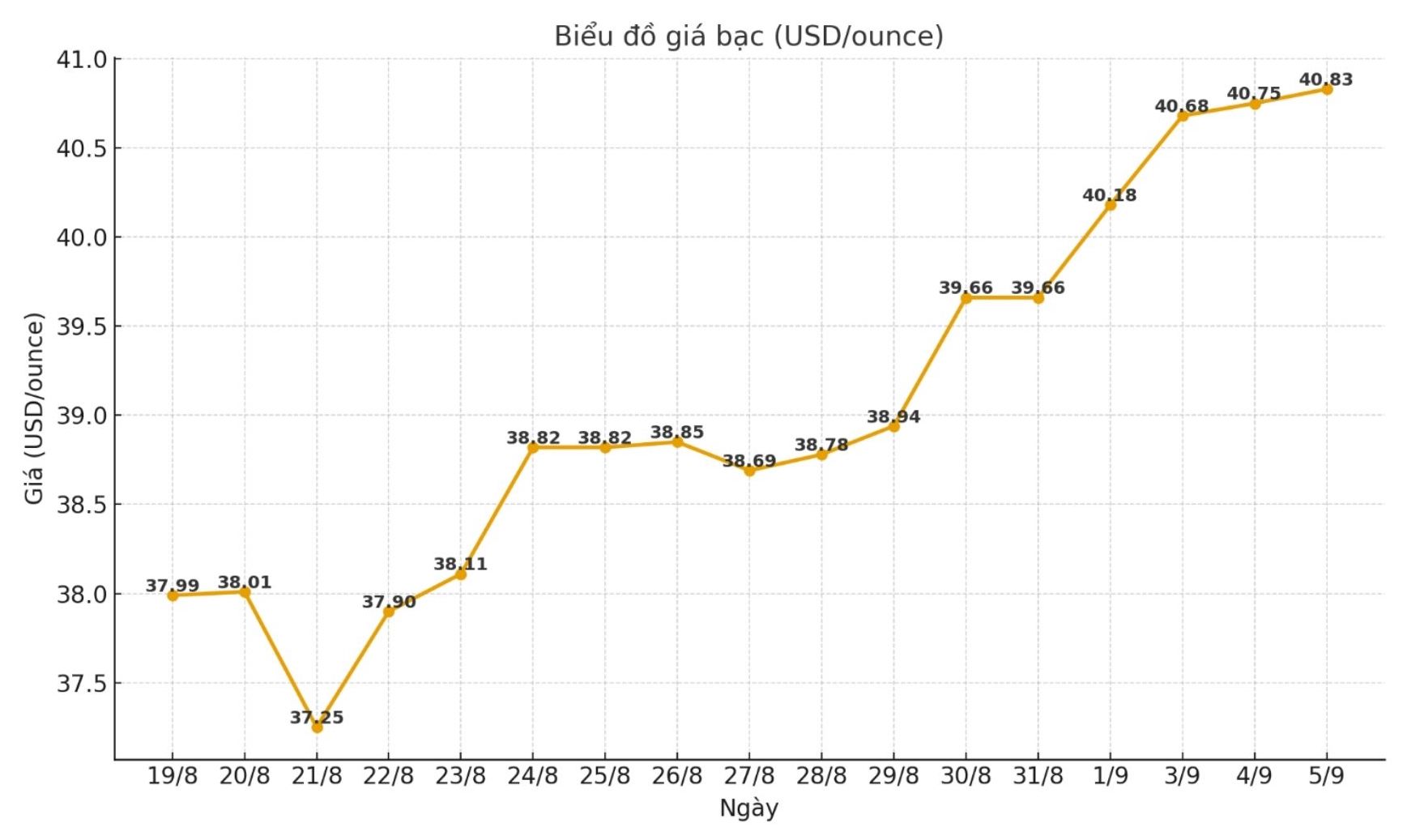

On the world market, as of 10:03 a.m. on September 5 (Vietnam time), the world silver price was listed at 40.83 USD/ounce; up 0.08 USD compared to yesterday morning.

Causes and predictions

Silver prices increased slowly due to profit-taking after a strong increase. According to analyst James Hyerczyk, this is also a general downward trend in the precious metals market as gold retreated after setting a new record.

"Investors are cautiously restructuring their positions ahead of the US non-farm payrolls (NFP) report, which is seen as a key factor for the upcoming policy decision of the US Federal Reserve (FED) - James Hyerczyk said.

Technically, the expert said that silver has an important support zone at 39.78 USD/ounce, a withdrawal rate of 50%, which is considered a potential buying point. Marks around $28.10 an ounce will also be closely monitored. If these levels are maintained, the upside prospects will remain maintained.

"From a macro perspective, the US labor data is disappointing as new jobs, private payrolls and unemployment claims are all weaker than expected. This raises expectations for the Fed to cut interest rates soon, with a probability of up to 97.4% for a 25 basis point cut in September," said James Hyerczyk.

He added that expectations of policy easing have caused bond yields to fall across the board, while the US dollar has moved sideways, creating a supportive environment for gold and silver.

In the short term, James Hyerczyk said that silver prices are likely to fluctuate between 39.78 - 41.47 USD/ounce until the NFP report is released. If it successfully breaks above $41.47/ounce, the metal could head toward a long-term resistance zone of $44.22/ounce.

See more news related to silver prices HERE...