Record cash flow flows into gold ETFs

In its monthly report on gold ETFs, the World Gold Council (WGC) said that the cash flow into gold-backed ETFs reached a record level in the third quarter, in September alone, it accounted for more than 60% of the total net buying volume of the whole quarter.

Global ETFs added 145.6 tonnes of gold in September, equivalent to more than $17.3 billion. In the whole quarter, holdings increased by 221.7 tons, worth nearly 26 billion USD.

The surge in gold prices has pushed the total value of assets under management (AUM) of funds to unprecedented highs, while physical gold is only about 2% lower than the record recorded in November 2020.

In terms of region, North American investors continued to lead with purchases of 88.4 tons of gold, worth 10.5 billion USD in September. The WGC believes that investment demand will increase thanks to the weakening of the US dollar, pressure from the risk of a US government shutdown and expectations of a rate cut when the FED lowers 0.25 percentage points for the month.

In Europe, gold ETFs recorded the fifth consecutive month of net attraction, increasing by 37.3 tons, worth 4.4 billion USD - the third strongest month in the region's history.

The fact that the European Central Bank (ECB) and the Bank of England (BoE) keep interest rates unchanged while inflation increases has led to actual interest rate cuts, increasing policy uncertainty.

The WGC said capital flows reflect both demand for purchasing power and following the uptrend, especially in the UK - where concerns about inflation are still high.

The Asia region also recorded positive capital flows, up 17.5 tons ($2.1 billion), with India leading with a net purchase value of $902 million. The WGC explains the reason as favorable fluctuations in the domestic currency and increased demand for shelter in the context of weak domestic stocks and geopolitical risks.

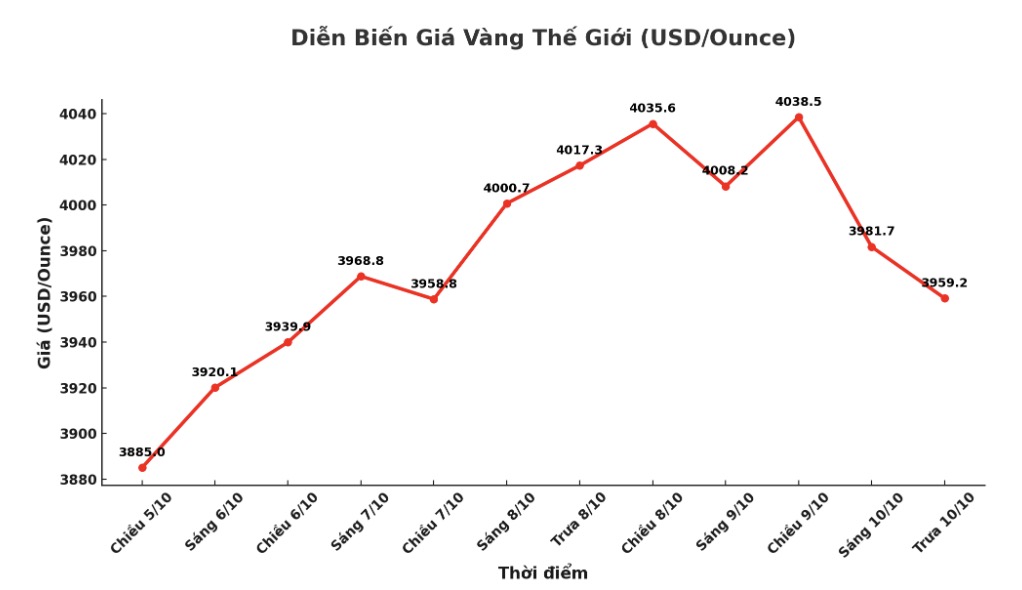

The market fell into a state of "excessive buying"

In a separate report, the WGC warned that investment demand is too strong - the main factor pushing gold prices to historical peaks is causing the market to fall into a state of "overbought". Despite the rising risk of an adjustment, the organization still believes that fundamental factors will continue to support gold prices until the end of the year.

The WGC added that the US dollar is also currently overbought, but the fluctuations in the stock market in October - which was the time when many fluctuations could help gold maintain its position.

Our analysis shows that gold is still likely to stand firm, and could even be further supported if stocks correct, as a series of other positive factors are still present. Perhaps just a major liquidity tighten can pull both gold and stocks down, but there is currently no clear sign of a crack in the credit or banking system, the WGC said.

See more news related to gold prices HERE...