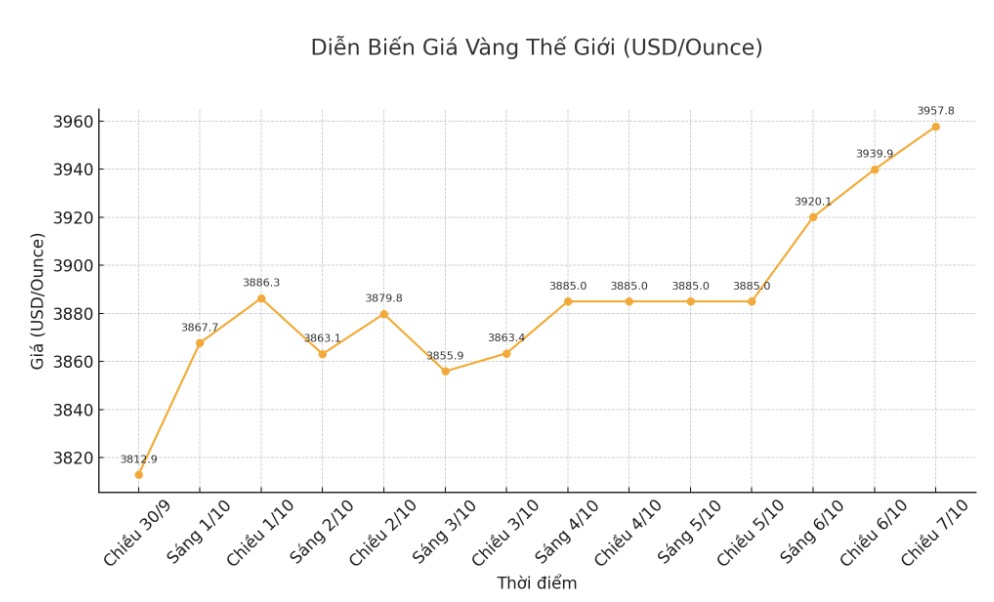

According to the report, gold prices are expected to increase to $4,000/ounce by mid-2026.

The report said that the main driver comes from strong structural demand from central banks, along with the Fed's monetary easing policy, which is expected to promote ETF inflows into gold.

Goldman Sachs believes that gold buyers in the market are divided into two large groups. The first group is steadfast investors, including central banks, ETFs and speculators, who regularly buy gold regardless of price fluctuations to hedge against risks or based on macroeconomic viewpoints.

This strategic capital flow is considered a price guideline factor, as on average, every 100 tons of gold purchased by this group will increase in price by about 1.7%.

Meanwhile, the remaining group is opportunity buyers, such as households in emerging markets, who only participate when prices are at what they consider reasonable. According to Goldman Sachs, this group can help create a "dyke" for prices when the market decreases and create a "resistance" force when prices increase.

The report said that in July, central banks bought about 64 tons of gold, lower than the average of 80 tons/month in 2025. However, this is a development in line with the seasonal law as gold buying activities often stagnate in the summer and accelerate again from September.

Since Russia froze foreign exchange reserves due to the conflict in Ukraine in 2022, central banks - especially in emerging economies - have accelerated gold purchases by five times compared to before, according to Goldman Sachs.

Goldman Sachs believes this is a structural change in reserve management behavior, and this trend is likely to last for at least another three years as emerging central banks continue to diversify reserves, increasing the proportion of gold in their portfolios.

The latest survey by the World Gold Council also corrobores this assessment, with 95% of central banks surveyed believing that global gold reserves will increase in the next 12 months, and 43% saying they will increase their holdings - the highest rate since 2018 and no bank plans to sell.

Goldman Sachs also noted a strong optimistic sentiment in the derivatives market. The net buying position on COMEX is currently at a high level, in the 73% group, the highest since 2014, showing that speculators are betting strongly on price increase.

However, the research team warned that focusing too many buying orders could lead to short-term technical adjustments as the market returns to a state of balance.

The report shows that traditional bond portfolios are vulnerable to slowing economic growth and high inflation, especially during times of monetary policy uncertainty or when supply shocks occur such as the energy crisis.

Goldman Sachs recalled the 1970s, when large public spending and declining confidence in the US central bank's ability to control inflation caused gold prices to increase sharply, as investors sought safe-haven assets outside the system.

Similarly, as Europe is cut off from gas supplies from Russia in 2022, gold and goods are rare assets that have actually increased in price.

According to Goldman Sachs, in any 12-month period where both stocks and bonds record negative yields, gold and commodities often bring positive results.

The report concludes that in the context of an increasingly focused global supply chain and resources becoming a geopolitical tool, gold continues to be a safe haven and an effective portfolio diversification tool in today's high-risk environment.

See more news related to gold prices HERE...