On August 26, the Government announced Decree 232/2025/ND-CP, ending the monopoly mechanism in the production of gold bars, export and import of raw gold.

This is considered a strategic turning point in the process of restructuring the gold market, expected to gradually reduce the gap between domestic gold prices and the world. Many people expect this information to affect market sentiment, helping gold prices cool down.

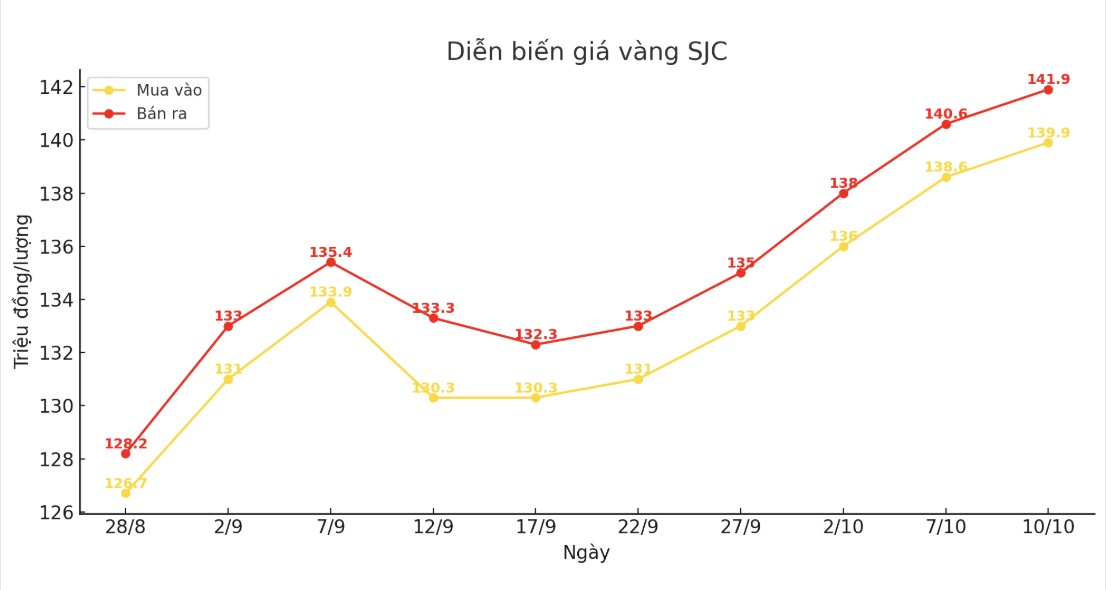

Since then, gold prices have continuously increased. On August 26, the price of SJC gold was listed at 126.1-127.7 million VND/tael (buy in - sell out). Gold rings are listed around 119.3-122.3 million VND/tael (buy in - sell out).

To date, the price of gold bars is listed at 139.9-141.9 million VND/tael (buy in - sell out). Gold rings increased to 136.8-139.8 million VND/tael (buy in - sell out).

Thus, the price of SJC gold bars increased by 13.8 million VND/tael for buying and 14.2 million VND/tael for selling. Meanwhile, gold rings increased by 17.5 million VND/tael for both buying and selling.

The increase in domestic gold prices is mainly due to the impact of the strong increase in the world market. Since August 26, the world gold price has increased by 60 60:00 USD/ounce.

Many people believe that the information about ending the monopoly mechanism in the production of gold bars does not affect the market, but in reality it is not. On August 26, domestic gold prices were about 19.9 million VND/tael higher than world gold prices (calculated at Vietcombank exchange rate). As of today (October 10), this difference has been reduced to about 15.15 million VND/tael.

Thus, the removal of monopoly in gold bar production, along with previous drastic moves in inspecting and examining the gold market, has helped gradually reduce the gap between the two markets.

Experts say that for the policy to penetrate and have a clear impact on the market, it will take time.

Sharing with Lao Dong reporter, Mr. Nguyen Quang Huy, CEO of the Faculty of Finance - Banking (Nguyen Trai University) commented that the removal of monopoly and permission of commercial banks to participate in the production of gold bars has strategic significance, helping to increase competitiveness, diversify supply and move towards a more stable market.

However, these impacts are not immediate. The licensing of production, the construction of production lines, the organization of supervision and especially the building of social trust takes a period of time. During this period, the market sentiment of " rare gold - price will increase" is still strongly dominated, leading to escalating prices and widespread buying - selling gaps.

"From the decree to the implementation, it can take several months, even several years to form a new trust and system. This is a gap that makes it difficult for gold prices to fall immediately but continues to fluctuate strongly" - Mr. Huy said.

In addition, speculative psychology continues to be the dominant factor. Gold is still considered a safe haven, so even if supply improves, prices may be pushed up by short-term speculative cash flow. The large gap between domestic and world gold prices, combined with expectations of exchange rate fluctuations, further increases this trend.

Previously the State was a monopoly on gold bars, now the State Bank will assign the right to import and produce gold bars to a number of eligible banks and enterprises.

Banks and enterprises that want to be licensed to produce gold bars must have a license to buy, sell and trade this item. They also have to meet capital requirements, for enterprises of VND 1,000 billion or more, banks with charter capital of VND 50,000 billion or more.

The dossier and procedures for granting a license to produce gold bars will be regulated by the Governor of the State Bank. This is to ensure that enterprises and banks producing gold bars are organizations with experience, financial capacity, and comply with the law.