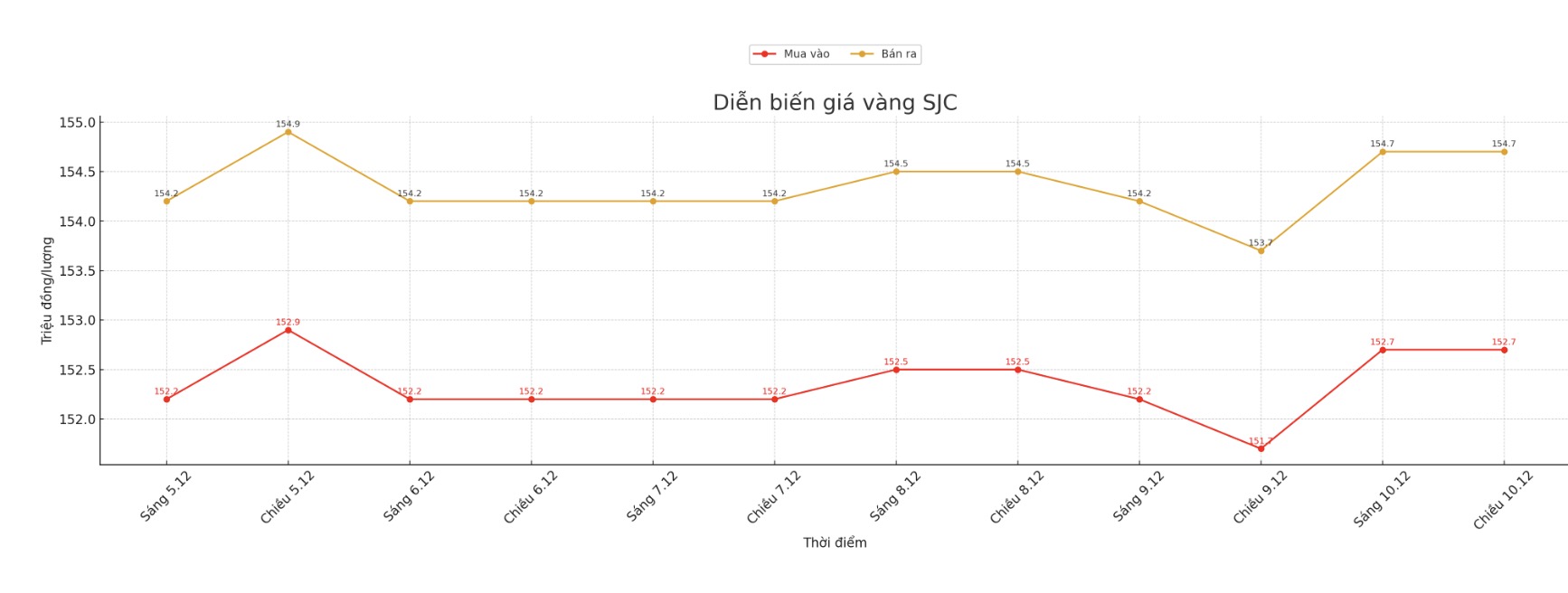

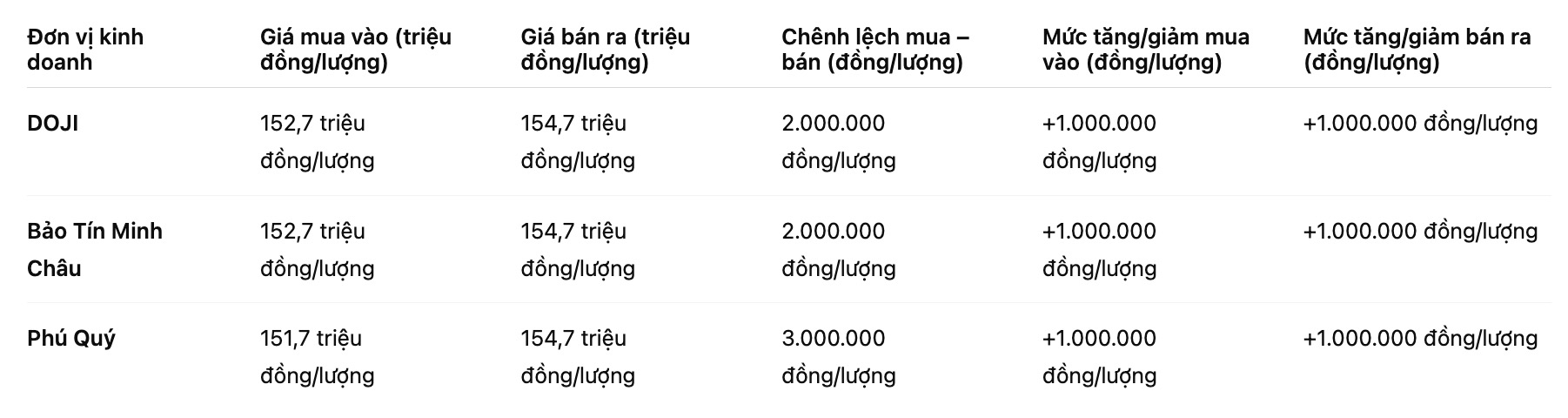

SJC gold bar price

As of 6:45 p.m., DOJI Group listed the price of SJC gold bars at VND152.7-154.7 million/tael (buy in - sell out), an increase of VND1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.7-154.7 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.7-154.7 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

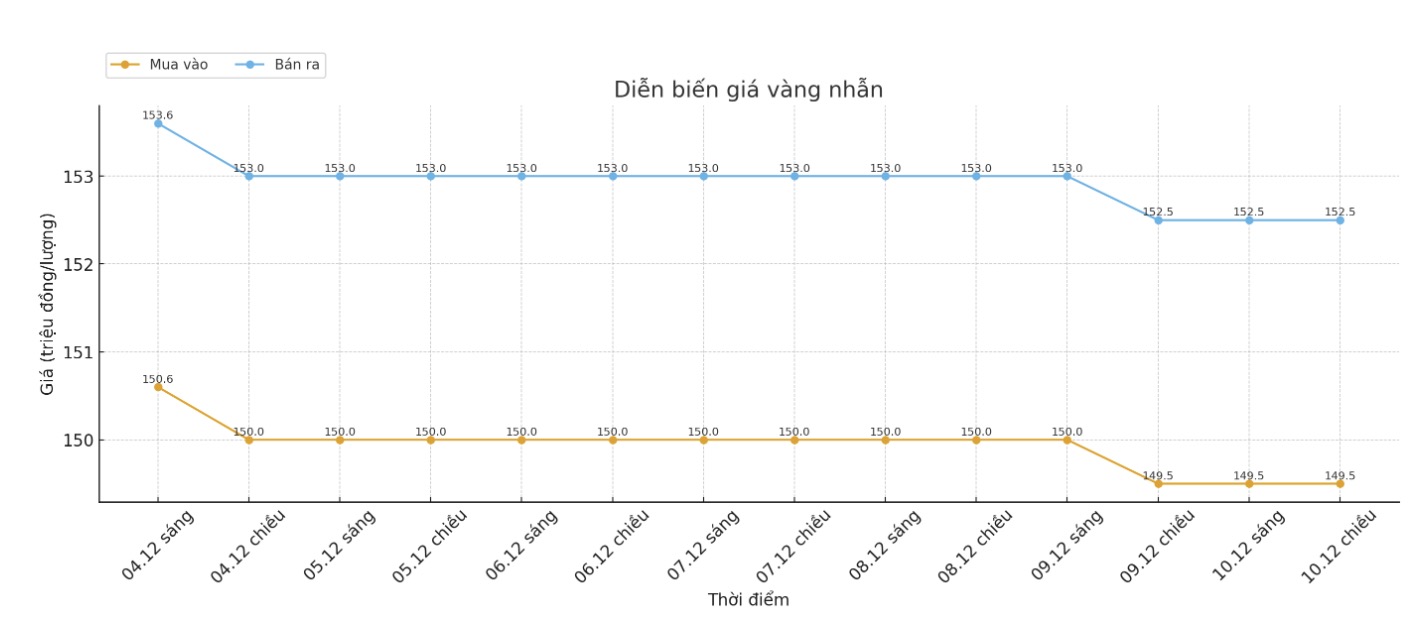

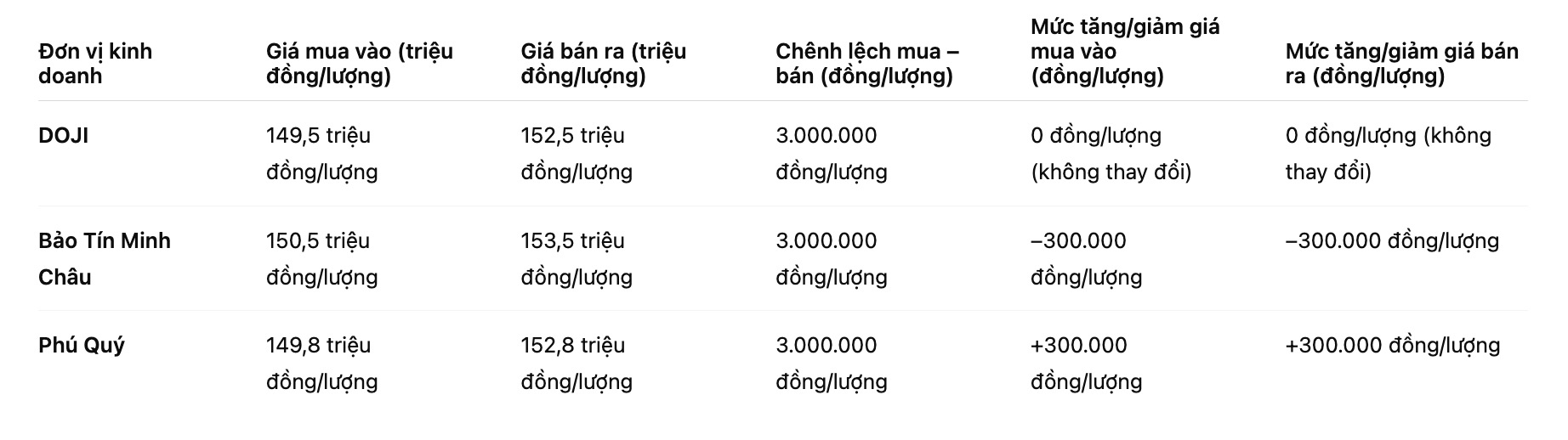

9999 gold ring price

As of 6:45 p.m., DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.8-152.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

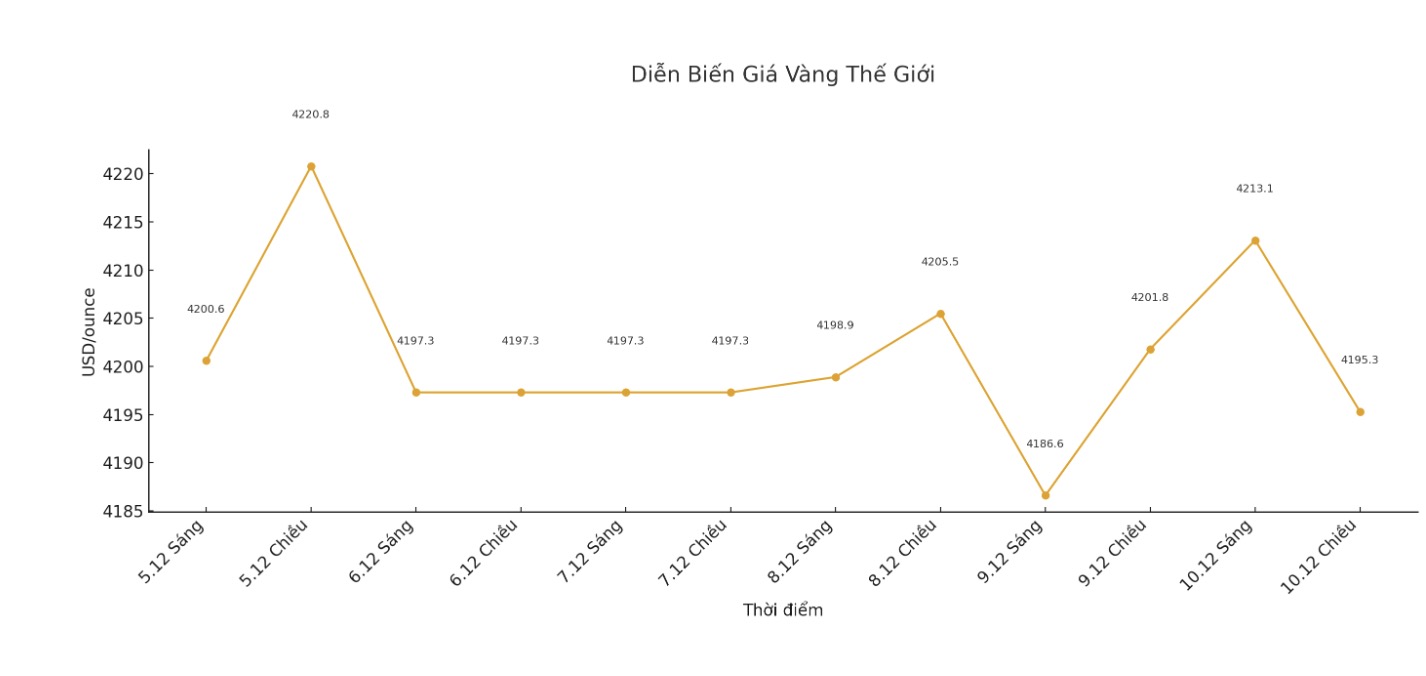

World gold price

The world gold price was listed at 5:45 p.m., at 4,195.3 USD/ounce, down 6.5 USD compared to a day ago.

Gold price forecast

According to analysts, the reason for the increase in gold prices comes from the combination of monetary policy expectations and inflation concerns. The market is confident in a 90 - 95% probability that the US Federal Reserve (Fed) will cut interest rates by another 0.25 percentage points at the monetary policy meeting ending in the early morning of December 12 (Vietnam time).

In an interview with Kitco News, Richard Laterman - Investment portfolio manager at ReSolve Asset Management said that with gold prices having increased by more than 50% since the beginning of the year, investors should not be surprised by the current accumulation period.

However, he emphasized that factors driving gold prices throughout 2025 will continue to persist in 2026. The Canadian asset management company is currently managing more than $300 million.

"geopolitical tensions have eased somewhat, but the system is still under a lot of pressure. Geopolitical uncertainty will continue to be an important factor.

The trend of trading based on currency depreciation is still very strong. Increased public spending is a rare issue of bipartisan consensus in Washington, so we would have a hard time expecting a balanced budget in the near future," he said.

See more news related to gold prices HERE...