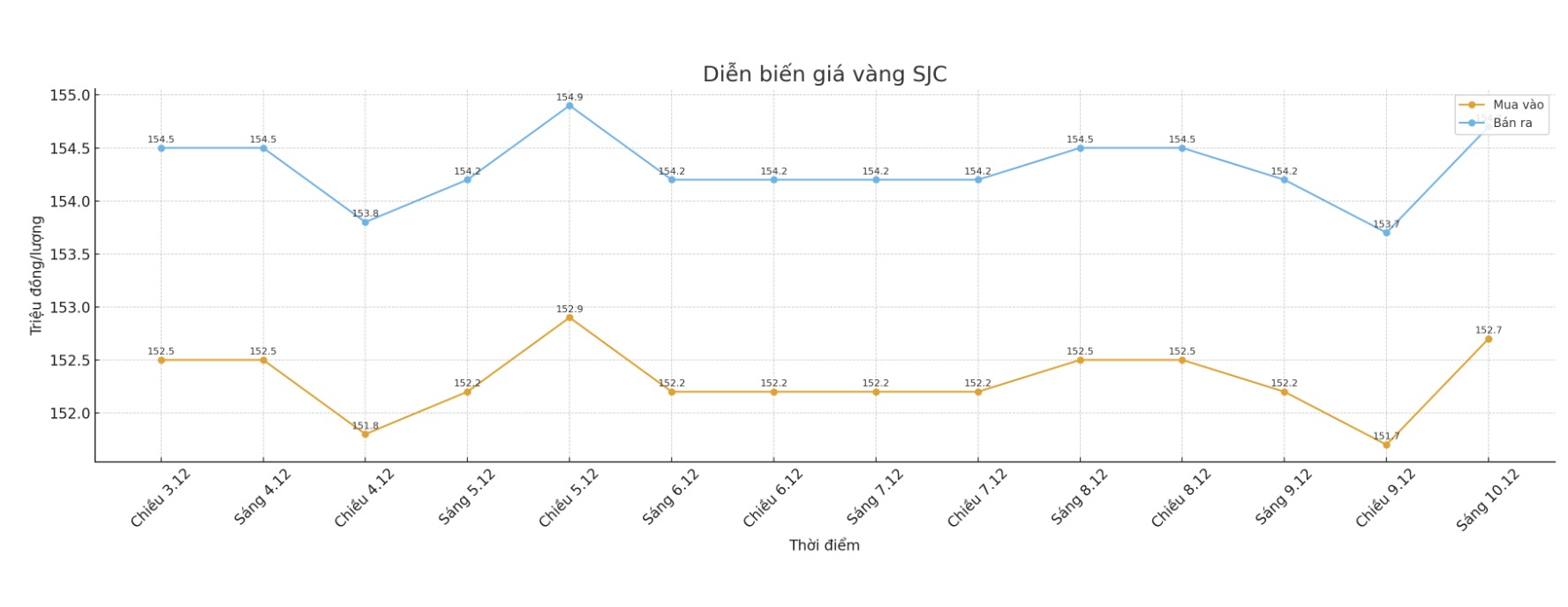

Updated SJC gold price

As of 9:15 a.m., the price of SJC gold bars was listed by DOJI Group at 152.7-154.7 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.7-154.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.7-154.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

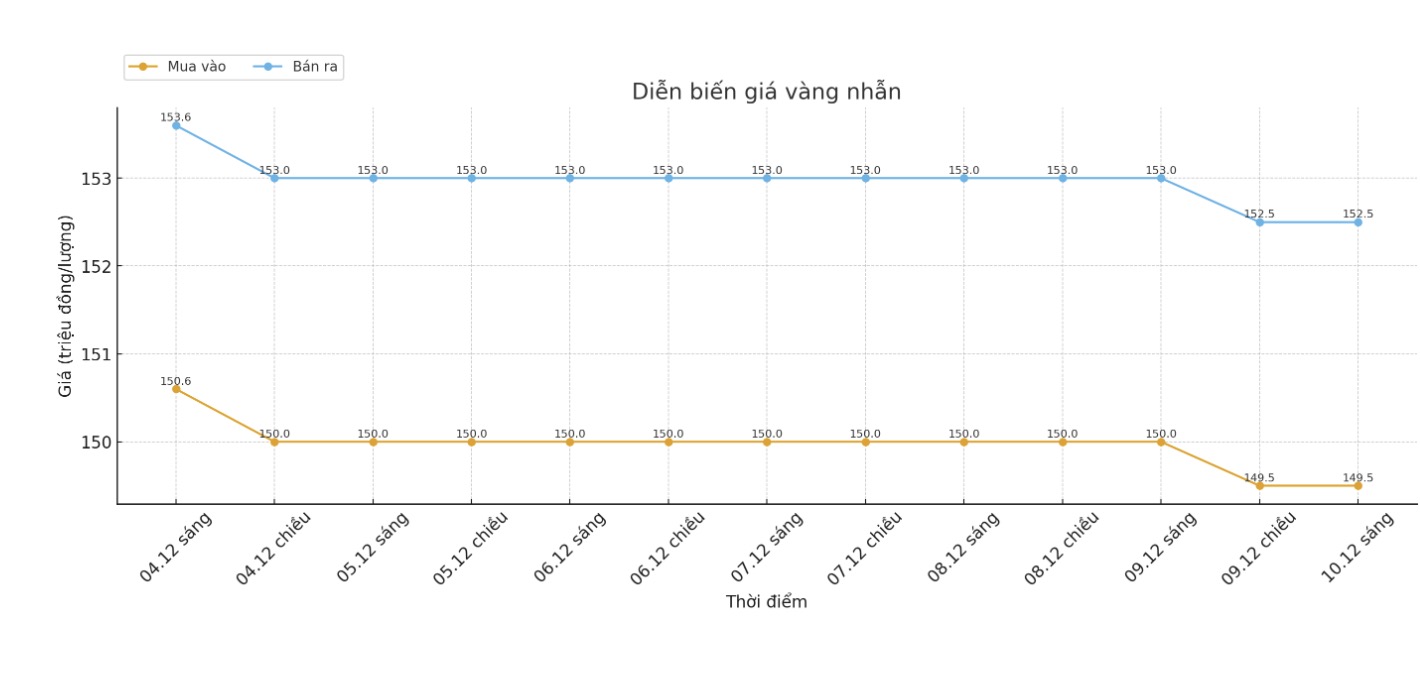

9999 round gold ring price

As of 9:15 a.m., DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.8-152.8 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

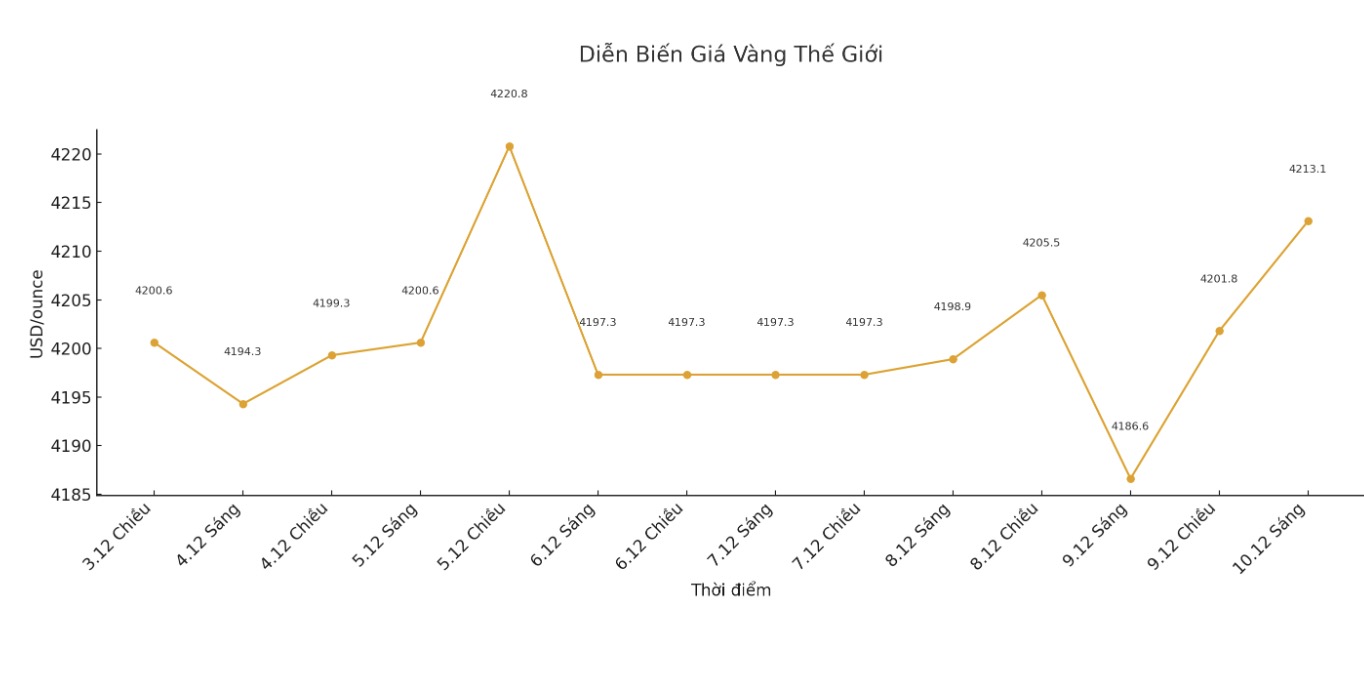

World gold price

At 9:20 a.m., the world gold price was listed around 4,186.8 USD/ounce, down 12.1 USD compared to a day ago.

Gold price forecast

Gold prices increased in the context of technical buying activities appearing as short-term and long-term price charts both maintained a strong upward trend.

According to Gary S. Wagner - commodity broker and market analyst at Kitco, both gold and silver are rising, as investors proactively position before the much-anticipated monetary policy decision of the US Federal Reserve (Fed), scheduled to be released at 2:00 p.m. Eastern time (EST) on Wednesday, after the FOMC meeting this month ended.

According to senior market expert Kelvin Wong at OANDA, investors are taking steps to resettle capital flows. "The market is reacting to the possibility that Fed Chairman Jerome Powell will give instructions on cutting interest rates from a tougher perspective. This means that although the Fed may cut interest rates this week, accompanying forecasts show that the policy easing threshold next year will be higher and tighter."

The market is pricing in a 90% chance that the Fed will cut interest rates by 0.25% this week. However, there are growing expectations that the FOMC statement and Chairman Powell's speech may have a more hawlish tone largely due to concerns about persistent inflation.

The US October and November production inflation reports, which were expected to be released this week, were postponed to January, further increasing the uncertainty surrounding local inflation.

Technically, the next bullish price increase for February gold futures is to reach a close above the solid resistance level at the peak of the contract, also a record level, 4,433 USD/ounce. The closest downside target for the bears is to pull prices below the strong technical support zone at $4,100/ounce.

The first resistance level was determined at 4,285.00 USD/ounce, followed by 4,300 USD/ounce. The first support level was at the night low of $4,197.8/ounce, followed by $4,150.00/ounce.

Notable economic data for the week

Wednesday: BoC interest rate decision, Fed monetary policy decision.

Thursday: SNB interest rate decision, US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...