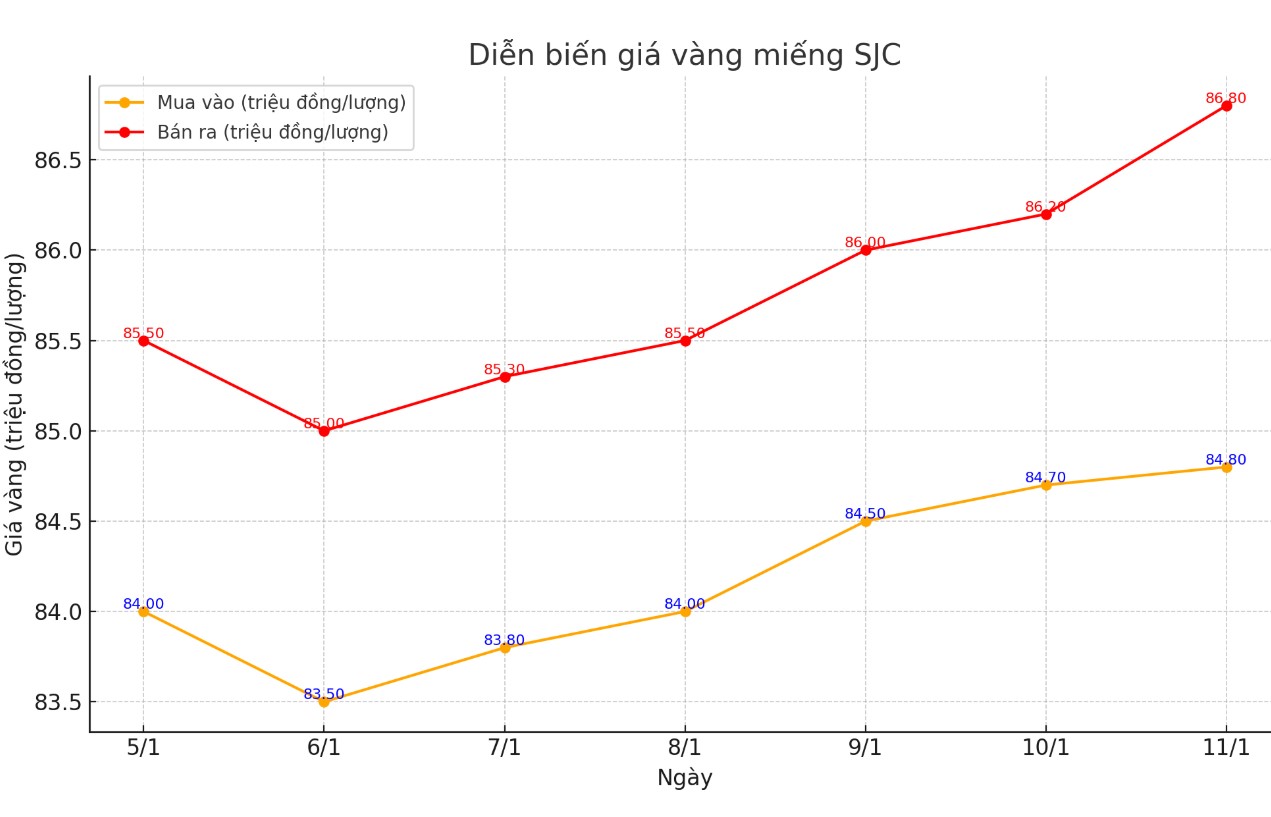

Update SJC gold price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.8-86.8 million/tael (buy - sell); an increase of VND100,000/tael for buying and an increase of VND600,000/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.9-86.8 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and an increase of 600,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.9 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-86.8 million VND/tael (buy - sell); increased by 100,000 VND/tael for buying and increased by 600,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

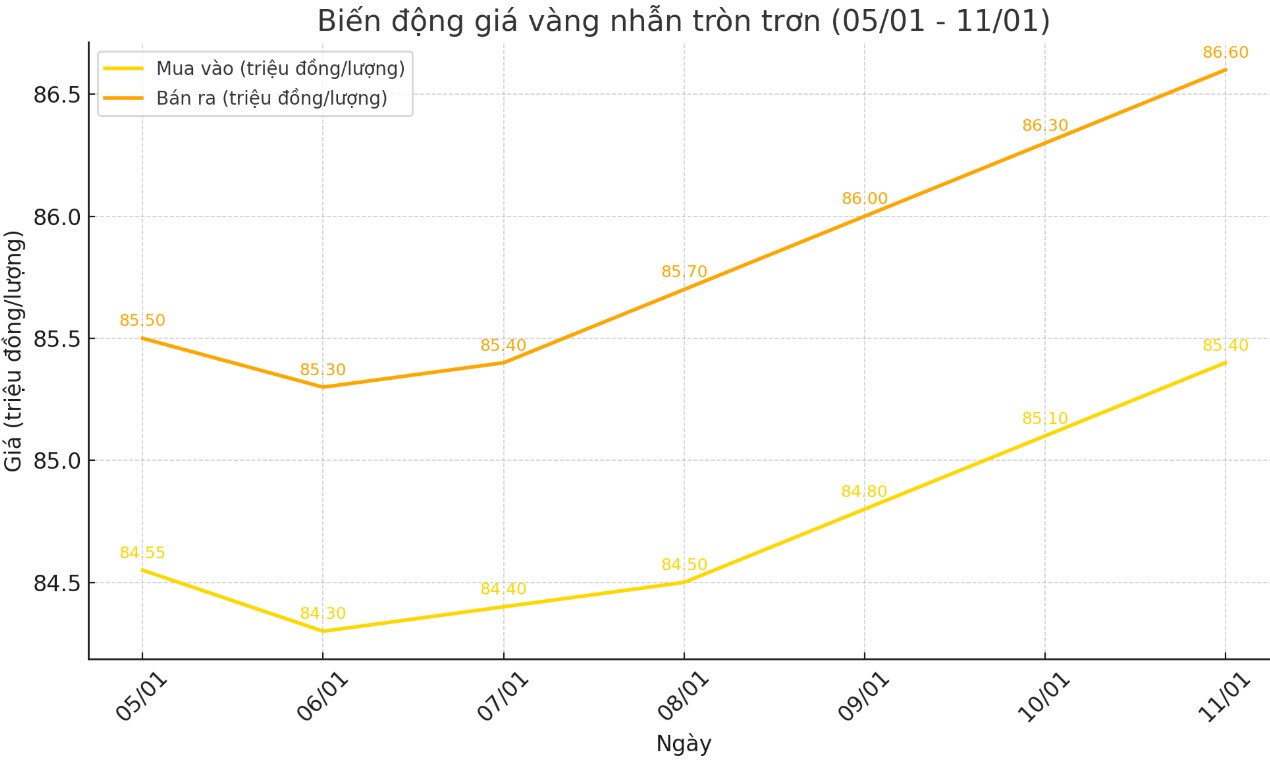

Price of round gold ring 9999

As of 7:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.4-86.6 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.5-86.9 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and an increase of 500,000 VND/tael for selling compared to the closing price of yesterday afternoon's trading session.

World gold price

As of 7:00 p.m., the world gold price listed on Kitco was at 2,689.3 USD/ounce, up 11 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased despite the sharp increase in the USD index. Recorded at 7:00 p.m. on January 11, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109.490 points (up 0.45%).

Gold prices rose sharply in the last trading session of the week despite the important US economic report being much stronger than expected, which supports the tightening monetary policy.

The demand for safe havens is gaining traction as bond investors increasingly dominate the market, causing concerns. Against this backdrop, gold futures for February delivery jumped to a four-week high, up $39.20 to $2,730.00 an ounce.

It is noteworthy that the gold market increased despite the increase in the USD index and US Treasury bond yields. Currently, the UK financial market is facing many fluctuations due to the increase in bond yields, reflecting the difficulties of the public debt in this country.

The key US economic report this week focuses on December's jobs report, with the number of jobs added by 256,000, far exceeding the market forecast of 160,000.

The unemployment rate fell to 4.1%, lower than the expected 4.2%. The Wall Street Journal commented: "The result is the latest sign that the US labor market has recovered from a mid-year slowdown and is even accelerating." This makes the market believe that the US Federal Reserve (FED) will have difficulty continuing to lower interest rates this year.

“Gold prices are still volatile ahead of the jobs report,” said David Meger, director of metals trading at High Ridge Futures. “One of the factors supporting gold is the uncertainty we saw ahead of the US presidential inauguration.”

Donald Trump will be inaugurated as US President on January 20. His tariff proposals are seen by some analysts as risking sparking trade wars and resurgent inflation. In this scenario, gold, seen as a hedge against inflation, could rise in price.

Giovanni Staunovo, an analyst at UBS, stressed that demand for safe-haven assets is partly supporting gold prices, offsetting downward pressure from a stronger US dollar and higher interest rates.

Diversification through gold bullion is “a trend that will continue,” said Greg Sharenow, portfolio manager at Pacific Investment Management Co. He expects central banks and high net worth families to continue to find gold an attractive asset.

US hedge fund Quantix Commodities has allocated 30% of its portfolio to gold, nearly double the metal's weighting in the Bloomberg Commodity Index. Quantix senior managing director Matt Schwab said the fund expects to maintain its outperformance in 2025, forecasting gold prices to rise to $3,000 an ounce by 2025.

See more news related to gold prices HERE...