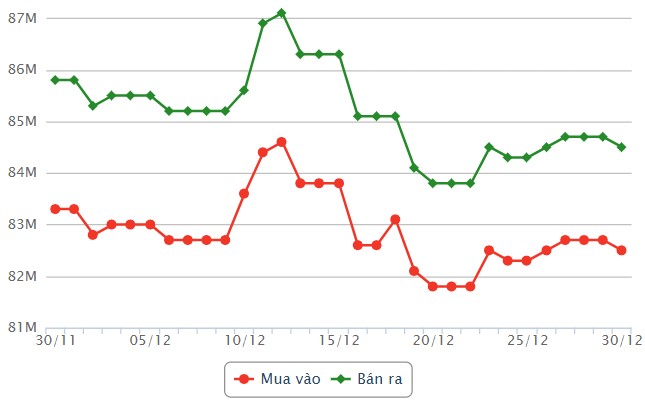

Update SJC gold price

As of 10:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.5-84.5 million/tael (buy - sell); down VND200,000/tael.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 82.5-84.5 million VND/tael (buy - sell); down 200,000 VND/tael.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.5-84.5 million VND/tael (buy - sell); down 200,000 VND/tael.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

As of 10:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.7-84.5 million VND/tael (buy - sell); down 150,000 VND/tael for buying and down 200,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.9-84.5 million VND/tael (buy - sell), down 200,000 VND/tael for both buying and selling compared to early this morning.

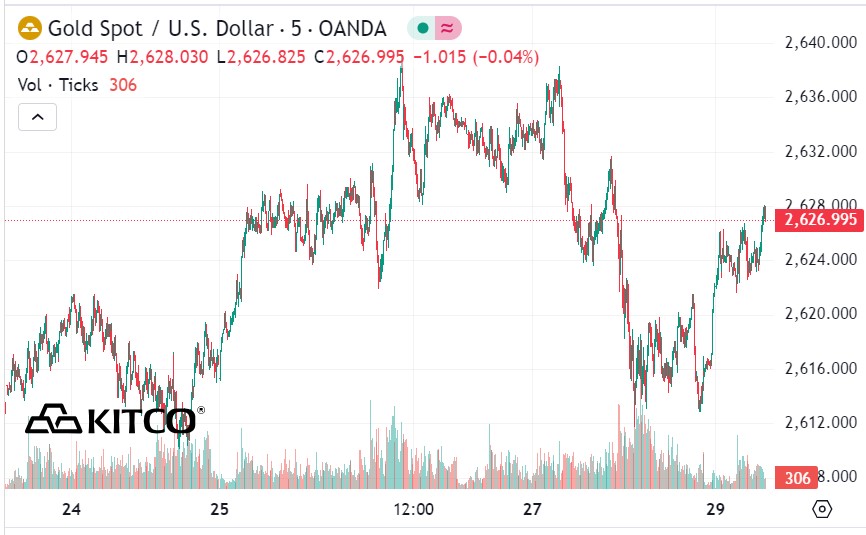

World gold price

As of 10:30 a.m., the world gold price listed on Kitco was at 2,626.9 USD/ounce, up 4.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased slightly as the USD tended to decrease. Recorded at 10:40 a.m. on December 30, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.795 points (down 0.01%).

Gold prices were limited to $2,650 an ounce last week, however, the market was able to withstand significant headwinds as the yield on 10-year Treasury bonds rose to 4.64%, a seven-month high.

Gold’s recovery this week was underpinned by escalating geopolitical tensions. Investors are closely monitoring conflicts in Eastern Europe and the Middle East. The armed developments of the past week have reinforced gold’s appeal as a safe-haven asset.

This week, investors and experts will focus on important economic data from the US, as global markets prepare to enter the new year with many expectations and challenges.

Monday (December 30, 2024): The US pending home sales report is due out, a key gauge of the health of the housing market, which is facing pressure from high interest rates.

Wednesday (January 1, 2025): On the first day of the new year 2025, global financial markets will take a break from trading to welcome the new year.

Thursday (January 2, 2025): Weekly US jobless claims data is expected to provide a clearer view of the labor market - a key factor in the US Federal Reserve's (FED) policy decisions.

Friday (January 3, 2025): The ISM Manufacturing PMI, a key indicator of economic activity in the manufacturing sector, will be released. Analysts expect the index to reveal growth as well as challenges in the US manufacturing industry.

See more news related to gold prices HERE...