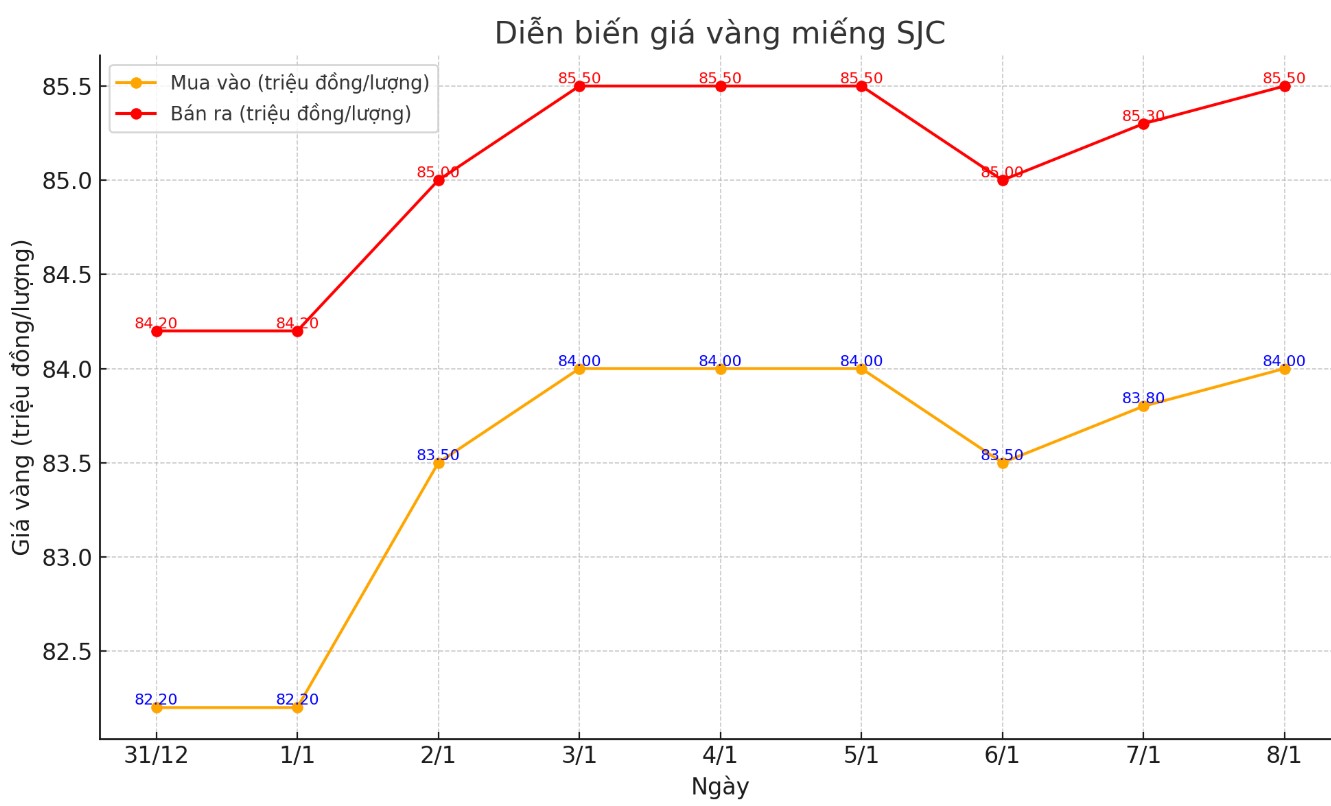

Update SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84-85.5 million/tael (buy - sell); an increase of VND200,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84-85.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.2-85.5 million VND/tael (buy - sell); increased 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

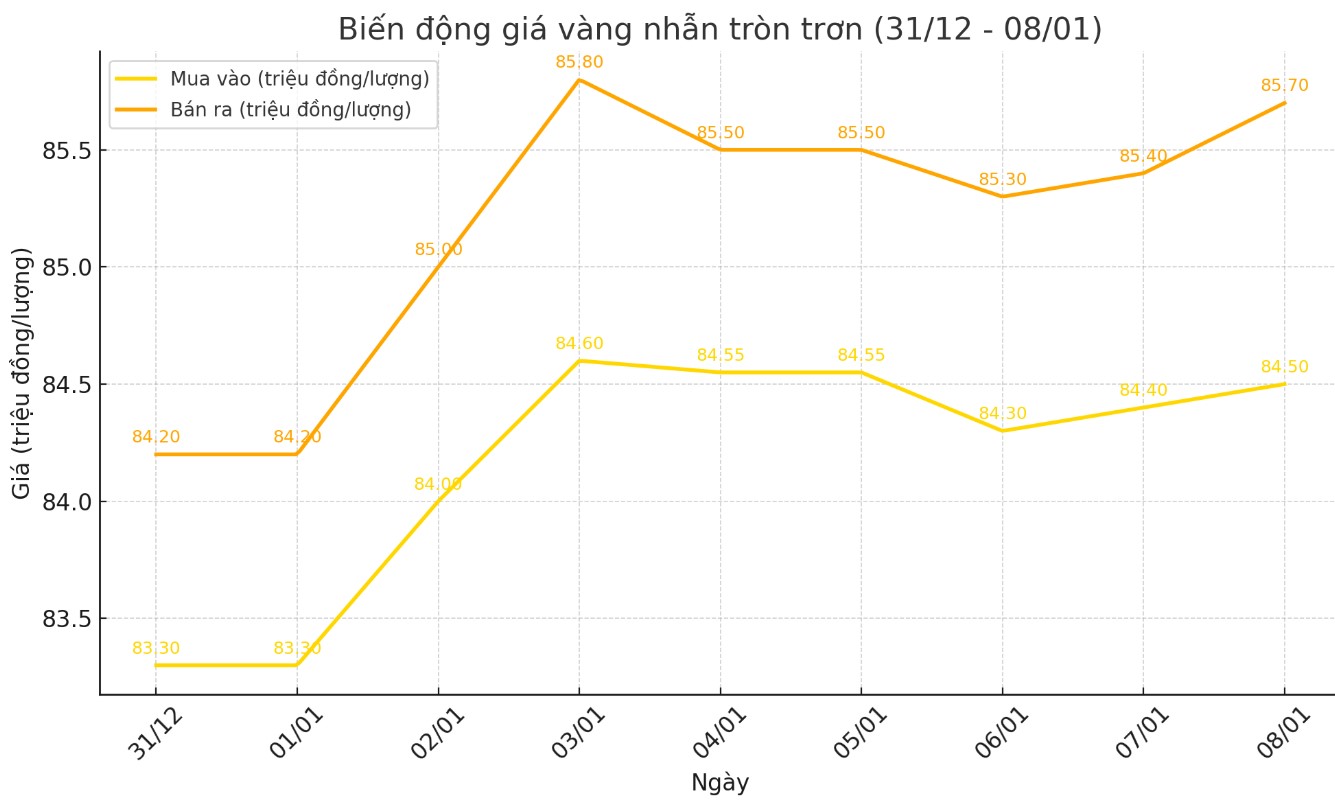

Price of round gold ring 9999

As of 5:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.5-85.7 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and an increase of 30,000 VND/tael for selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.7-85.9 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

World gold price

As of 5:00 p.m., the world gold price listed on Kitco was at 2,650.6 USD/ounce, up 6.6 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased despite the strong increase in the USD index. Recorded at 5:00 p.m. on January 8, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 109,020 points (up 0.6%).

The dollar strengthened and 10-year Treasury yields hit an eight-month high after the latest jobs report showed the US economy is strengthening.

The number of job openings in the US increased to 8.098 million in November 2024, surpassing market expectations and up from 7.839 million recorded in the previous month.

Markets are looking ahead to Friday's U.S.

nonfarm payrolls report for further clues on the Fed's policy path.Markets are betting the Fed will cut interest rates just once in 2025, down from two in December 2024, according to CME's FedWatch tool.

The US dollar index has rallied on hopes that the Fed’s monetary policy will be less volatile in 2025, so gold prices have come under some downward pressure, said Kelvin Wong, senior market analyst for Asia Pacific at brokerage OANDA.

However, the precious metal is also receiving strong support from central bank buying. The People’s Bank of China increased its gold reserves in December, buying another 300,000 ounces, bringing its total reserves to 73.3 million ounces, indicating that China has resumed buying gold after a six-month pause last year.

Central banks around the world continued to drive gold demand in November 2024, with the majority of transactions being carried out by emerging markets, according to Krishan Gopaul, senior analyst for the EMEA region at the World Gold Council.

The National Bank of Poland (NBP) was the largest buyer, adding 21 tonnes of gold in November 2024, bringing its total reserves to 448 tonnes. "Gold now accounts for nearly 18% of total reserves, close to the previously announced target of 20%. This purchase also strengthens the NBP's position as the largest buyer of gold since the beginning of the year (90 tonnes)," Gopaul said.

The Central Bank of Uzbekistan increased its reserves by 9 tonnes, marking the first increase since July, bringing total net purchases for the year to 11 tonnes and gold reserves to 382 tonnes.

The Reserve Bank of India continued its gold buying streak in 2024, adding another 8 tonnes in November. "This brings the total purchases year-to-date to 73 tonnes, taking the total gold reserves to 876 tonnes, maintaining its position as the second-largest buyer in 2024 after Poland," he said.

The National Bank of Kazakhstan added 5 tons of gold, raising reserves to 295 tons and becoming a net buyer of 1 ton in 2024...

See more news related to gold prices HERE...