Update SJC gold price

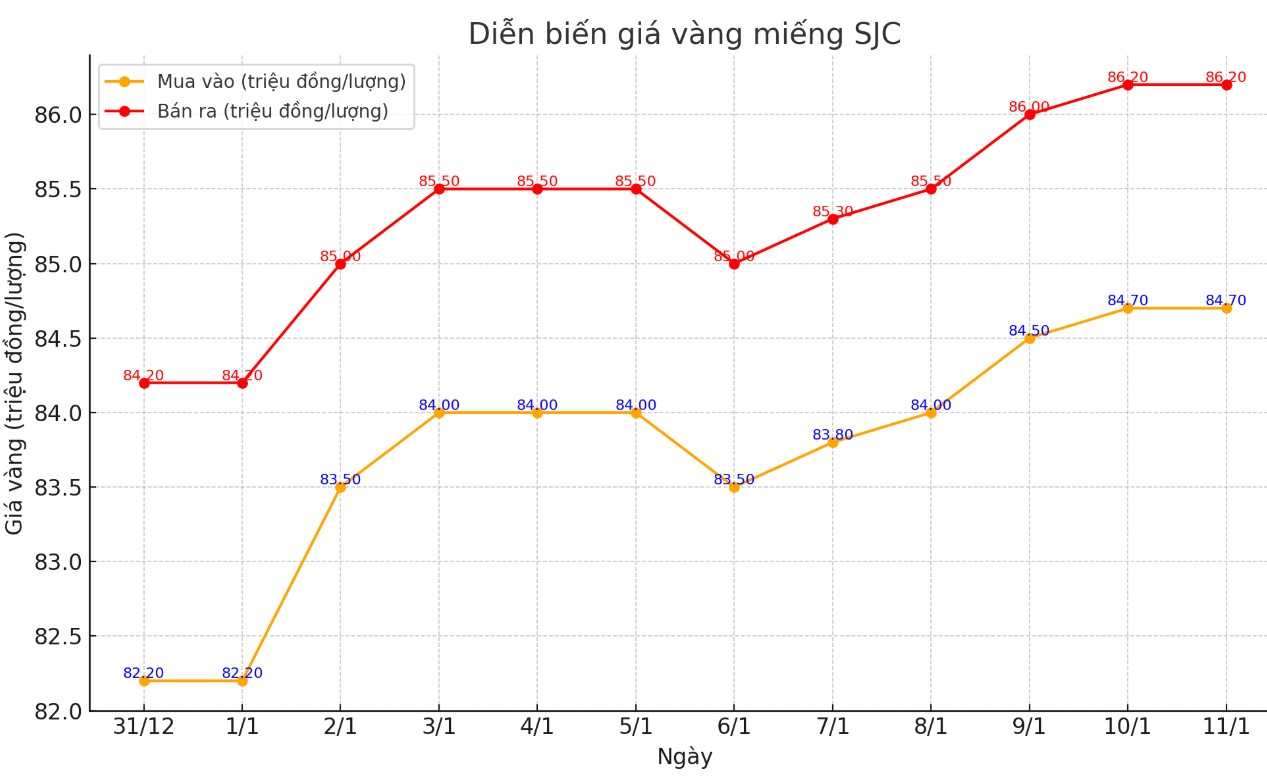

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.7-86.2 million/tael (buy - sell); an increase of VND200,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.7-86.2 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-86.2 million VND/tael (buy - sell); increased by 100,000 VND/tael for buying and increased by 200,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

Price of round gold ring 9999

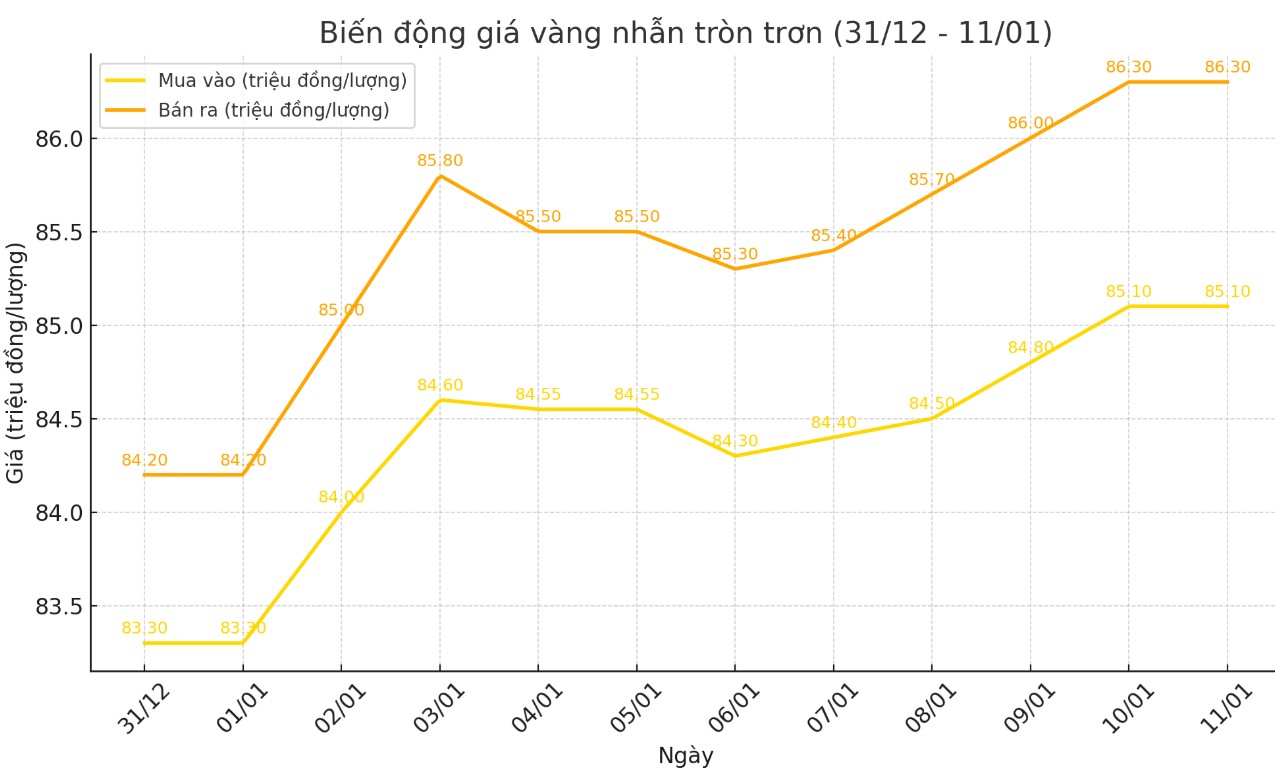

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.1-86.3 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday afternoon.

Bao Tin Minh Chau listed the price of gold rings at 85.1-86.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday afternoon.

World gold price

As of 3:00 a.m. on January 11 (Vietnam time), the world gold price listed on Kitco was at 2,687 USD/ounce, up 16.1 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold Price Forecast

World gold prices increased despite the USD's increase. Recorded at 3:00 a.m. on January 11, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109.480 points (up 0.44%).

Gold prices rose sharply despite a key US economic report that was much stronger than expected, which supported tighter monetary policy.

The demand for safe havens is gaining traction as bond investors increasingly dominate the market, causing concerns. Against this backdrop, gold futures for February delivery jumped to a four-week high, up $39.20 to $2,730.00 an ounce.

It is noteworthy that the gold market increased despite the increase in the USD index and US Treasury bond yields. Currently, the UK financial market is facing many fluctuations due to the increase in bond yields, reflecting the difficulties of the public debt in this country.

The key US economic report this week focuses on December's jobs report, with the number of jobs added by 256,000, far exceeding the market forecast of 160,000.

The unemployment rate fell to 4.1%, lower than the expected 4.2%. The Wall Street Journal commented: "The result is the latest sign that the US labor market has recovered from a mid-year slowdown and is even accelerating." This makes the market believe that the US Federal Reserve (FED) will have difficulty continuing to lower interest rates this year.

US stock indexes fell after the jobs report. The yield on the 10-year Treasury note jumped to nearly 5.0% immediately after the report, but then fell back to 4.8%.

“This is a significant headwind for US equities, and will only get worse if yields continue to rise. The next important threshold is 5.0%. If it is broken and held above this level, there is likely to be a large rotation from US equities, especially overvalued growth tech stocks, to bonds with a near-guaranteed 5% annual yield,” said David Morrison of Trade Nation.

In other news, the People's Bank of China has temporarily suspended its open market purchases of government bonds, citing strong public demand. The move is also aimed at supporting the yuan amid China's economic woes.

Today’s external market factors saw Nymex crude oil prices surge to a 5.5-month high, trading around $77 a barrel. The 10-year Treasury yield is currently at 4.8%.

See more news related to gold prices HERE...