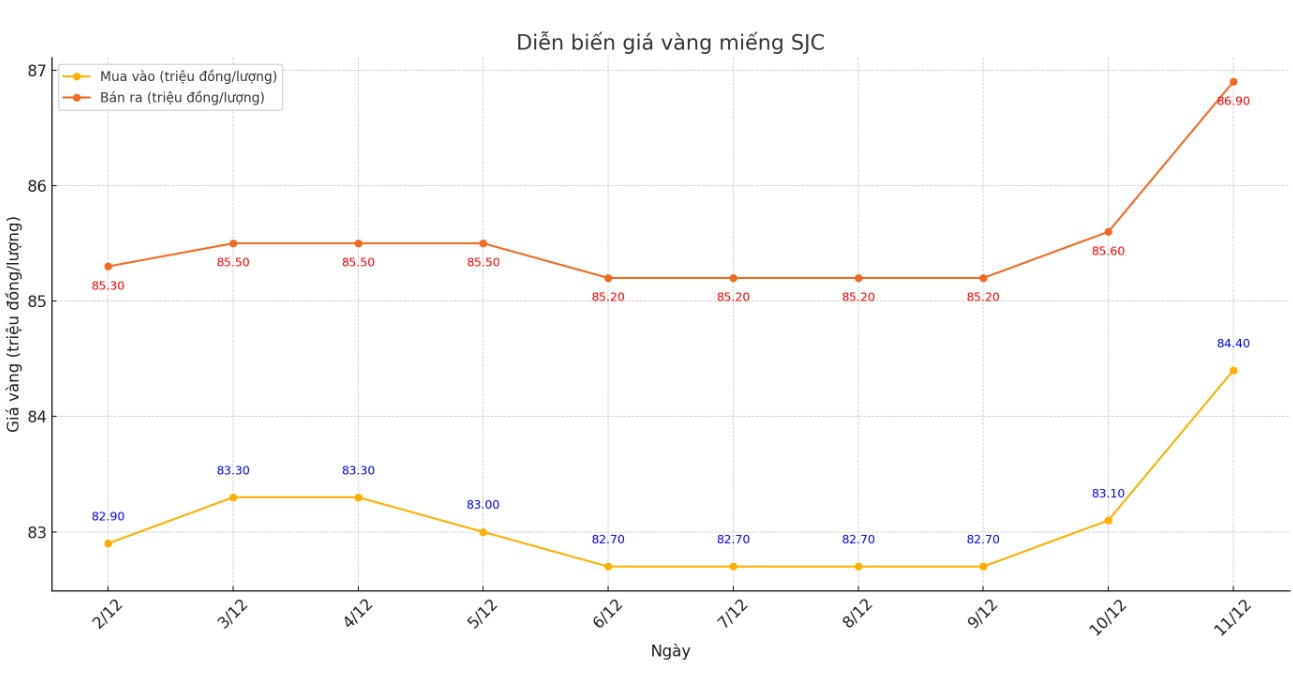

Update SJC gold price

As of 7:15 p.m., DOJI Group listed the price of SJC gold bars at VND84.4-86.9 million/tael (buy - sell), an increase of VND800,000/tael for buying and an increase of VND1.3 million/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 84.4-86.9 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.4-86.9 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

The difference between the buying and selling price of gold is listed at around 2.5 million VND/tael. This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

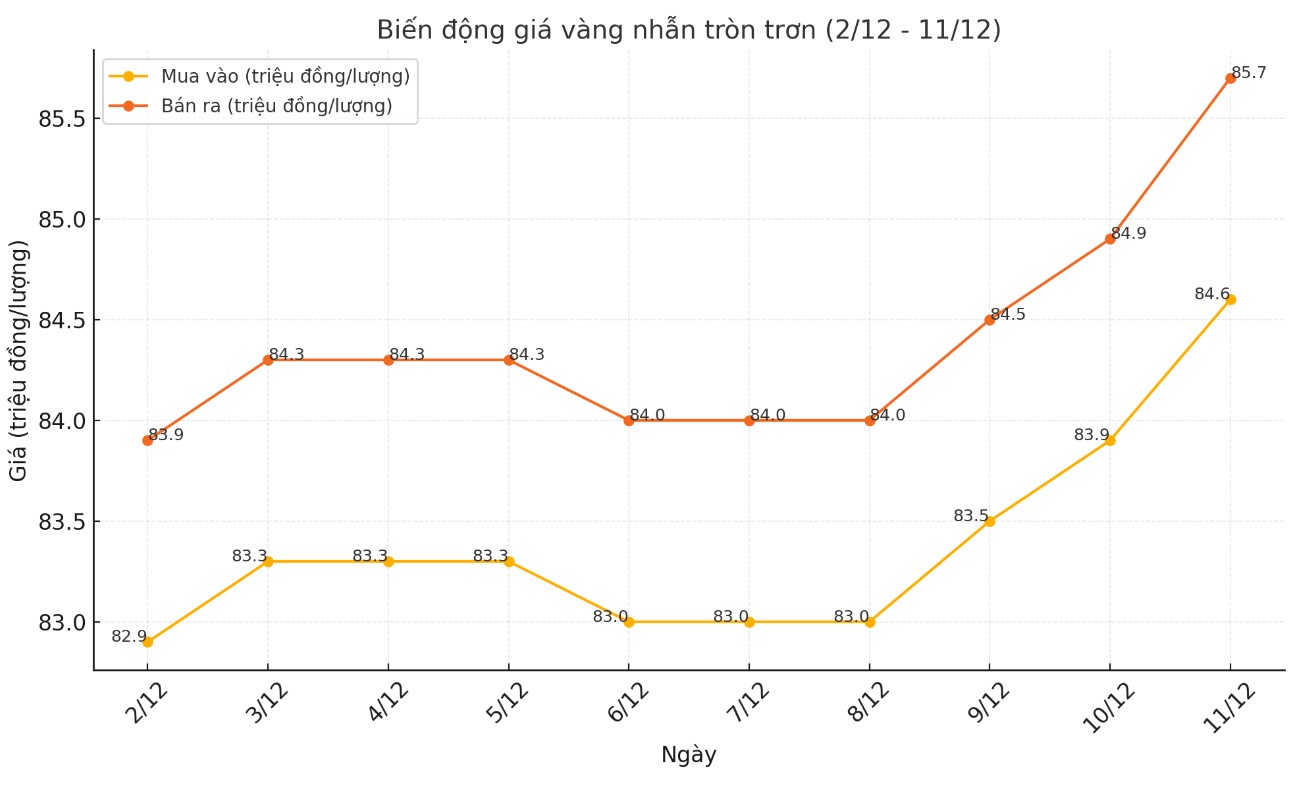

Price of round gold ring 9999

As of 7:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.6-85.7 million VND/tael (buy - sell); an increase of 700,000 VND/tael for buying and an increase of 800,000 VND/tael for selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.48-85.98 million VND/tael (buy - sell); increased by 50,000 VND/tael for both buying and selling.

World gold price

As of 7:20 p.m., the world gold price listed on Kitco was at 2,695.7 USD/ounce, up 21.7 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased despite the increase in the USD index. Recorded at 19:22 on December 11, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 106.250 points (up 0.14%).

According to Kitco, the current price rally is supported by many attractive factors, starting with geopolitical uncertainties in the Middle East.

Market sources said safe-haven demand has increased following dramatic developments in the region, including news of the collapse of the long-time regime in Syria. Interestingly, the rally has come despite a stronger US dollar, which typically puts downward pressure on commodities.

In addition, central bank activity has emerged as another important driver of gold’s rally. The People’s Bank of China has been particularly notable for signaling a return to buying gold reserves after pausing at record highs. The bank’s purchases reflect growing confidence in gold as a strategic asset.

The US Federal Reserve’s (FED) monetary policy strategy also plays a key role in the current gold market dynamics. FED Chairman Jerome Powell has outlined a cautious approach to interest rate normalization, forecasting a gradual decline from the current over 5% to around 3% - 3.5% in the coming years.

Recent rate cuts, including 50 basis points and then 25 basis points, have laid the groundwork for further easing.

Markets are now focused heavily on the upcoming Federal Open Market Committee (FOMC) meeting. The CME Fed Watch tool shows an 86.1% probability of a 25 basis point rate cut. Following recent comments from Jerome Powell, the Fed is in no rush to cut rates, but will closely monitor economic indicators and inflation trends.

While Powell’s stance on maintaining high borrowing costs typically puts a damper on gold, the market’s subdued reaction suggests those considerations have already been priced in. The precious metal continues to receive support from a complex mix of geopolitical tensions, central bank strategy and monetary policy expectations.

See more news related to gold prices HERE...