Update SJC gold price

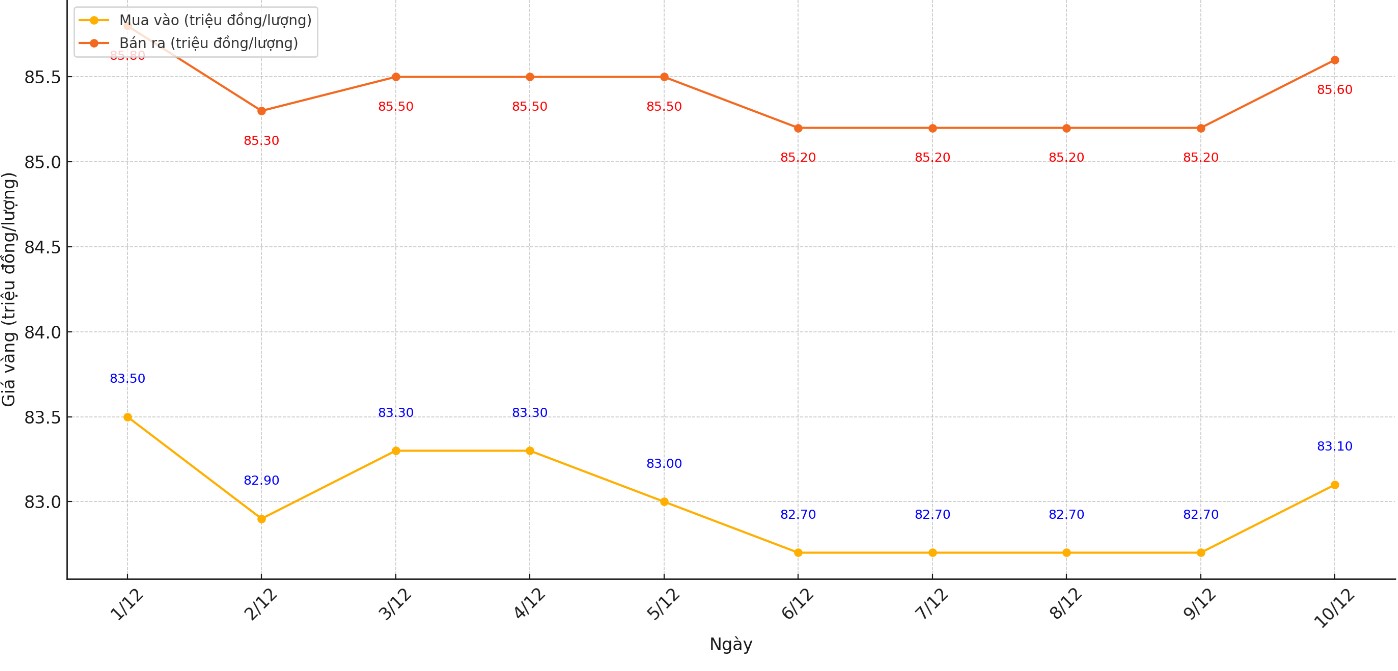

As of 8:30 p.m., DOJI Group listed the price of SJC gold bars at VND83.1-85.6 million/tael (buy - sell), an increase of VND400,000/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83.6-85.6 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and an increase of 400,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.6-85.6 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and an increase of 400,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

The difference between the buying and selling price of gold is listed at around 2.5 million VND/tael. This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

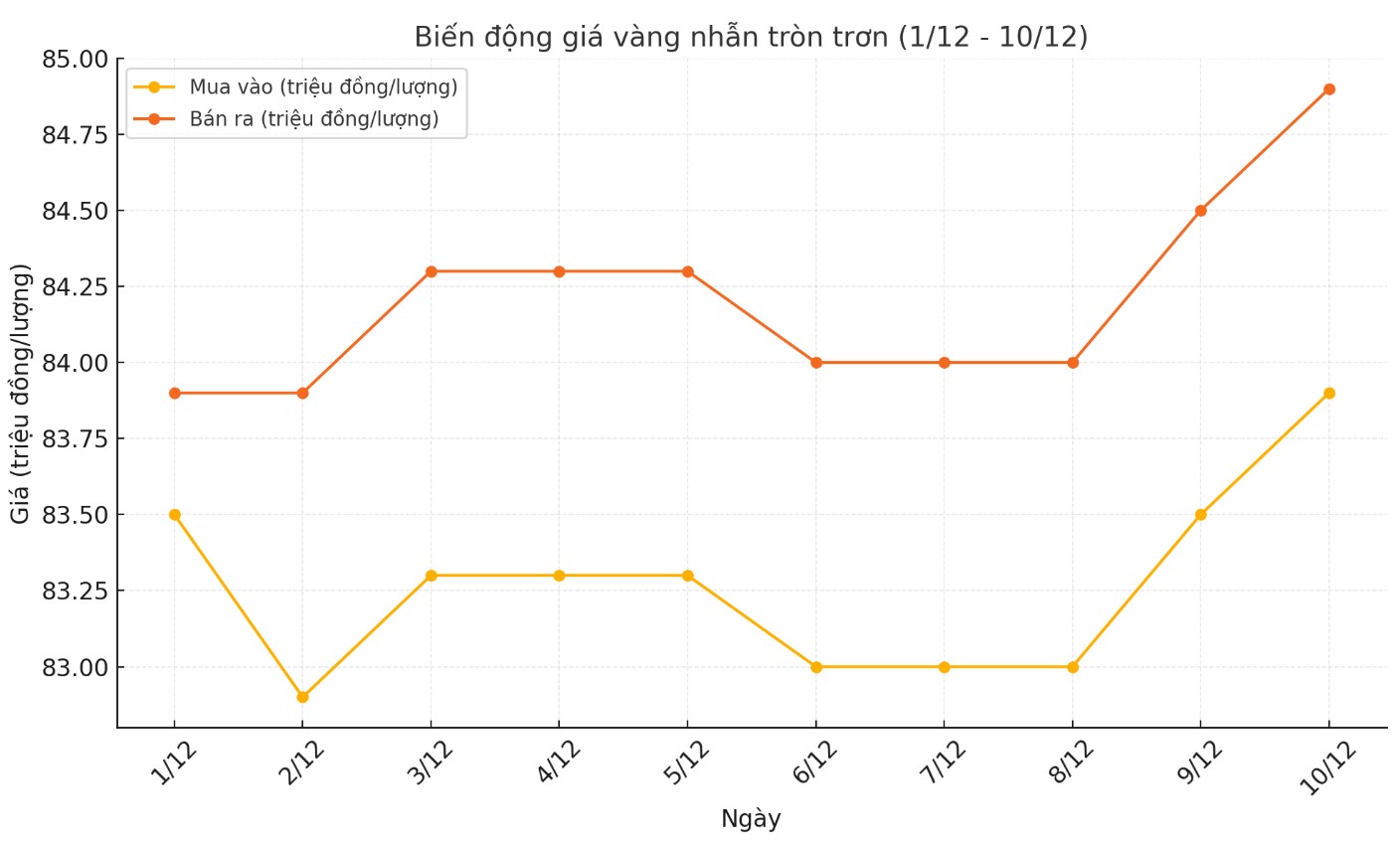

Price of round gold ring 9999

As of 8:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.9-84.9 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.43-84.93 million VND/tael (buy - sell); increased by 50,000 VND/tael for buying and increased by 450,000 VND/tael for selling.

World gold price

As of 8:30 p.m., the world gold price listed on Kitco was at 2,674 USD/ounce, up 16.5 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased despite the increase in the USD index. Recorded at 20:30 on December 10, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 106.050 points (up 0.22%).

Demand for safe-haven assets has resurfaced as China began investigating US conglomerate Nvidia for alleged antitrust violations, suggesting the US and China could step up their tit-for-tat measures, some experts said.

Traders are now turning their attention to U.S. inflation data for November 2024 after a better-than-expected jobs report last week increased the odds of a Federal Reserve rate cut next week. The probability of a 25 basis point rate cut at the Fed's December 18 meeting is now at 89.5%, according to the CME Fedwatch tool.

Bank of America (BoA) - one of the largest banks in the world - has just forecast that the price of gold will reach 3,000 USD in the second half of 2025.

“Gold is currently stuck in an environment where there is no specific factor to attract investors,” Michael Widmer, head of metals research at BoA, said at the bank’s “2025 Outlook” conference last week.

The bank said gold would face headwinds in the new year, as demand from China remained weak, while Western investors faced the prospect of higher bond yields and a stronger dollar.

"The Trump administration is likely to push a series of economic policies that favor the US, through strong growth, higher inflation, higher interest rates and a stronger US dollar, which could limit investor demand for gold in the short term," analysts wrote in the report.

See more news related to gold prices HERE...