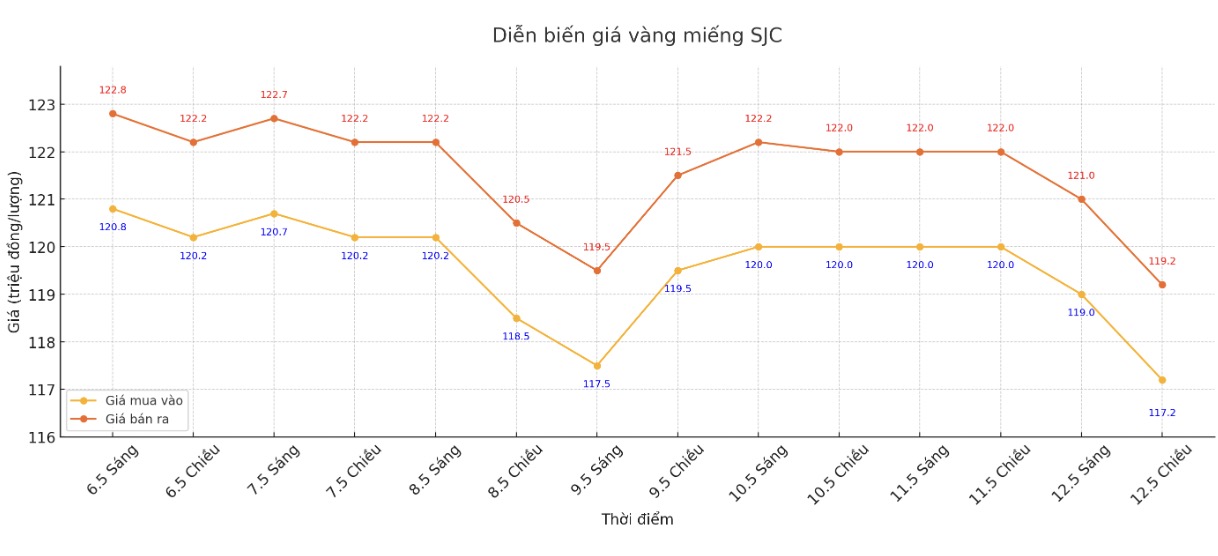

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.2-119.2 million VND/tael (buy in - sell out), down 2.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.2-119.2 million VND/tael (buy in - sell out), down 2.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.2-119.5 million VND/tael (buy - sell), down 2.8 million VND/tael for buying and down 2.5 million VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Gold and Gemstone Group listed the price of SJC gold bars at VND 116.19.2 million/tael (buy in - sell out), down VND 2.8 million/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

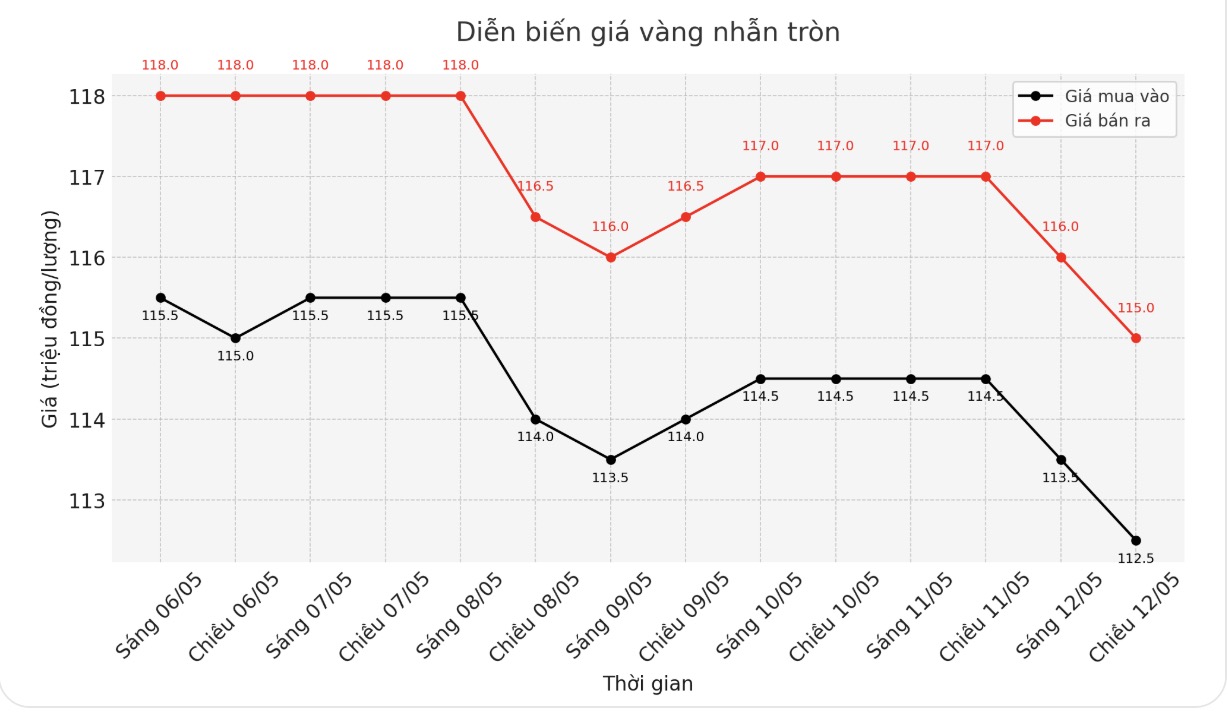

9999 round gold ring price

As of 6:00 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-115 million VND/tael (buy in - sell out), down 2 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113-116 million VND/tael (buy in - sell out), down 2 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

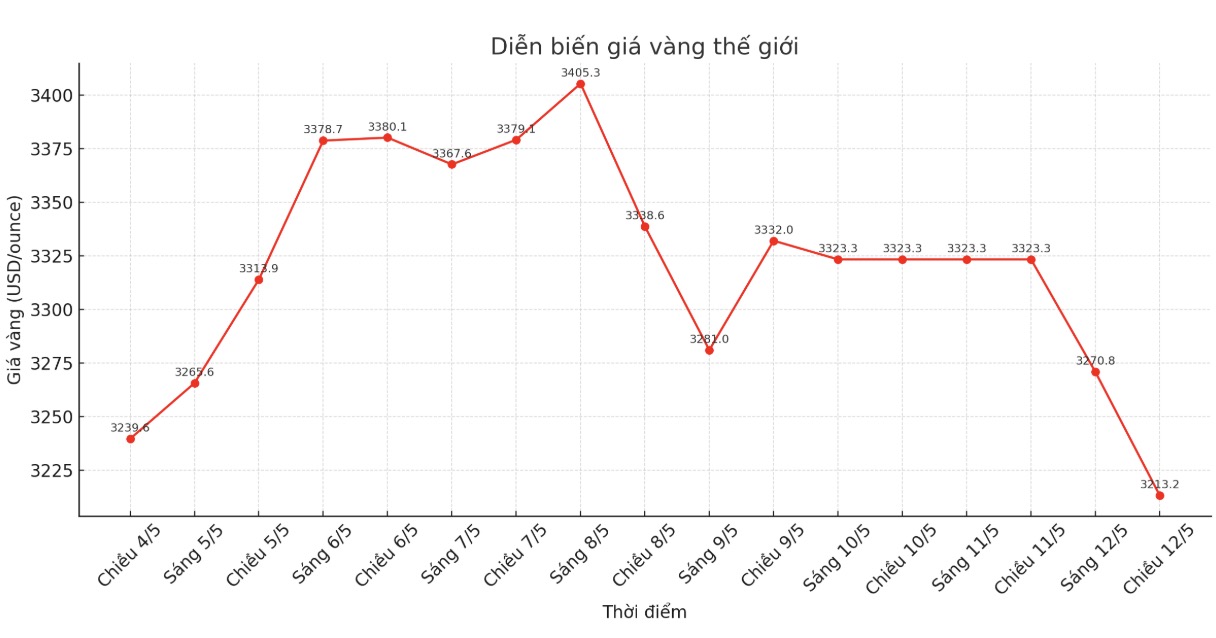

World gold price

At 5:53 p.m., the world gold price listed on Kitco was around 3,213.2 USD/ounce, down sharply to 110.1 USD/ounce.

Gold price forecast

According to Reuters, world gold prices fell on Monday as active trade talks between the US and China helped ease concerns about tariffs. Many investors have withdrawn from safe-haven assets such as gold to switch to more risky investment channels.

The US and China ended their important trade talks on Sunday with positive results. The US side said the two sides had reached a agreement to reduce trade deficits, while the Chinese side said the two sides had reached an essential consensus.

Reliance Securities senior commodity analyst Jigar Trivedi said: The US dollar index is rising as the Trump administration continuously released positive signals from trade talks with China over the weekend in Switzerland, which has put pressure on gold prices.

In the short term, gold prices could continue to fall as the US dollar appreciates and geopolitical risks are easing, weakening demand for shelter, Trivedi added. Therefore, gold may fall to $3,200/ounce in the near term.

Ms. Beth Hammack - President of the US Federal Reserve (FED) Cleveland branch - said the Fed needs more time to assess the impact of policies, including Mr. Trump's tariffs, before giving appropriate responses.

Alex Kuptsikevich, senior expert at FxPro, noted that the recent $3,500/ounce hit in the spot market has led to a strong sell-off.

This weeks fluctuations are quite similar to last April, possibly due to crop factors. Last year, gold prices took three months to accumulate before rising again. This time, I think the most positive scenario is to go sideways, and there is still a possibility of prices falling sharply to the $2,800/ounce zone before the end of the year.

Adam Button - Head of currency strategy at Forexlive.com - said that the resumption of trade negotiations between the US and China could undermine gold's upward momentum.

This weekends meeting is very important. If the results show that tariffs are reduced, gold could be sold off to make way for other risky assets such as stocks. Gold is currently becoming a symbol of global trade, when tensions increase, gold increases, when the temperature cools down, gold decreases" - this expert said.

Traders are also waiting for the US Consumer Price Index (CPI) report to be released on Tuesday to predict the Fed's monetary policy orientation.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...