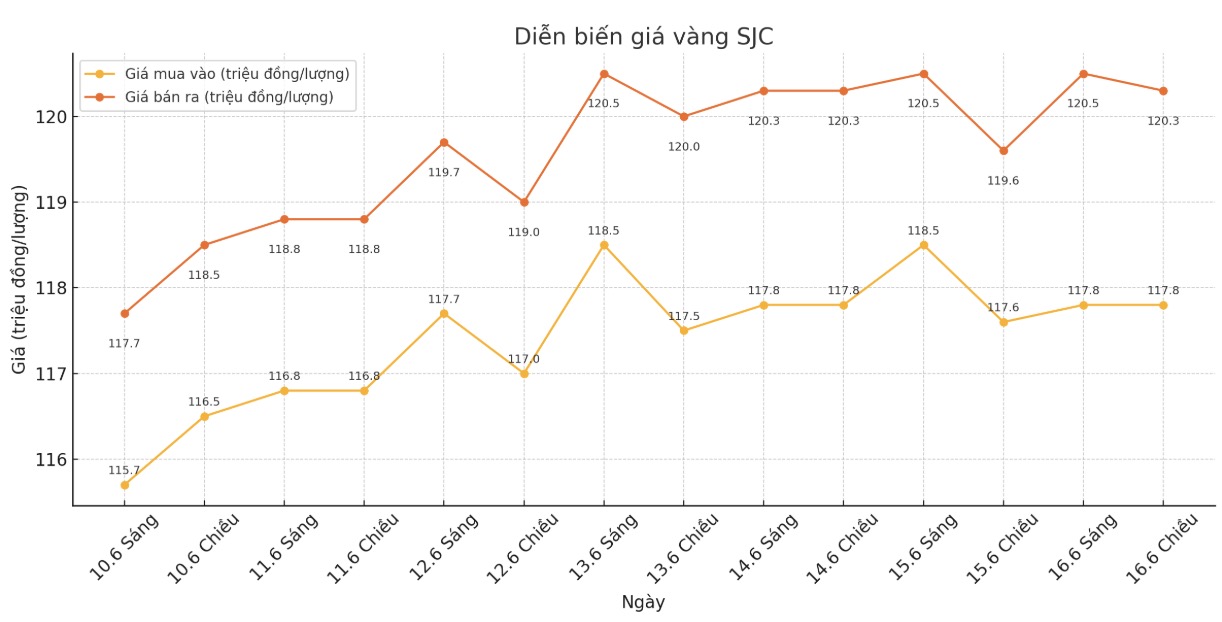

SJC gold bar price

As of 5:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.6 crore VND (1.619.000 VND/tael (buy - sell); down 200,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.6-119 1.6 million VND/tael (buy - sell); down 200,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.6-119 1.6 million VND/tael (buy - sell); down 200,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 1.6 million VND/tael (buy - sell); kept the same for buying and decreased by 400,000 VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

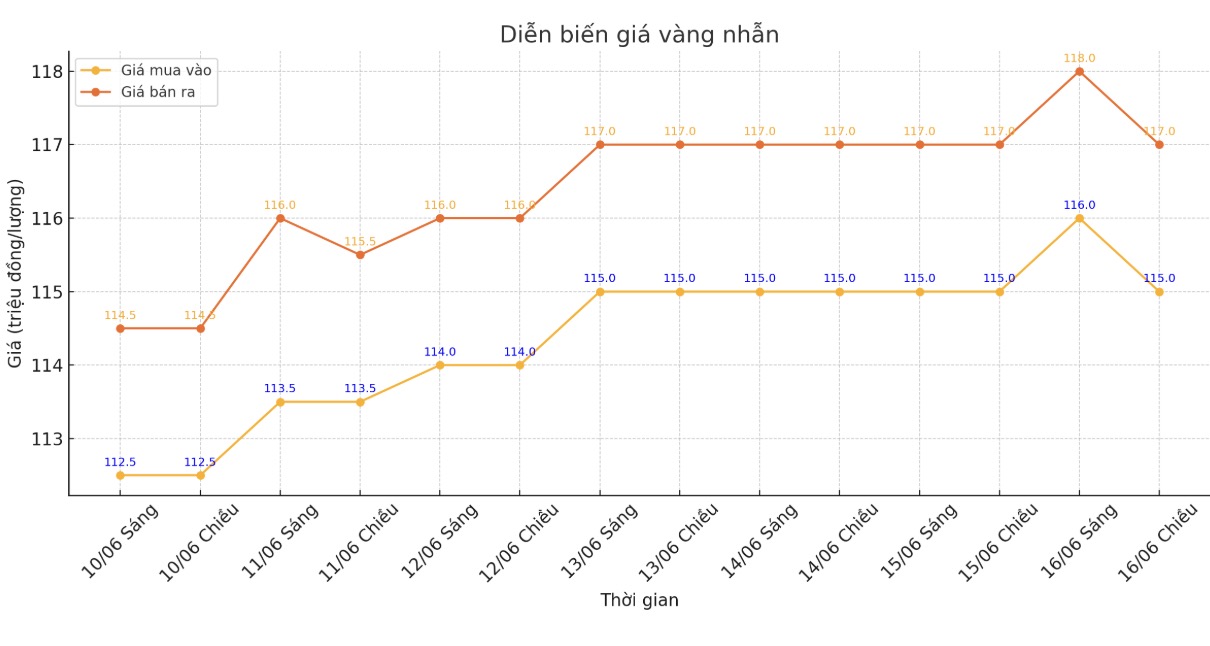

9999 gold ring price

As of 5:49 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.1-119.1 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

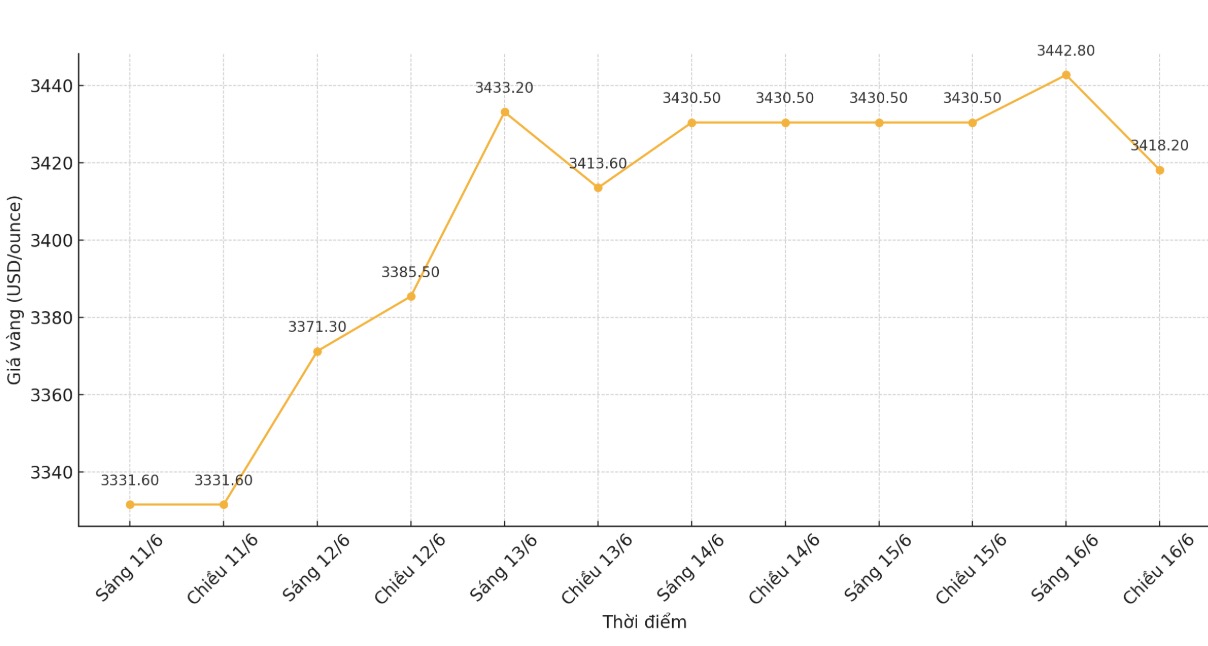

World gold price

The world gold price was listed at 5:51 p.m. at 3,418.2 USD/ounce, down 12.3 USD.

Gold price forecast

Gold prices fell on Monday as investors considered the impact of the ongoing Israel-Iran conflict, focusing on a meeting of G7 leaders and a policy decision by the US Federal Reserve (FED) to be announced this week.

As of 8:54 a.m. GMT, US gold futures fell 0.5% to $3,434.50 an ounce.

geopolitical tensions will not disappear in the short term, and interest rates are likely to continue to be cut by central banks, which will create a supportive floor for gold, said Giovanni Staunovo, an analyst at UBS.

Iranian missiles attacked Tel Aviv and the port city of Haifa in Israel in the early hours of Monday, killing at least 8 people and destroying many homes.

The risk of escalating tensions overshadowed the G7 summit in Canada, while US President Donald Trump expressed hope on Sunday that an agreement could be reached but there were no signs of fighting easing on the fourth day of the conflict.

There are no signs of panic among investors as the currency market remains stable and Wall Street stock futures increase again after a decline at the beginning of the session.

Investors will closely monitor developments in the Middle East, especially the risk of other countries being drawn into the conflict, said Ole Hansen, head of commodity strategy at Saxo Bank.

Gold is considered a safe haven asset in times of geopolitical and economic instability. This precious metal also often benefits in a low interest rate environment.

The focus this week is the Fed's interest rate decision and Chairman Jerome Powell's speech on Wednesday. The Fed has kept its policy interest rate around 4.25%-4.50% since December.

In other markets, spot silver prices rose 0.3% to 36.41 USD/ounce, platinum increased 1.2% to 1,242.85 USD/ounce, and gold increased 1.6% to 1,044.4 USD/ounce.

See more news related to gold prices HERE...