As gold prices continue to react to geopolitical developments, market attention is shifting to the US Federal Reserve (FED), as Chairman Jerome Powell spoke after this week's monetary policy meeting.

Economists widely predict that the Fed will keep interest rates unchanged. However, there is growing speculation that Mr. Powell could begin preparing for rate cuts later this year.

Recent inflation data, combined with signs of weakening US economic momentum, create space for the Fed to loosen monetary policy. However, rising geopolitical uncertainty may prompt some market participants to adjust their expectations.

If the Fed has a softer tone than expected after the release of the latest inflation data, it could give gold bulls a new confidence, said Lukman Otunuga, Senior Market Analyst at FXTM.

Such a move could push gold above its all-time high of $3,500 an ounce, especially with support from geopolitical factors.

However, if the meeting has a hawkish tone and Mr. Powell expresses caution about future cuts, gold prices may lose some of their appeal as investors reduce expectations of Fed cuts," the expert said.

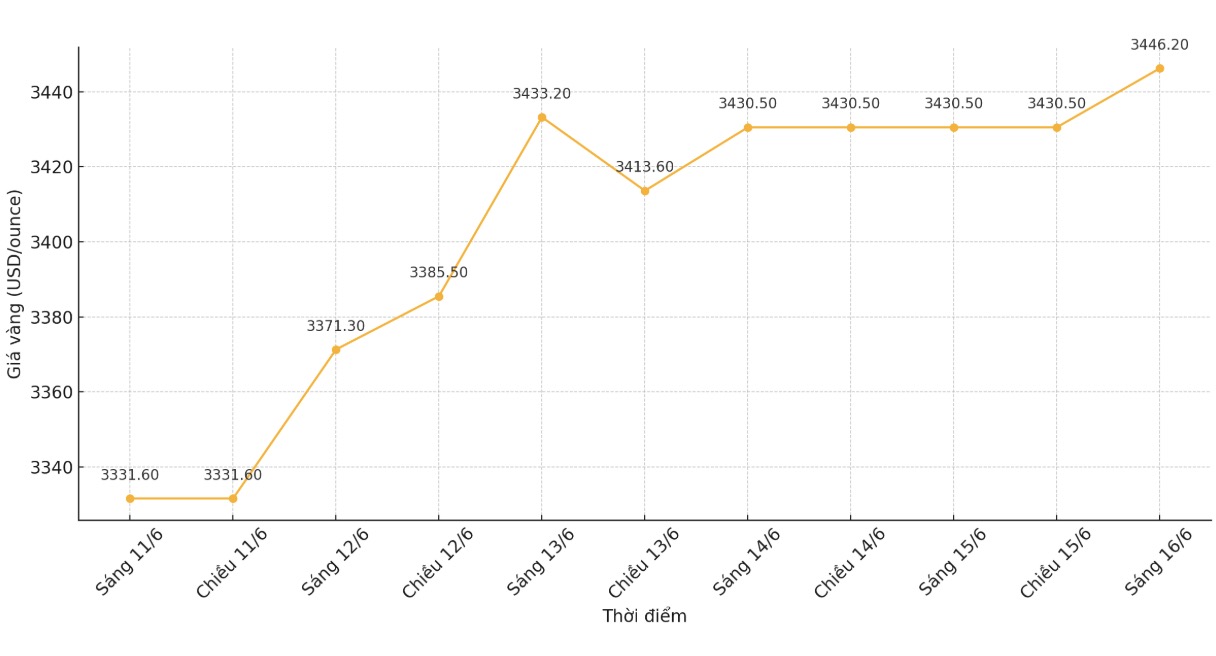

Technically, gold prices are trending up on daily charts. A solid weekly close above $3,430 an ounce could signal a move towards an all-time high of $3,500 an ounce and beyond, Otunuga added.

This week, important economic data to watch include: Empire State Production Survey and Bank of Japan's policy meeting (Monday); US retail sales (Tuesday); unemployment claims, housing construction start-ups and the FED meeting (Thursday).

The US market will have a Juneteenth holiday on Thursday, but other major central banks such as Switzerland and the UK will hold a policy meeting. At the end of the week, investors will observe the Philly FED manufacturing survey released on Friday.

In the context of many uncertainties intertwined, analysts recommend that investors be cautious with strong fluctuations in gold, especially when the FED is playing a key role in deciding the direction of the market.