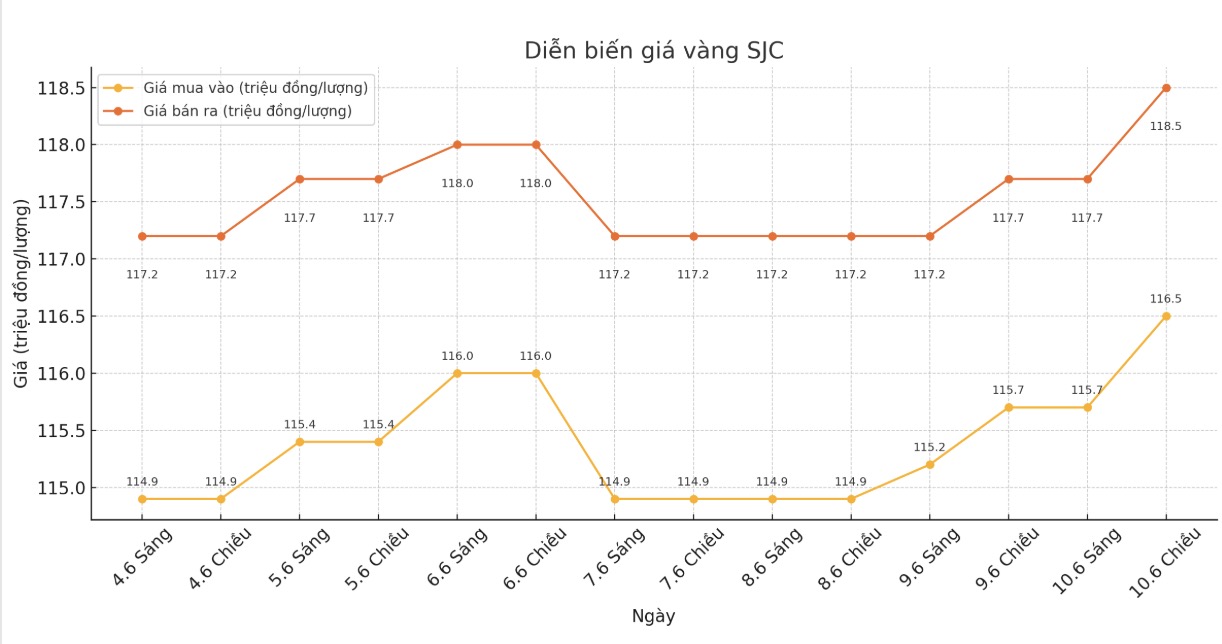

SJC gold bar price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116.5-118.5 million/tael (buy in - sell out); increased by VND800,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116-118 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.5-118.5 million VND/tael (buy in - sell out); increased by 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 115.8-118.5 million/tael (buy in - sell out); increased by VND 800,000/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 gold ring price

As of 5:30 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113-125.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.2-117.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.2-125.2 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

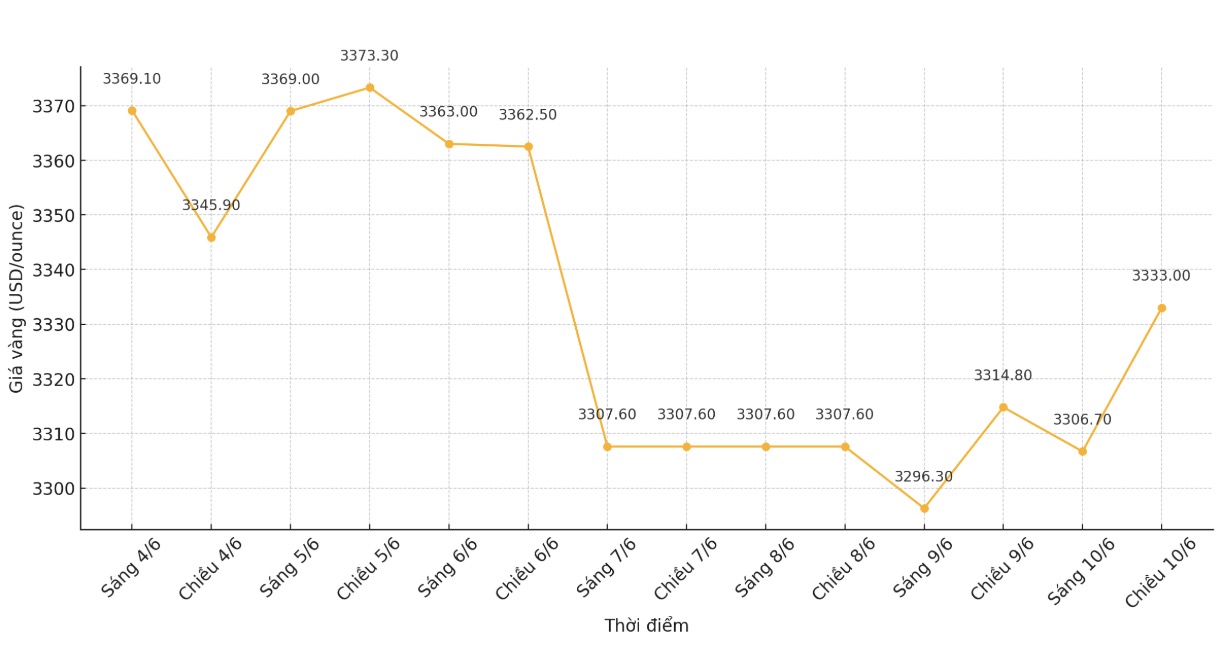

World gold price

The world gold price was listed at 5:35 p.m. at 3,333 USD/ounce, up 18.2 USD.

Gold price forecast

World gold prices increased as investors awaited more clear information about US-China trade negotiations and important US inflation data due this week, in order to find clues on the interest rate orientation of the US Federal Reserve (FED).

Spot gold rose to $3,333 an ounce, after hitting a low of $3,301.54 an ounce at one point. Meanwhile, US gold futures fell 0.2%, to $3,350/ounce.

Jigar Trivedi - senior commodity analyst at Reliance Securities, commented: "Gold is finding support thanks to bottom-fishing buying power, but the increase is not really strong. fiscal concerns and expectations of a Fed rate cut are factors that are driving the price recovery.

Senior officials from the world's two largest economies are working to ease escalating trade tensions from tariffs to restrictions on rare earths, with the round of talks taking place for the second day in London.

In April, the US and China imposed tariffs on each other's goods, raising concerns about a full-scale trade war. However, last month, the two sides agreed to temporarily suspend the tax, bringing some optimism to the financial market.

Investors are now focusing on the Consumer Price Index (CPI) data due out on Wednesday. This is one of the last important economic data before the Fed's policy meeting on June 17-18, which is expected to keep interest rates unchanged.

Meanwhile, spot silver fell 0.2% to $36.64 an ounce, remaining around its highest level in more than 13 years. platinum fell 0.9% to $1,209.20 an ounce, after hitting its highest level since May 2021. Palladium lost 1.4%, to 1,059.44 USD/ounce.

In indifference to recent macro data has created an opportunity for silver and platinum to attract attention, as both metals have boosted strongly in previous sessions, before showing signs of taking profits in todays session, said Ole Hansen, head of commodity strategy at Saxo Bank.

See more news related to gold prices HERE...