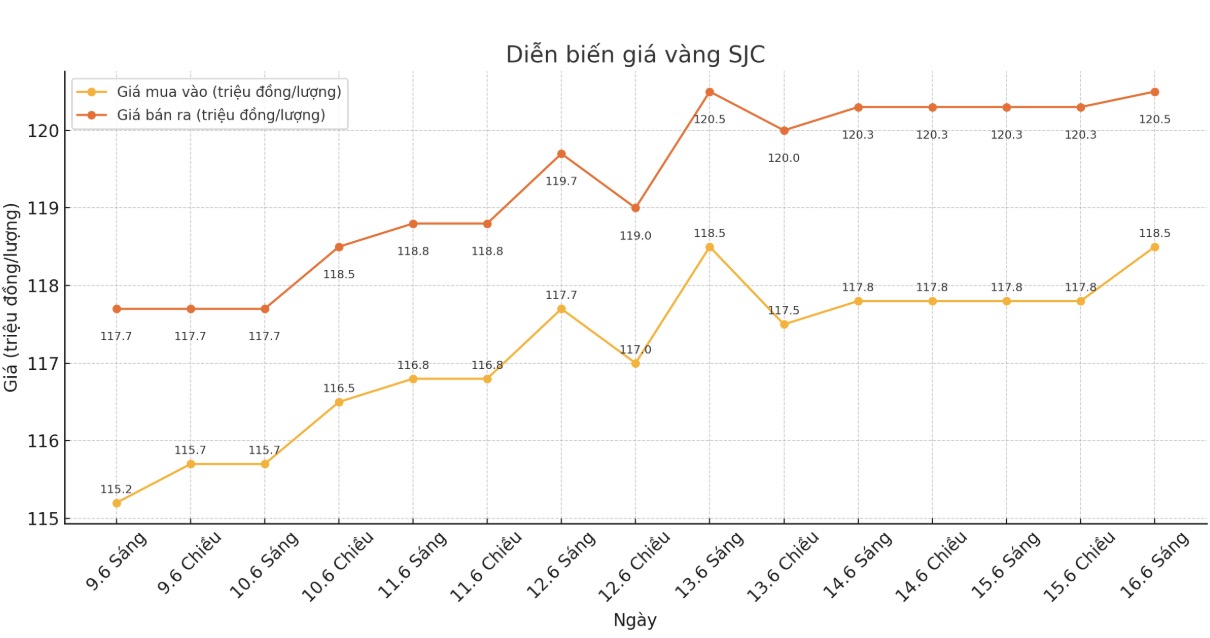

Updated SJC gold price

As of 9:15 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy - sell), an increase of VND 700,000/tael for buying and an increase of VND 200,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 200,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 200,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117.3-120.3 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

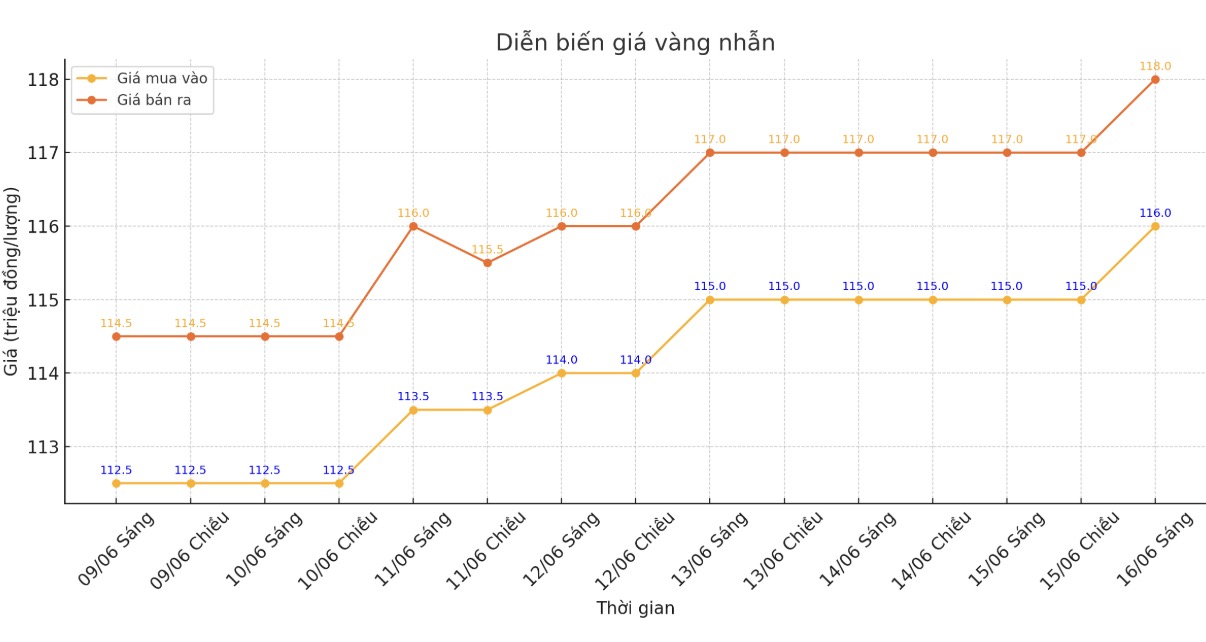

9999 round gold ring price

As of 9:15 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 116-118 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-119 1.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

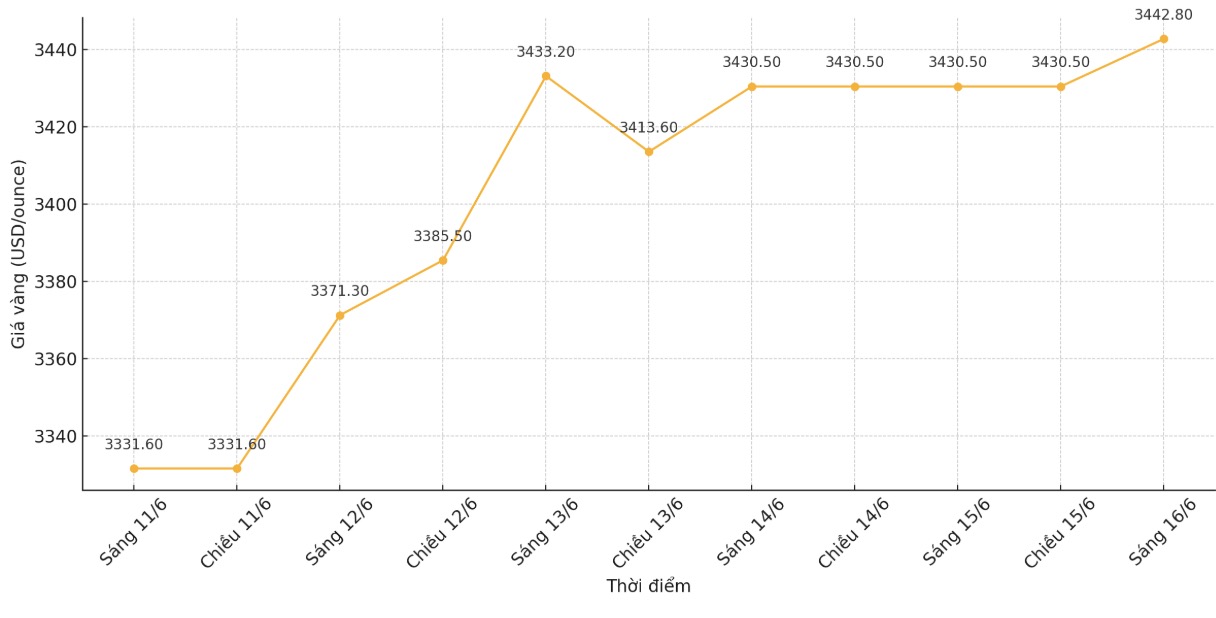

World gold price

At 9:23, the world gold price was listed around 3,442.8 USD/ounce, up 12.3 USD compared to 1 day ago.

Gold price forecast

Mr. Naeem Aslam - Investment Director at Zaye Capital Markets said that gold investors seem to be monitoring the world geopolitical situation and waiting after Israel carried out an airstrike on Iran on Friday.

Aslam stressed the importance of monitoring oil prices and Iran's ability to retaliate: "If Iran retaliates strongly, especially by threatening oil flows through the Hormuz Strait, skyrocketing crude oil prices could trigger a run into safe-haven assets, pushing gold prices higher as investors take precautions against geopolitical chaos and inflation risks.

Conversely, the gold rally could subside as demand for shelter weakens. Gold traders should now monitor Brent oil above $80 a barrel as a test for deeper chaos. If oil prices remain high, gold could be ready for another rally; otherwise, a quick correction is expected as tensions ease."

As gold prices continue to react to geopolitical developments, market attention is shifting to the US Federal Reserve (FED), as Chairman Jerome Powell spoke after this week's monetary policy meeting.

Mr. Lukman Otunuga - Senior Market Analyst at FXTM said: "If the Fed has a softer tone than expected after the release of the latest inflation data, this could bring new confidence to gold price supporters.

Such a move could push gold above its all-time high of $3,500 an ounce, especially with support from geopolitical factors.

However, if the meeting has a hawkish tone and Mr. Powell expresses caution about future cuts, gold prices may lose some of their appeal as investors reduce expectations of Fed cuts," the expert said.

Mr. Michael Brown - Senior Research Strategist at Pepperstone, said he is still optimistic about gold, even as the current risk offset is starting to decrease. He said long-term structural factors still support higher gold prices.

Overnight developments once again highlight why gold deserves to be in portfolios as a hedge against the current uncertainty. I still like gold to increase from here, especially as reserve asset distributors continue to diversify their holdings, he said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...