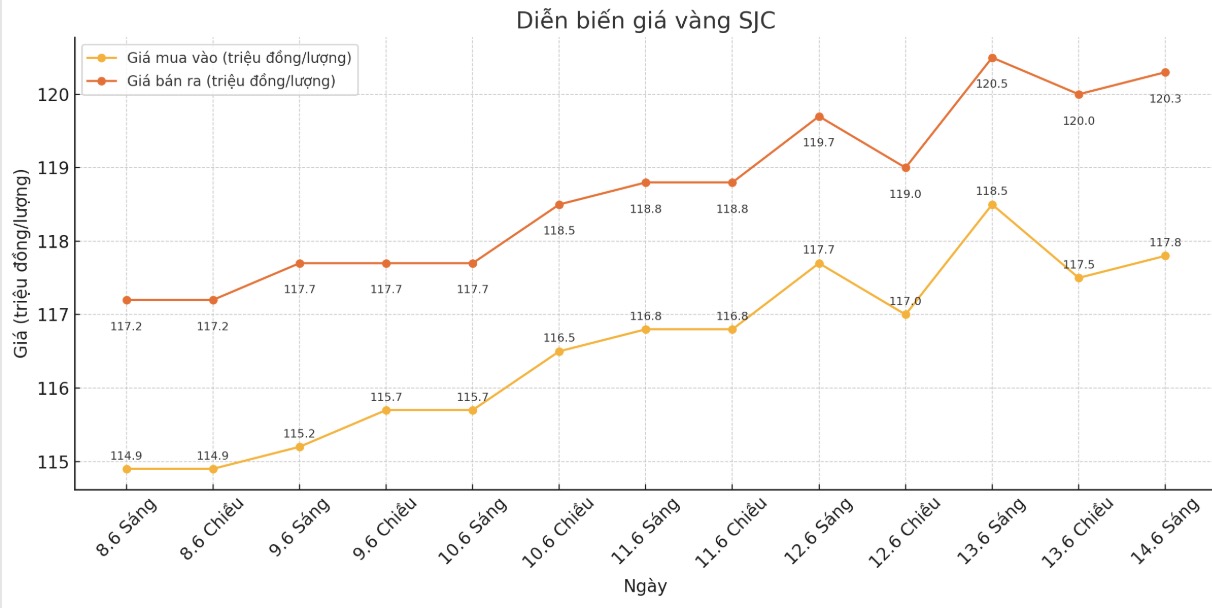

SJC gold bar price

As of 2025, the price of SJC gold bars was listed by Saigon Jewelry Company at 117.8-120.3 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.8-120.3 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.8-120.3 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-120 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 3 million VND/tael.

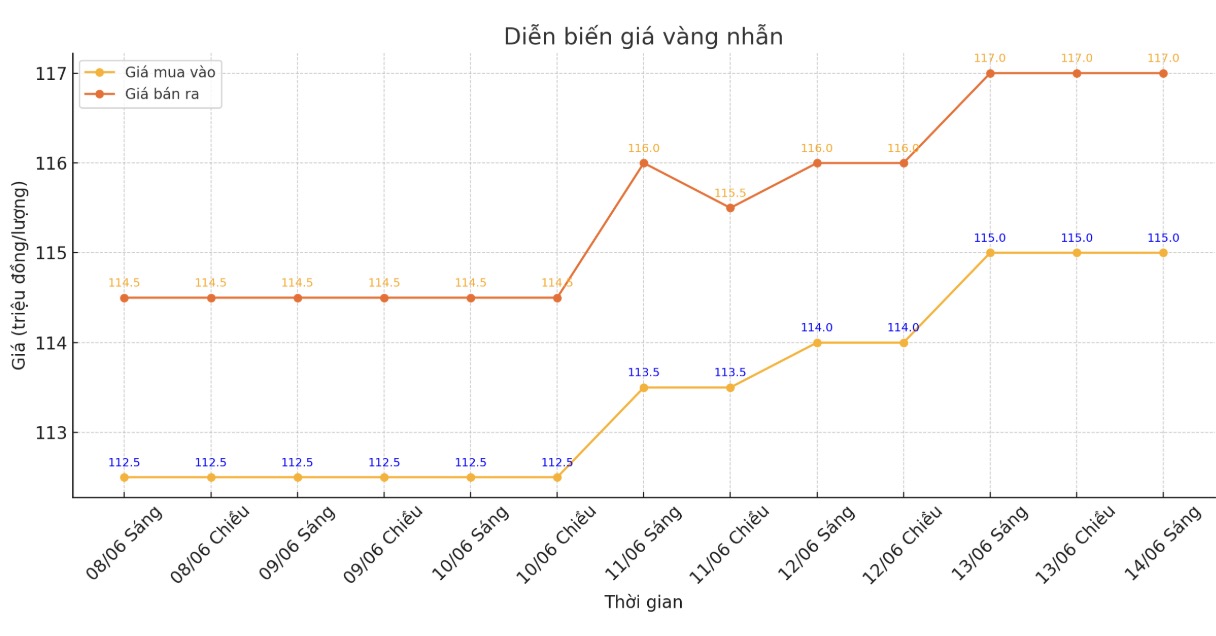

9999 gold ring price

As of 2025, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

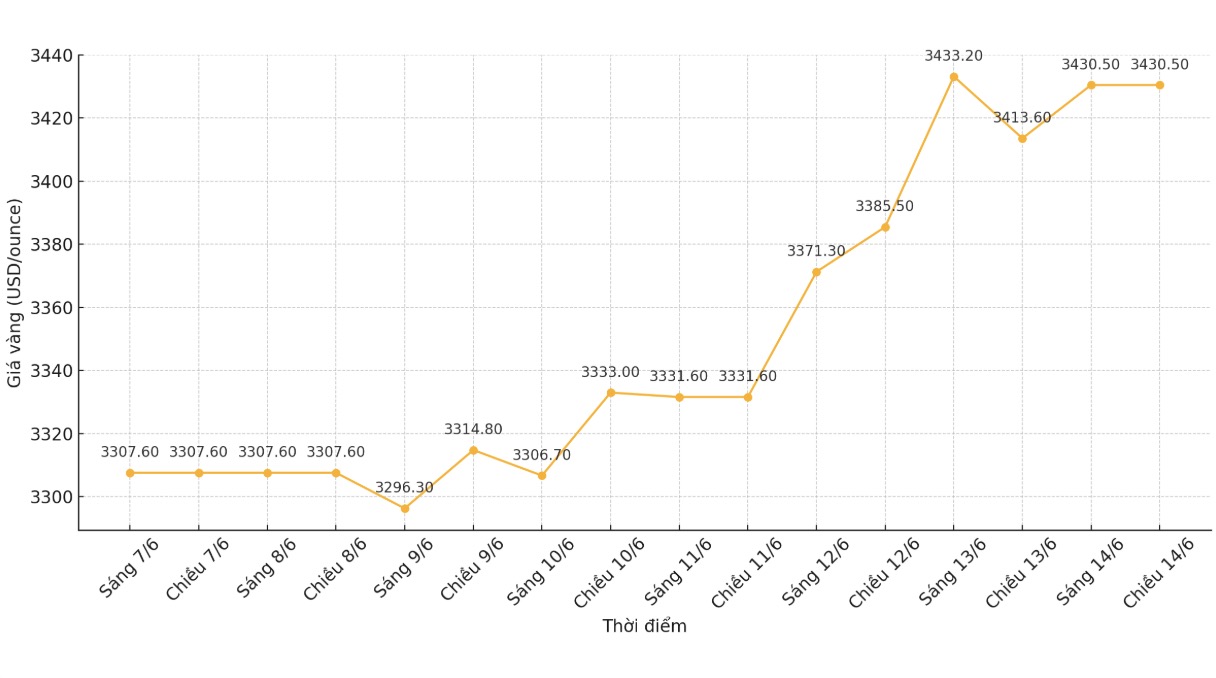

World gold price

The world gold price was listed at 20:32 at 3,430.5 USD/ounce, up 16.9 USD.

Gold price forecast

Gold prices increased sharply as the situation in the Middle East was tense, while the USD suddenly weakened, marking a shift in capital flows to seek safe havens.

The conflict that has broken out in the Middle East has once again prompted money to seek gold as a safe haven. Israel's initial attack triggered a sell-off in the stock market and pushed oil prices up. At the same time, safe-haven demand has pushed gold prices to their highest level since the record peak in April of $3,500/ounce. However, the biggest surprise was that bond yields and the US dollar remained almost unchanged.

The gold market ended the week up 3.7%, while the USD may end the week down 1%, trading at its lowest level in about three years.

The decline in the USD in the current context is really surprising. The US economy is often considered a stable support for the global economy.

Gold prices have broken through the resistance level of $3,400/ounce but remained steady below their all-time high of $3,500/ounce in April. Looking at the long term, strategists predict that gold will continue to benefit from cyclical factors and price structure in the second half of 2025.

Roukaya Ibrahim - commodity strategist at BCA Research (an international financial research and analysis company), said that their model portfolio still maintains an outstanding position in precious metals, including silver and platinum. However, gold is still a major asset, as all three are strong.

We are seeing a high correlation between stocks and bonds, and this is putting upward pressure on gold as investors seek new diversification tools. In this environment, gold is positioned to benefit from many different scenarios," she said.

See more news related to gold prices HERE...