Update SJC gold price

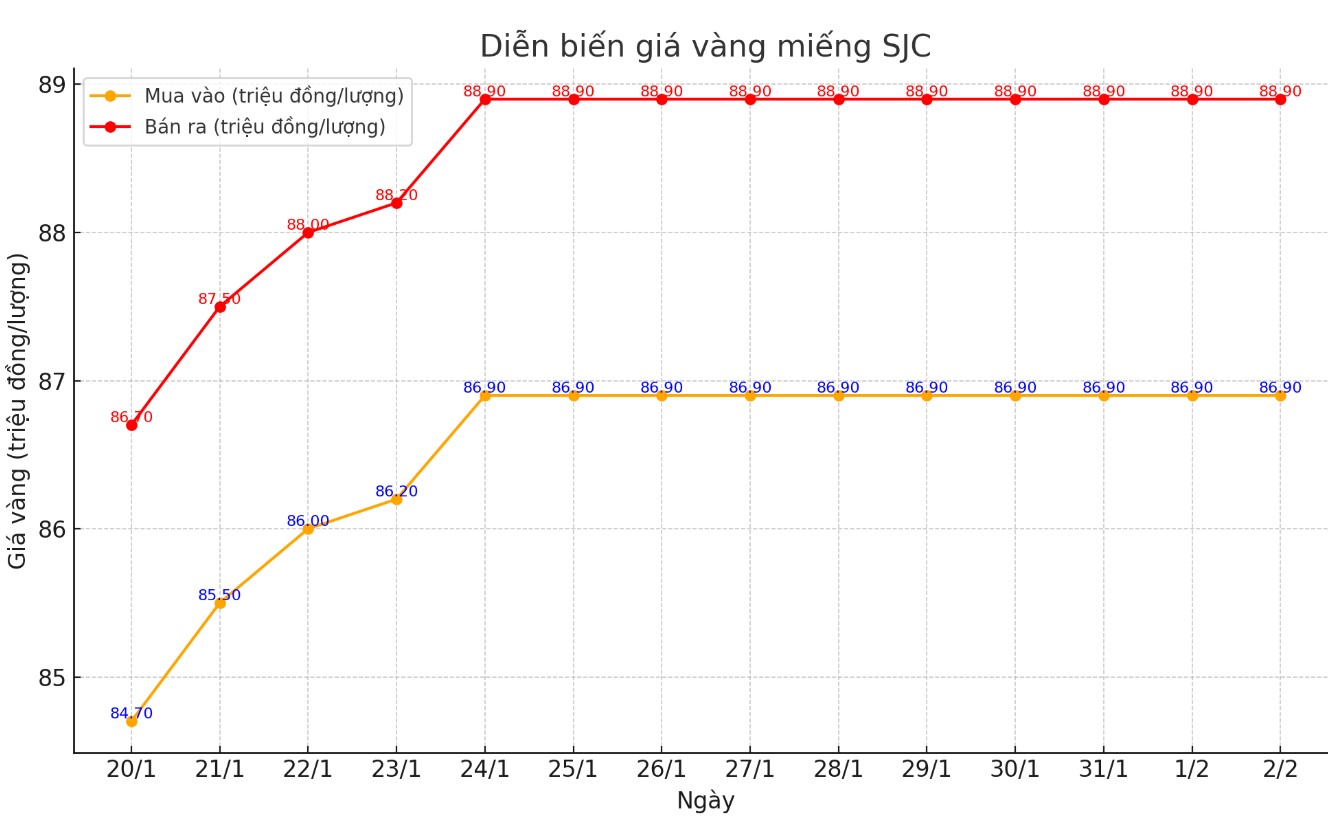

At the end of the weekly trading session, DOJI Group listed the price of SJC gold bars at 86.9-88.9 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI remained the same for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 86.8-88.8 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of January 26 and selling it in today's session (February 2), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 2 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say this difference is very high, causing investors to face the risk of losing money when investing in the short term.

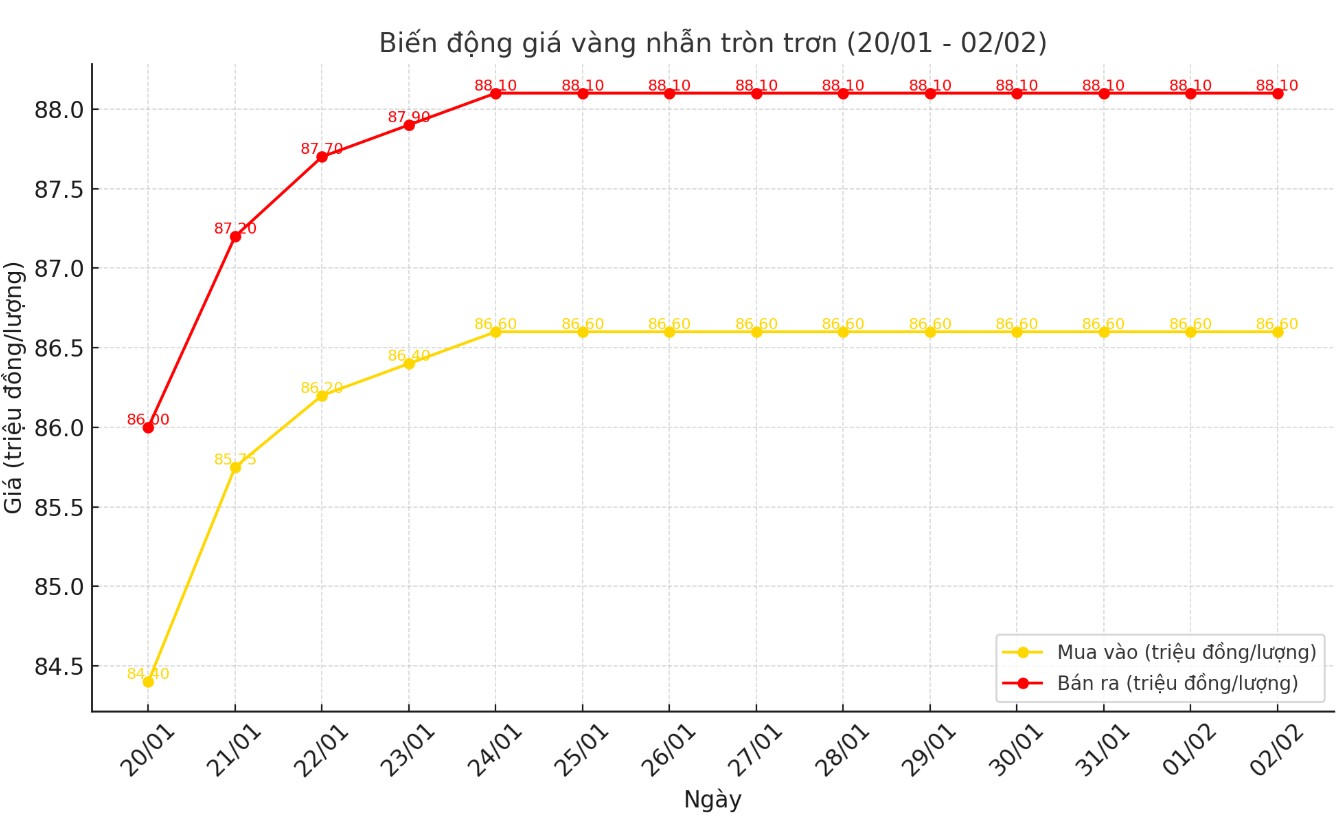

Price of round gold ring 9999

As of 6:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain unchanged compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to the closing price of last week's trading session.

If buying gold rings in the session of January 26 and selling in today's session (February 2), the buyer at DOJI will lose 1.5 million VND/tael; meanwhile, the buyer at Bao Tin Minh Chau will still lose 2.3 million VND/tael.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,797.9 USD/ounce, up 27.1 USD/ounce compared to the close of the previous week's trading session.

Gold Price Forecast

World gold prices remain high despite the increase in the USD index. Recorded at 7:00 a.m. on February 2, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 108.220 points (up 0.55%).

Financial market turmoil and geopolitical tensions pushed gold prices to a new record high above $2,800 an ounce last week. Despite signs of mild overbought conditions in speculative positions, analysts say the precious metal remains well supported in the short term.

Gold's momentum indicators are entering overbought territory but remain below October's highs, David Morrison, senior analyst at Trade Nation, said in a note on Friday.

Not only is gold hitting an all-time high, Comex gold is also trading at a significant premium to spot prices - one of the factors driving the sharp price increase.

Gold and silver flows into New York vaults are surging at an unprecedented rate, as banks and investors are hoarding the metal as a hedge against the risk of US tariffs on Mexico and Canada - the world's two largest silver producers - under President Donald Trump.

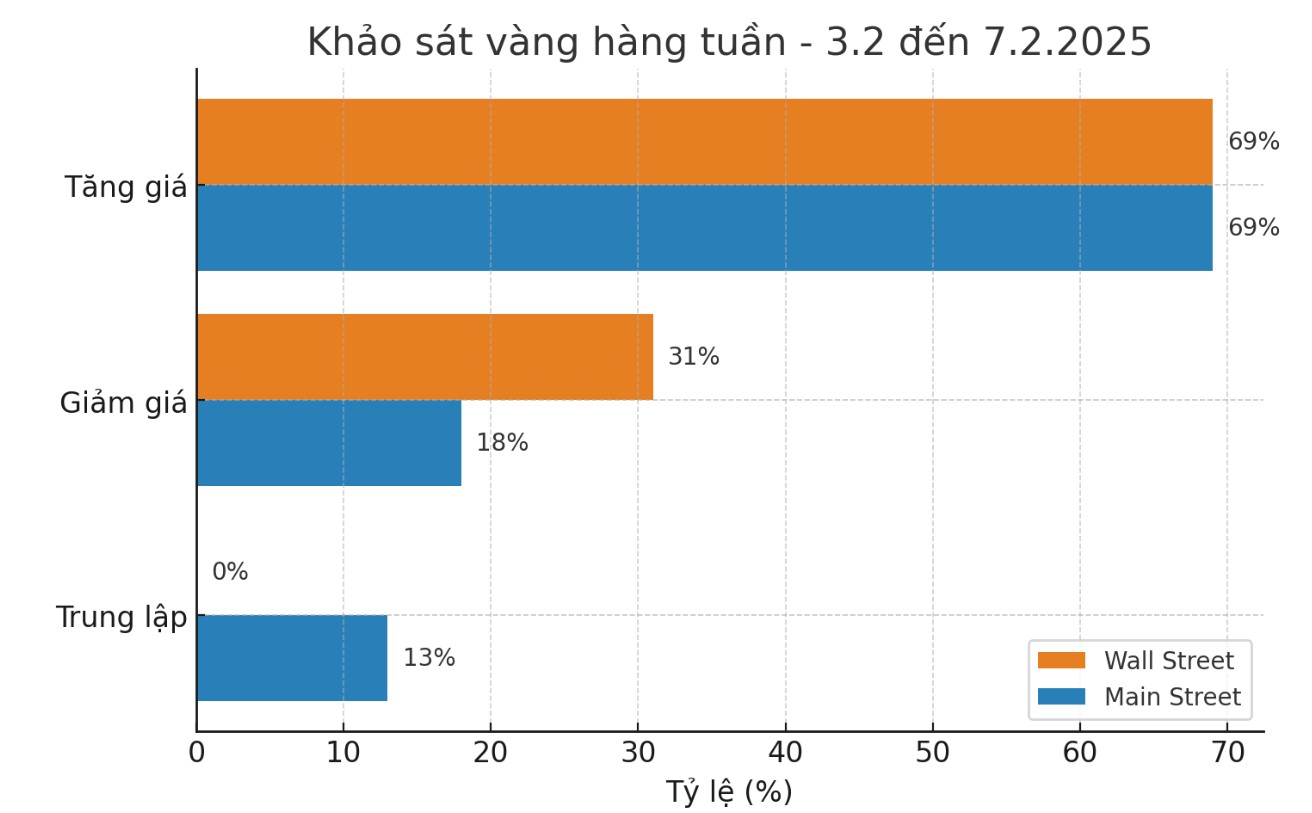

The latest Kitco News weekly gold survey shows that industry experts remain bullish on the precious metal, while retail investors also see higher prices in the near future.

Nine experts, or 69%, expect gold prices to surpass this week’s record next week. Four experts, or 31%, predict gold prices will fall. None expect gold to trade sideways or consolidate next week.

Meanwhile, 147 investors participated in Kitco's online poll, with retail investors as bullish as the professionals.

101 traders, or 69%, forecast gold prices to rise next week, while 27, or 18%, expect gold to fall. The remaining 19 investors, or 13% of the total, believe gold will move sideways in the short term.

“I am bullish on gold next week,” said Colin Cieszynski, chief strategist at SIA Wealth Management. “Gold has just completed a consolidation phase and has broken out to an all-time high. Technically, it looks like it is starting a new rally.”

See more news related to gold prices HERE...