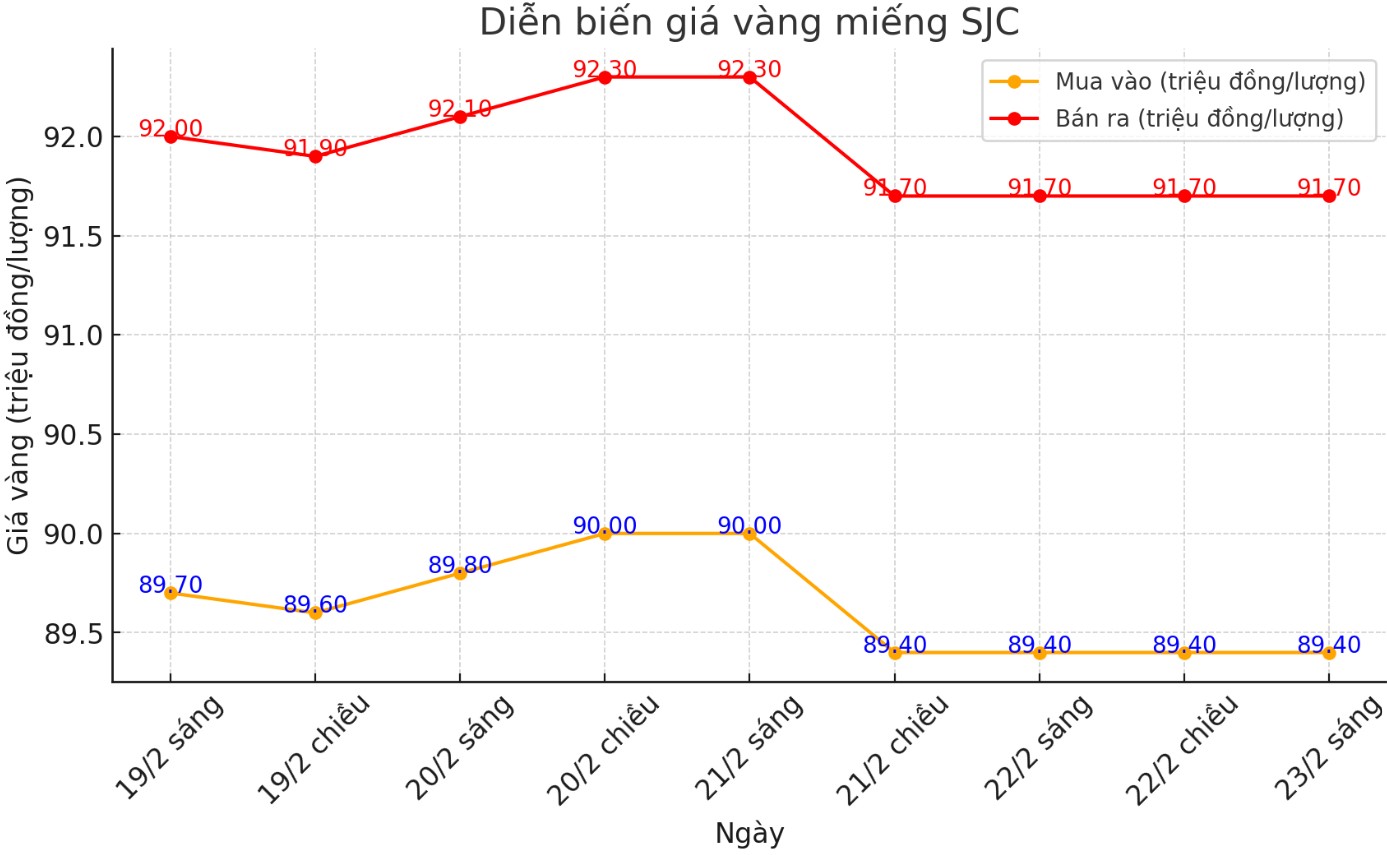

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at 88.5-90.5 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 23, 2025), the price of SJC gold bars at DOJI decreased by VND900,000/tael for buying and VND1.2 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 88.5-90.5 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 23, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by VND900,000/tael for buying and VND1.2 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of February 23 and selling it in today's session (March 2), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 3.2 million VND/tael.

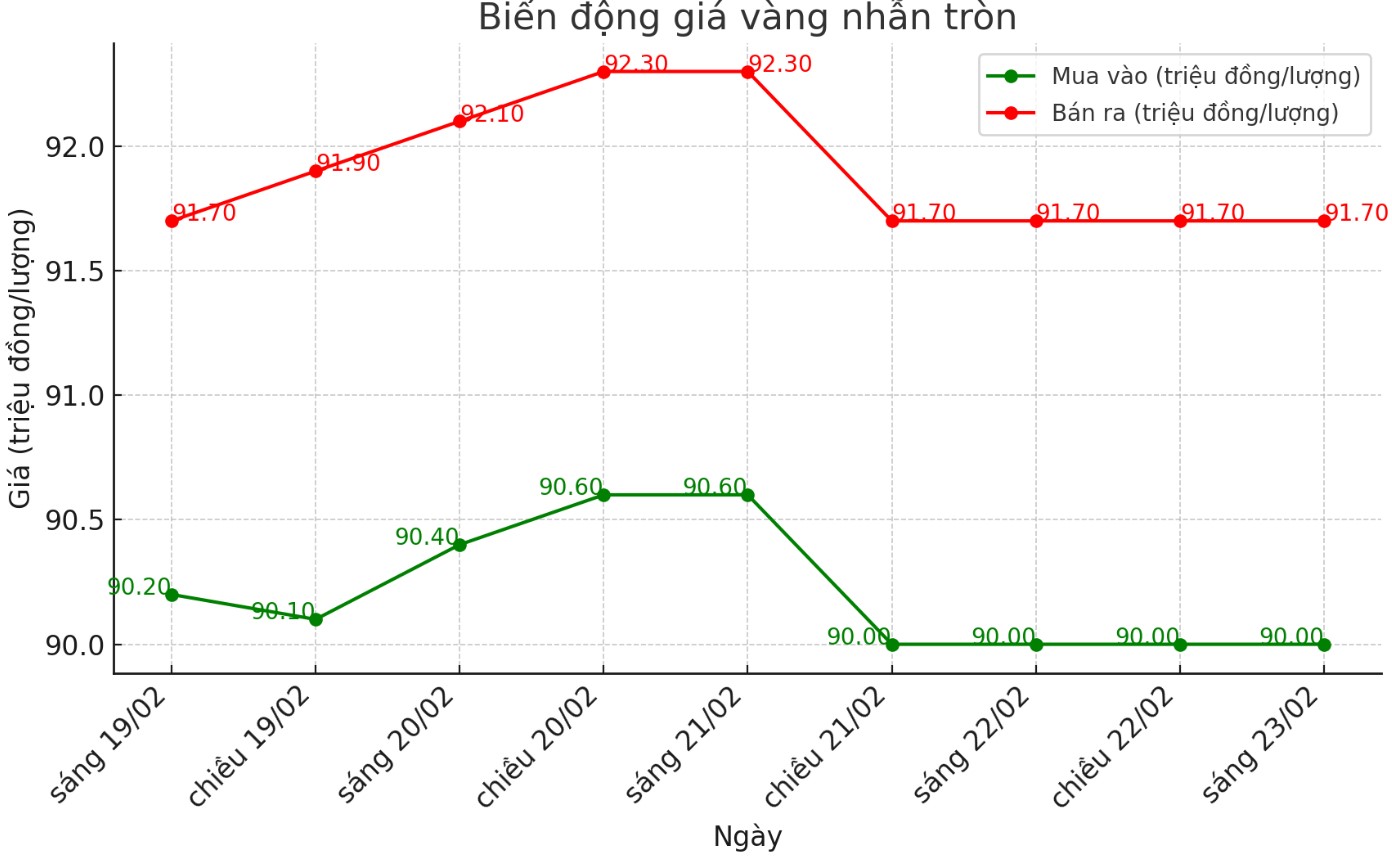

9999 gold ring price

This afternoon, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 90-91 million VND/tael (buy - sell); kept the same for buying and decreased by 700,000 VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.1-91.3 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 500,000 VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.2 million VND/tael.

If buying gold rings in the session of February 23 and selling in today's session (March 2), buyers at DOJI and Bao Tin Minh Chau both suffered a loss of 1.7 million VND/tael.

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 2,858.1 USD/ounce, down 78.1 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices were under pressure at the end of the week as the USD index increased. Recorded at 5:00 p.m. on March 2, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.560 points (up 0.35%).

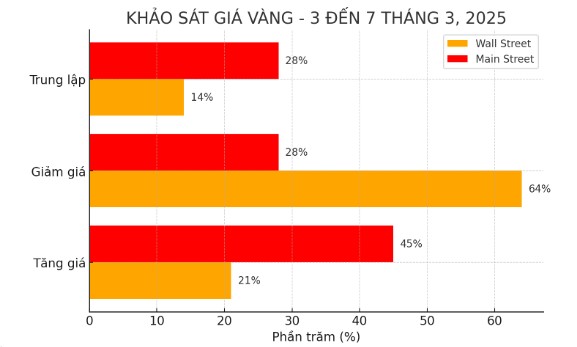

The latest weekly survey from Kitco News shows that the number of people optimistic about gold prices is decreasing, both among experts and individual investors, as gold continues to lose value every session.

Last week, 53% of experts (9/17 people) predicted gold prices to increase, while this week, this figure decreased sharply to only 21% (3/14 people). At the same time, experts predict that gold prices will fall from 24% (4/17 people) to 64% (9/14 people), showing increasingly negative sentiment.

Optimism among individual investors has also declined. Last week, 71 (744/204 people) expected gold prices to increase, but this week, the ratio has decreased to only 45% (62/138 people). Meanwhile, investors forecast gold prices to fall from 17% to 28%, while the forecast price for sideways remains at 28%.

These figures clearly reflect the loss of confidence in gold's upward momentum as the precious metal has continuously adjusted over the past week.

Marc Chandler - CEO of Bannockburn Global Forex believes that gold prices may continue to decline in the short term. "Gold set a record on February 24 at $2,956 an ounce but was later sold off. Gold is showing signs of trading as a risky asset rather than a safe-haven asset," Chandler analyzed.

According to this expert, the next support level for gold could be at 2,814 USD/ounce, if it breaks this level, the price could fall to 2,770 USD/ounce.

Despite the decline in prices, some experts believe that selling pressure has not caused significant technical damage to gold.

This is still a normal correction and I am not worried, said Jess Colombo, an independent precious metals analyst and founder of BubbleBubble Report.

Gold could retest to support $2,800 an ounce a high in late October. If prices close below $2,800/ounce, I will have a more cautious view of gold mining stocks and short-term trading positions, but not affecting the physical gold I hold, said Jess Colombo.

This expert also said that it is difficult to have a negative view of gold in the context of continued inflation and a weakening of the US economy.

See more news related to gold prices HERE...