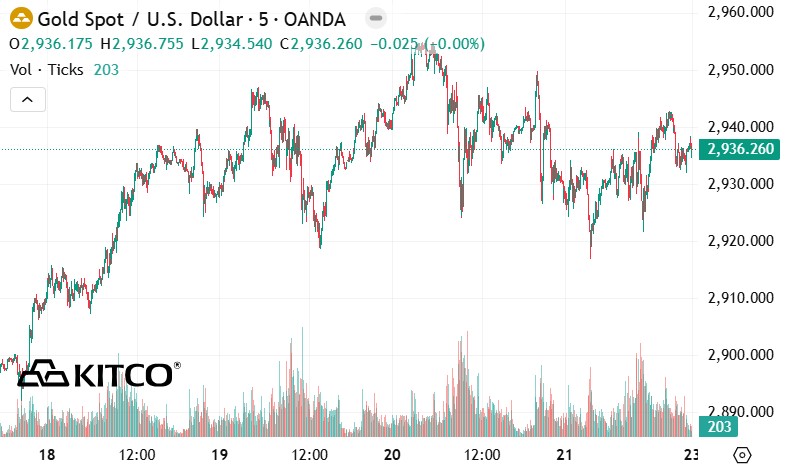

According to Kitco - World gold prices are in an unprecedented increase, with 8 consecutive weeks of closing at an all-time high. This is the longest increase since mid-2,000, when gold prices approached the $2,000/ounce mark for the first time.

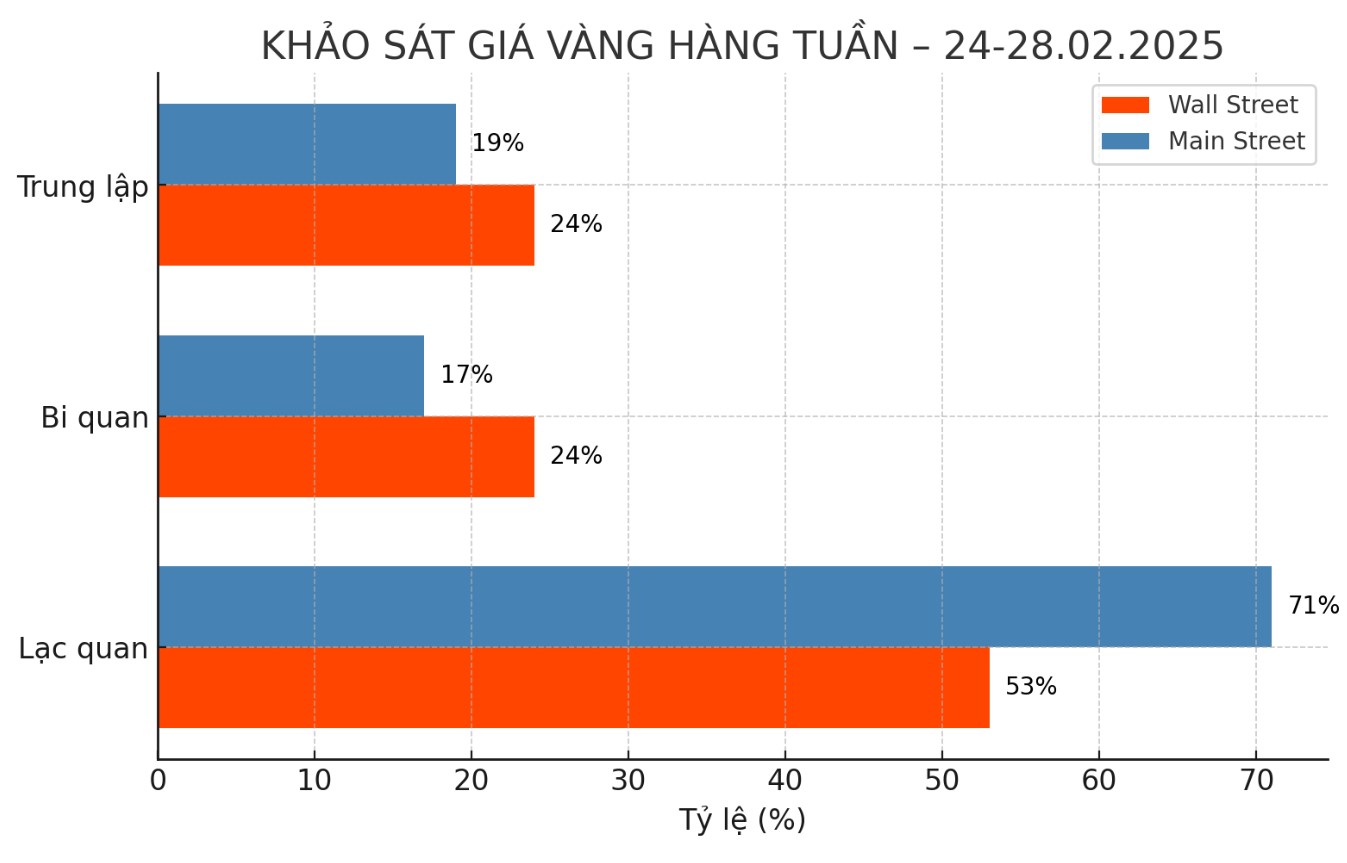

Although the gold market seems to be overvalued, Christopher Vecchio - Head of futures & Forex at Tastylive.com - said he could not ignore the strong rally supported by solid fundamentals.

Vecchio believes that the trend of gold is going from bottom to top, which means it is only a matter of time before gold prices reach $3,000/ounce and above.

Technically, he said gold is receiving solid support at the 5-day moving average. As long as this trend has not changed, he still maintains an optimistic view on gold prices.

Gold has story-based flexibility, which will continue to support higher prices. Basic factors have pushed gold prices to the current level that is getting stronger, whether it is concerns about inflation, disruptions in global trade or the trend of shifting away from traditional currencies in central bank reserves. These factors will continue to impact the market, he said.

Lukman Otunuga - Director of Market Analysis at FXTM also emphasized that gold still has a lot of room to increase prices. Due to unstable geopolitics, investment demand for gold ETFs has increased sharply in recent weeks.

He added that new geopolitical uncertainty in Europe will continue to boost safe-haven demand for gold next week.

Germany - Europe's largest economy will enter the election on Sunday, February 23. The election results could shape Germany's political and economic prospects in the coming years.

If the election leads to a divided parliament, it could create a wave of risk evasion, thereby boosting demand for safe-haven assets such as gold, he said in a report to Kitco News.

In addition to politics, the US PCE inflation report on Friday could also impact gold prices through expectations of a Fed rate cut. As gold fails to yield, an inflation report reinforces the possibility that a Fed rate cut could support gold prices.

Technically, if gold falls below $2,950/ounce over the long term, prices could retreat to $2,900/ounce. Conversely, if buyers push the price above $2,950/ounce, the next milestone will be $3,000/ounce," said the expert.

James Stanley - Senior Market Strategist at Forex.com - said that gold prices will not face any significant resistance until they reach the $3,000/ounce mark. He emphasized that this is an important psychological threshold, which needs time for the market to absorb.

I expected gold to hit $3,000 an ounce, but it could hover around for a while, he said.

Stanley believes that gold's increase above the $3,000/ounce mark will depend on the US government's fiscal policy and the Fed's monetary policy.

Gold prices are rising because even though the Fed is keeping interest rates unchanged, they understand that they cannot continue to raise interest rates higher, he said.

Looking ahead to next week, Naeem Aslam - Investment Director at Zaye Capital Markets - said that inflation data could be the biggest risk for gold prices.

Currently, the biggest risk for gold is a shift in monetary policy expectations. If inflation cooles down faster than expected or central banks tighten policy more strongly, gold prices may be under downward pressure. In addition, any significant recovery of the US dollar or rising bond yields could threaten gold's current rally, he said.

Economic events to watch affect gold prices

Sunday: Election in Germany.

Tuesday: US consumer confidence.

Wednesday: New home sales in the US.

Thursday: US Q4 preliminary GDP, US long-term goods orders, US weekly jobless claims, US pending home sales.

Friday: US core PCE index, personal income and spending.