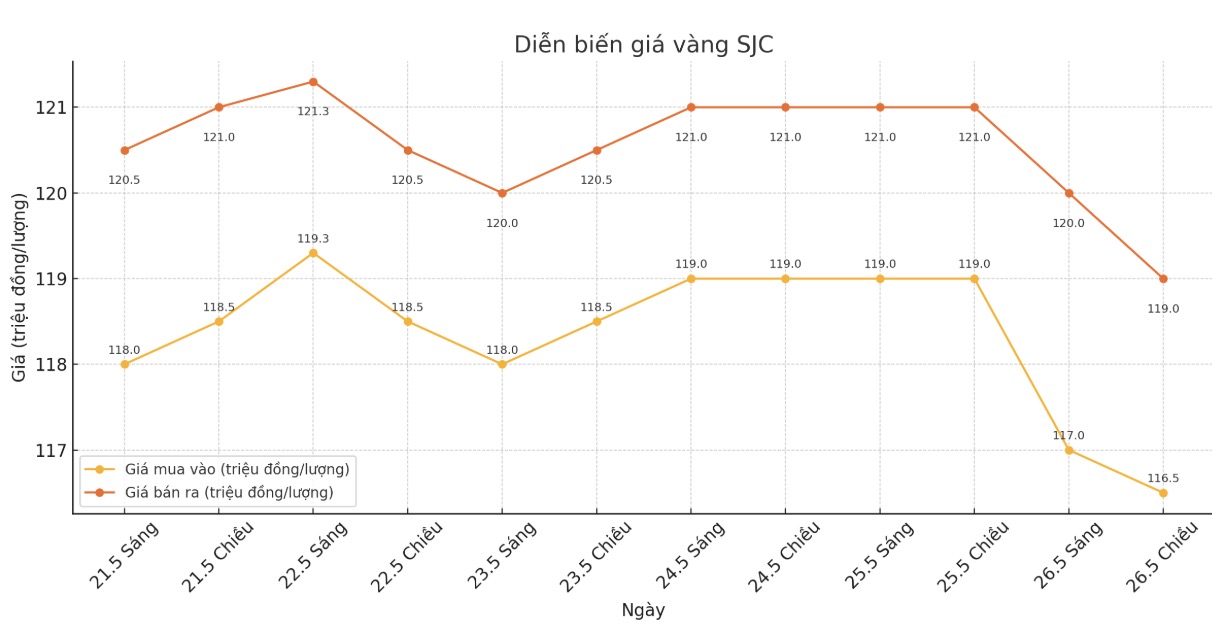

Updated SJC gold price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116.5-119 million/tael (buy - sell), down VND2.5 million/tael for buying and down VND2 million/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116.5-119 million VND/tael (buy - sell), down 2.5 million VND/tael for buying and down 2 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.5-119 million VND/tael (buy - sell), down 2.5 million VND/tael for buying and down 2 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116-119 million VND/tael (buy - sell), down 2 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

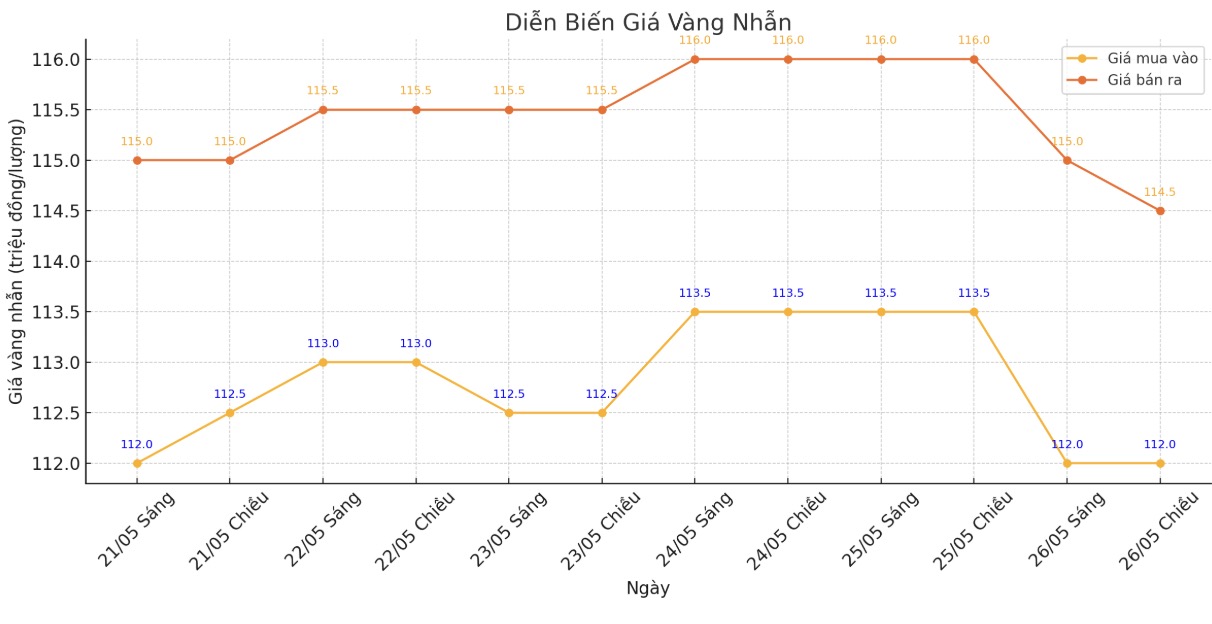

9999 round gold ring price

As of 5:15 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112-124.5 million VND/tael (buy - sell), down 1.5 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.7-117.7 million VND/tael (buy - sell), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112-115 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

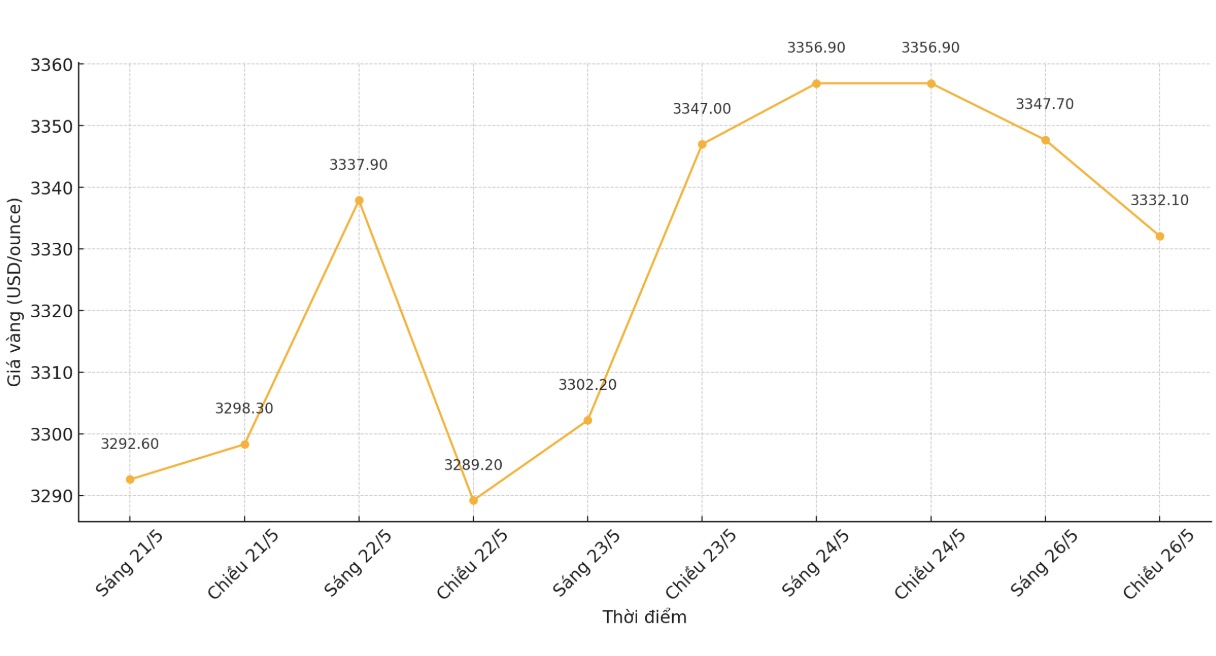

World gold price

At 5:20 p.m., the world gold price listed on Kitco was around 3,332.1 USD/ounce, down 24.8 USD/ounce.

Gold price forecast

According to Reuters, world gold prices fell in the first session of the week after US President Donald Trump decided to postpone the deadline for imposing a 50% tax on goods from the European Union (EU), reducing demand for safe-haven assets such as gold.

This is a slightly volatile trading session, UBS analyst Giovanni Staunovo said, suggesting the slight decline was due to Trump's delay in imposing higher tariffs on the EU. He also noted that because the US is on Memorial Day, trading volume will be low.

We still expect gold prices to rise again in the next few months, with the possibility of re-evaluating the $3,500/ounce zone, Mr. Staunovo predicted.

Citi Bank has also raised its gold price forecast for the past 3 months to $3,500/ounce (from $3,150/ounce released on May 12), due to the impact of US tax policy, geopolitical tensions and concerns about the federal budget. Citi believes gold prices will range from $3,100 to $3,500/ounce.

Notable economic data this week

Tuesday: Long-term US orders, US consumer confidence, monetary policy decision of the Reserve Bank of New Zealand.

Wednesday: FOMC meeting minutes for May.

Thursday:Weekly jobless claims, preliminary Q1/2025 GDP, US pending home sales.

Friday: US PCE core inflation index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...