World gold prices fell in the first session of the week after US President Donald Trump decided to postpone the deadline for imposing a 50% tax on goods from the European Union (EU), reducing demand for safe-haven assets such as gold.

This is a slightly volatile trading session, UBS analyst Giovanni Staunovo said, suggesting the slight decline was due to Trump's delay in imposing higher tariffs on the EU. He also noted that because the US is on Memorial Day, trading volume will be low.

Both the US and UK markets are closed today due to the holiday.

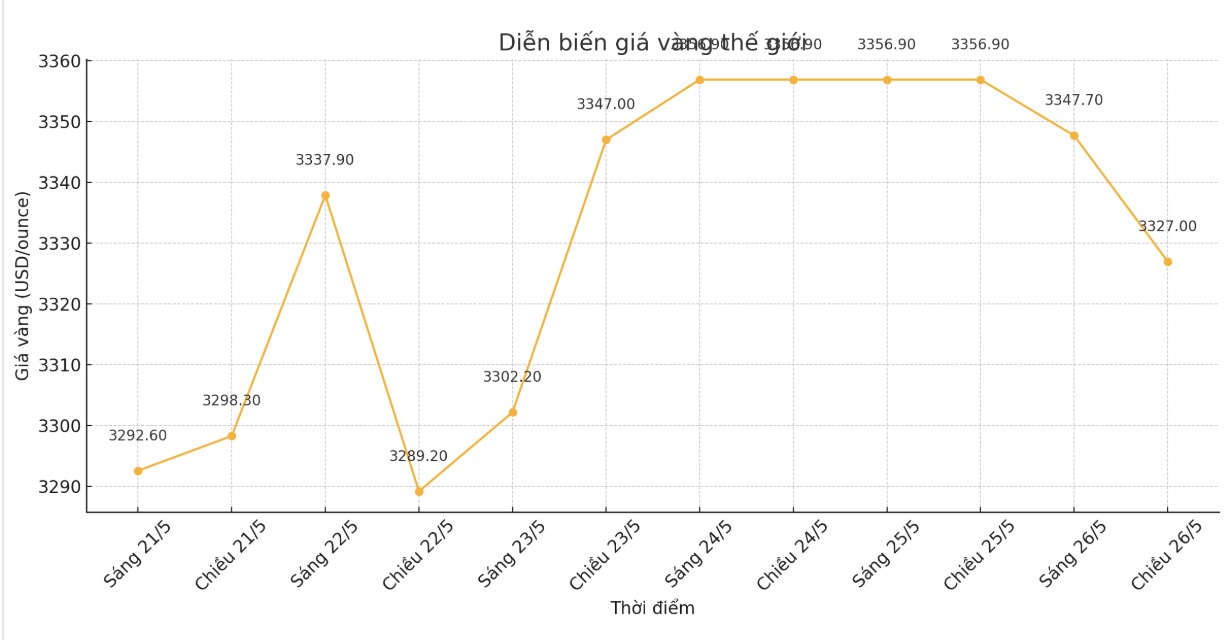

On Sunday, Mr. Trump announced a delay in the deadline for taxation to July 9 so that the two sides have time to negotiate. Last week, gold prices had their strongest week of increase in 6 weeks, after Mr. Trump threatened to impose tariffs on EU goods and considered taxing 25% on iPhones sold in the US but manufactured outside this country.

The USD Index (DXY) has fallen to its lowest level in nearly a month against a basket of major currencies.

We still expect gold prices to rise again in the next few months, with the possibility of re-evaluating the $3,500/ounce zone, Mr. Staunovo predicted.

Citi Bank has also raised its gold price forecast for the past 3 months to $3,500/ounce (from $3,150/ounce released on May 12), due to the impact of US tax policy, geopolitical tensions and concerns about the federal budget. Citi believes gold prices will range from $3,100 to $3,500/ounce.

Regarding geopolitical situations, Russia continues to attack Ukraine for the third consecutive night, according to information from regional officials and rescue forces of this country. The day before, the largest road attack since the war began had killed at least 12 people.

Spot silver prices fell 0.2% to $23.4 an ounce. platinum fell 0.8% to $1,085.76/ounce and paladi lost 0.6% to $987.18/ounce.

See more news related to gold prices HERE...