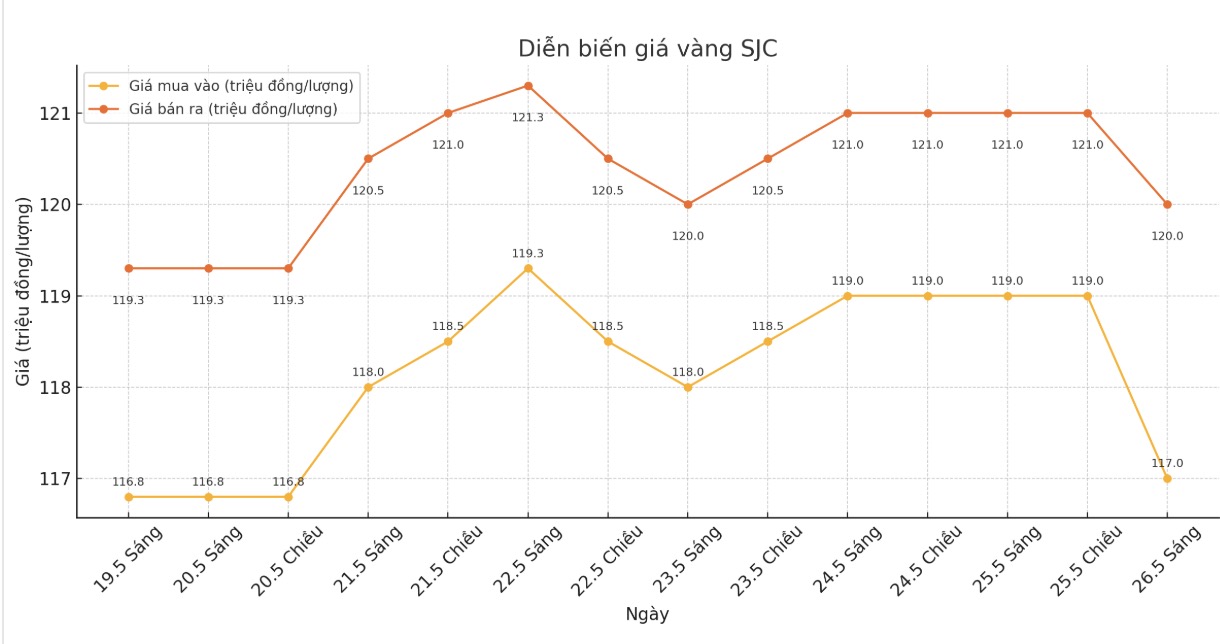

Updated SJC gold price

As of 10:00, the price of SJC gold bars was listed by Saigon Jewelry Company at 117-120 million VND/tael (buy - sell), down 2 million VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), down 2 million VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), down 2 million VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 116.5-120 million/tael (buy - sell), down VND 1.5 million/tael for buying and down VND 1 million/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

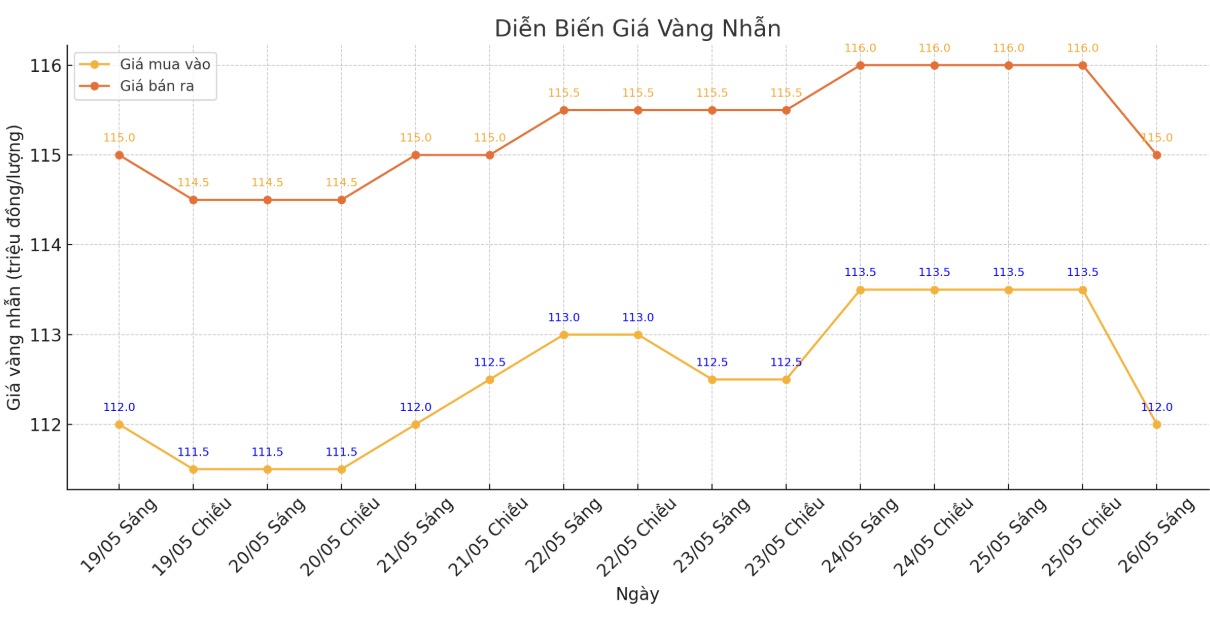

9999 round gold ring price

As of 10:00, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112-115 million VND/tael (buy - sell), down 1.5 million VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.5-125.5 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

At the Government Standing Committee meeting on gold market management last weekend, Prime Minister Pham Minh Chinh said that recently, a number of issues have arisen such as large domestic and world gold price differences, some moves of enterprises participating in the gold market are manipulated, hoarding, and price increases.

In the immediate future, the Prime Minister requested the State Bank to strengthen management, quickly bringing the gap between domestic and world gold prices to only about 1-2%, unable to be above 10% as recently.

Following the Prime Minister's direction, domestic gold prices were simultaneously adjusted down by business units.

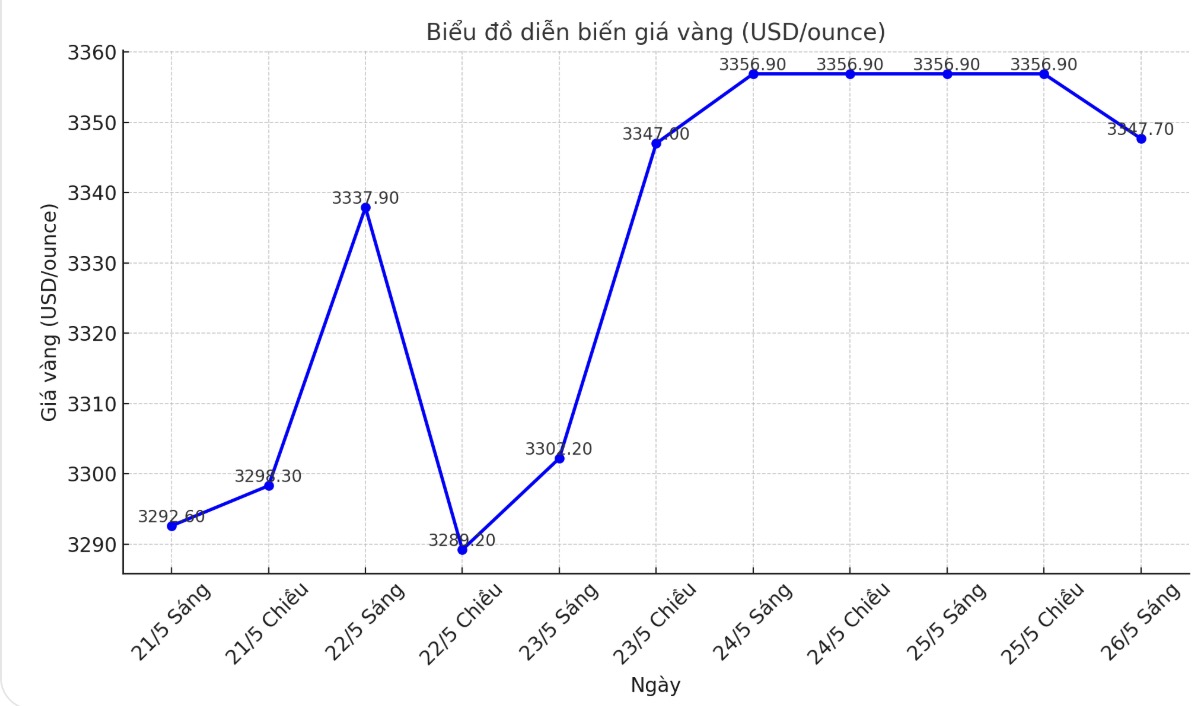

World gold price

At 10:00, the world gold price listed on Kitco was around 3,347.7 USD/ounce, down 9.2 USD/ounce.

Gold price forecast

On Kitco, the majority of Wall Street experts gave positive forecasts for short-term gold prices. Colin Cieszynski - Chief Strategist at SIA Wealth Management assessed that trade tensions will be beneficial for gold prices: "With US President Donald Trump once again being tough in his tariff statements, I am leaning towards the possibility of gold prices continuing to increase in the next few weeks" - he said.

Sharing the same view, Adam Button - Head of currency strategy at Forexlive.com said that the market has chosen gold as a defensive asset in the context of the trade war:

The trade war has returned, and gold is a trading tool in this war. I think gold buyers will become more confident, because now they understand how the market reacts. In the early stages of the trade war, gold was sold off due to the withdrawal of risky assets, but now that is no longer the case.

The market is forming muscle memories, meaning that every time there is a trade war, people buy gold, buy Yen, buy Swiss francs and sell USD.

I think that will make trading more intense, with higher leverage, stronger confidence and ultimately higher gold prices. Gold is gradually becoming a priority asset as the trade war becomes tense. If you think the trade war is getting worse, buy gold. If you think the situation will improve, then take profits, he added.

Marc Chandler - CEO at Bannockburn Global Forex said that gold prices are preparing to challenge the $3,400/ounce mark once again. The correction from the top on April 22 seems to be over, he said.

Immediate delivery prices have touched the trend line drawn from the peaks of April and May. The momentum indicators are currently positive, and the Dollar Index has just ended a 4-week increase streak, which is also of an adjustment nature. It seems that the three-step correction model of gold prices has been completed and the possibility of a new peak in the medium term is reasonable.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...