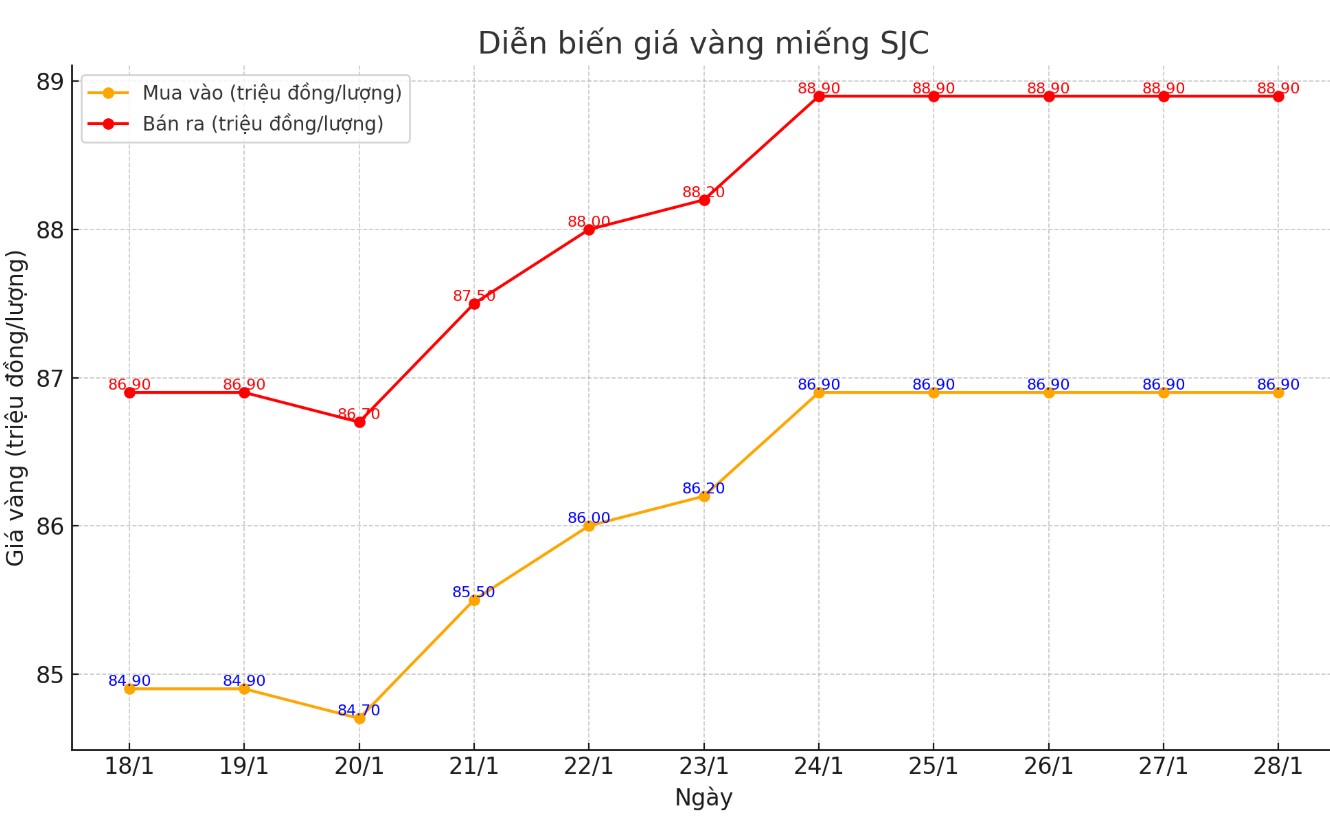

Update SJC gold price

As of 6:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); increased 100,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

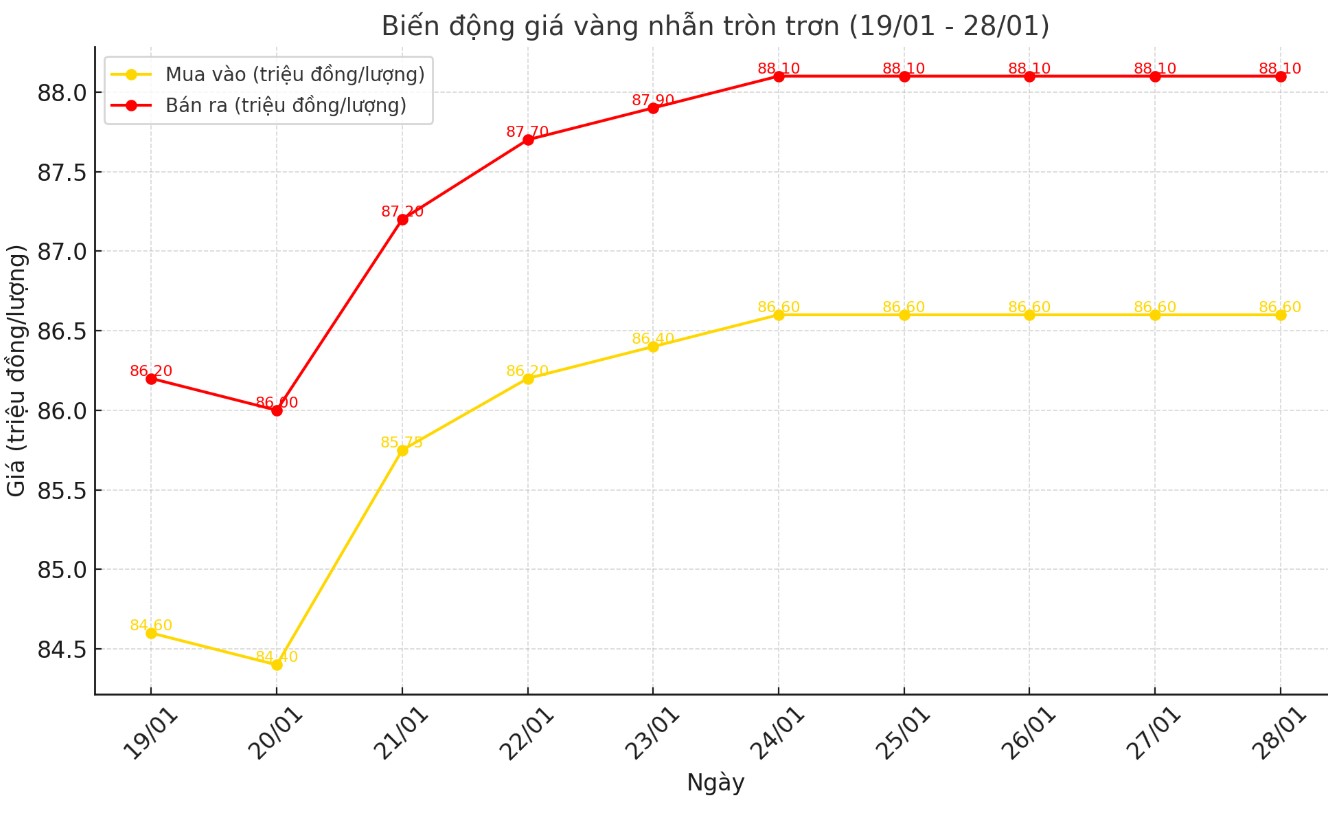

Price of round gold ring 9999

As of 6:30 p.m. today, the price of round gold rings listed by DOJI Group is at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain unchanged compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to the closing price of yesterday's trading session.

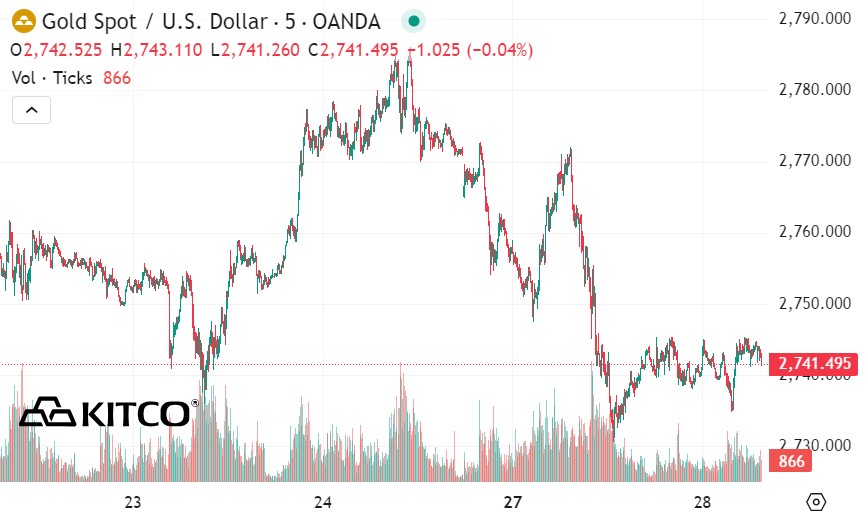

World gold price

As of 7:10 p.m., the world gold price listed on Kitco was at 2,741.4 USD/ounce, down 28.3 USD/ounce compared to the same time in the previous session.

Gold Price Forecast

World gold prices fell sharply amid an increase in the USD index. Recorded at 7:15 p.m. on January 28, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.850 points (up 0.64%).

According to Kitco, the world gold price fell sharply when the stock market faced a large wave of sell-off, causing confusion for investors and traders. The mentality of "if you can't sell what you want, you'll sell what you have" is spreading in the market.

Over the weekend, news broke that China was challenging the US for leadership in artificial intelligence (AI). DeepSeek, a small and emerging Chinese AI company, reportedly developed a large language model that rivals leading US models, at a fraction of the cost.

This week, major tech companies began reporting fourth-quarter earnings. Before DeepSeek made headlines, earnings were forecast to be at their lowest level in nearly two years.

Despite the decline, supporting factors such as US policy fluctuations, banks' gold accumulation trend and the global economic situation are supporting gold prices.

Adrian Day, chairman of Adrian Day Asset Management, said he expects gold prices to continue rising this week. “The current momentum is certainly in favor of gold, even as North American investors continue to sell,” he said.

Darin Newsom, senior market analyst at Barchart.com, said there is little to stop gold from setting new highs as global markets continue to react to the unpredictability of the new US President.

“At this point, we can ignore technical and fundamental analysis,” he said. “Gold is a safe-haven market in the midst of the chaos surrounding the new US administration. No one can predict what the next words or actions will be.”

Deutsche Bank has a bullish outlook for gold this year, saying it doesn’t see gold falling below $2,450 an ounce or above $3,050 an ounce. The high end of that range is more optimistic than Goldman Sachs’ price target, which implies a 10.62% return from current levels.

Deutsche Bank also believes that central bank gold purchases will be a catalyst for the precious metal's long-term performance. With many countries deeply in debt, gold offers reliable protection.

Also bullish is JPMorgan, which forecasts prices will hit $3,000 an ounce, fueled by concerns about policy uncertainty and geopolitical risks.

However, according to the bank, that does not mean that gold prices will steadily rise to that target price. JPMorgan believes that the precious metal will experience a short-term downturn due to the Trump administration's expected tariffs. However, the bank expects gold to recover in the second half of the year to reach its price target. Some gold investors may interpret this as a period of waiting for prices to fall.

See more news related to gold prices HERE...