Gold has long been seen as a defensive asset, acting as insurance in an investment portfolio. However, the precious metal’s historic rally over the past year may begin to challenge that seemingly outdated definition.

This week, the Swiss Federal Pension Fund Publica (one of the largest pension funds in Switzerland, operating as an autonomous public institution) said that in 2024, its total net investment return will be 5.9%, across all pension plans it manages.

The fund said its returns were driven by investments in stocks and precious metals. Publica said the stocks portfolio would have the biggest positive impact on the fund's consolidated assets in 2024.

“With an annual net return of 14.5%, equity investments contributed 4.7 percentage points to the total return of 5.9%,” Publica said in the report.

North American-listed companies performed best, while European stocks underperformed.

Meanwhile, the fund said precious metals are the second-largest contributor to Publica's consolidated assets in 2024, delivering a 33% return.

“For diversification purposes, Publica invests a portion of its assets in precious metals such as gold and silver,” the fund said.

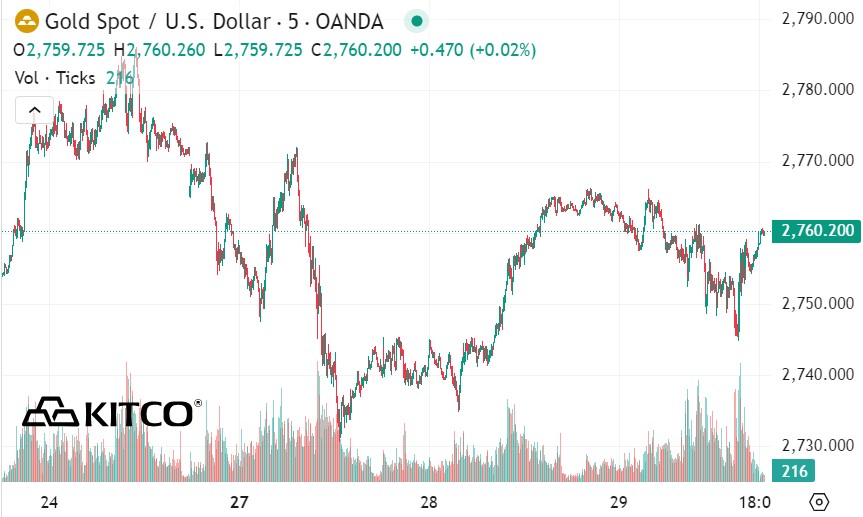

Despite a correction in the gold market in the last two months of 2024, gold prices still recorded one of the strongest increases in the past four decades, with an increase of 27%.

Publica said the bond portfolio was the weakest point last year.

“With a total annual return of just 1%, bonds contributed a modest 0.4 percentage point increase to total returns,” the fund said.

See more news related to gold prices HERE...