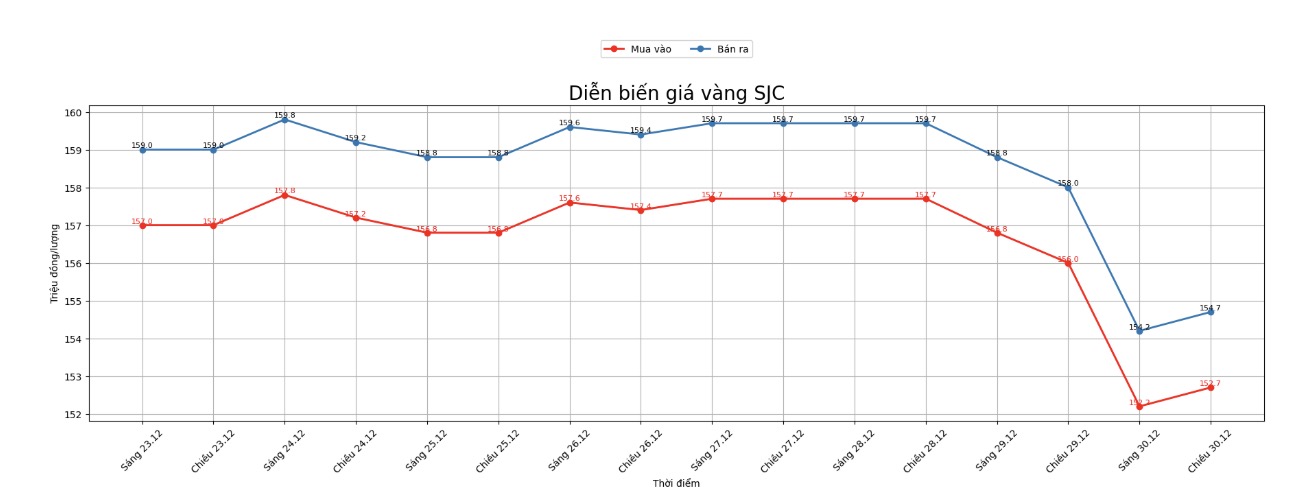

SJC gold bar price

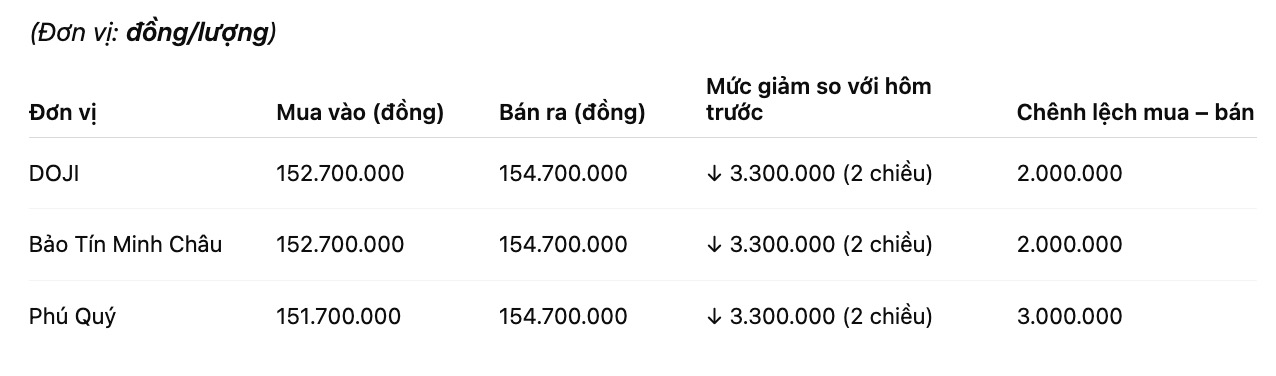

As of 5:50 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 152.7-154.7 million VND/tael (buying - selling), down 3.3 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 152.7-154.7 million VND/tael (buying - selling), down 3.3 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 151.7-154.7 million VND/tael (buying - selling), down 3.3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

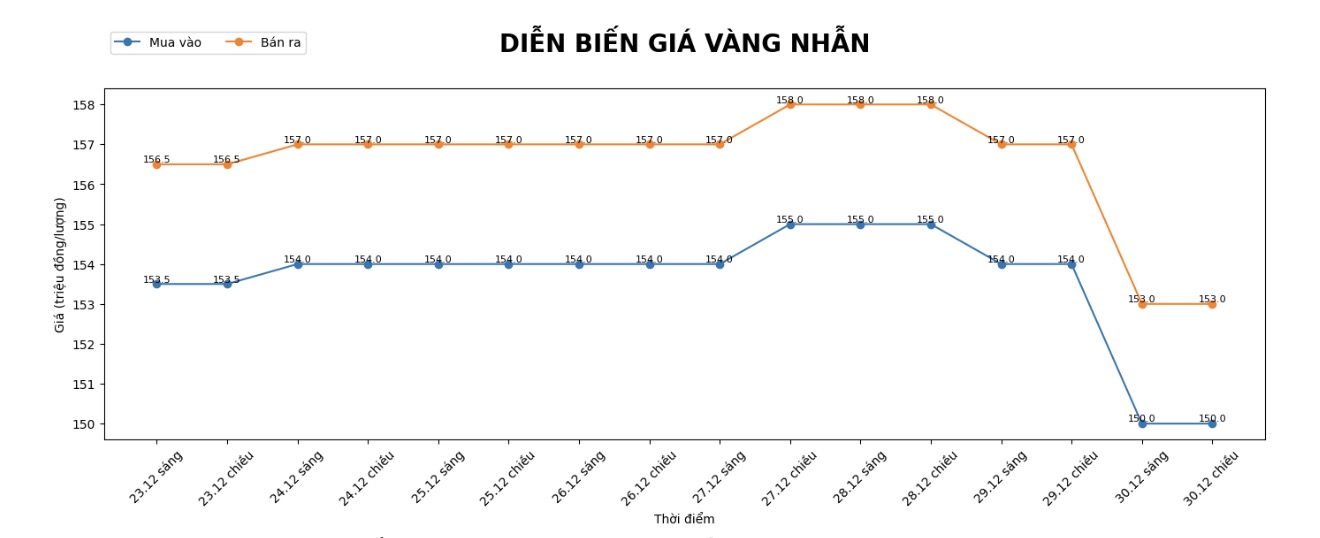

9999 gold ring price

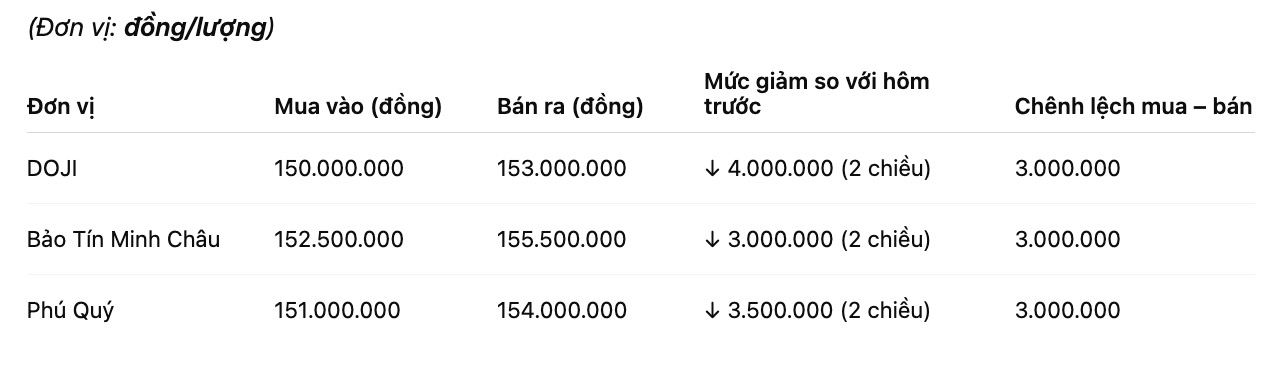

As of 6:00 PM, DOJI Group listed the price of gold rings at 150-153 million VND/tael (buying - selling), down 4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.5-155.5 million VND/tael (buying - selling), down 3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 151-154 million VND/tael (buying - selling), down 3.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

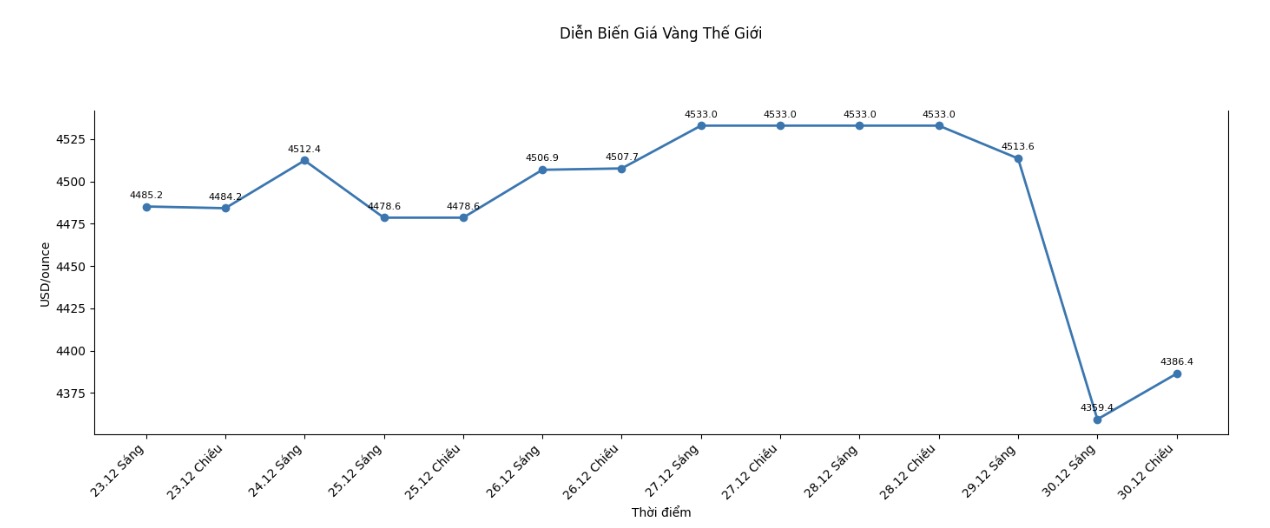

World gold price

World gold price listed at 18:02 was at the threshold of 4,386.4 USD/ounce, down 56.1 USD compared to the previous day.

Gold price forecast

Gold and silver prices witnessed strong sell-offs this week, mainly due to profit-taking after a year of explosive price increases. Gold once set a historic peak of $4,550/ounce on Friday, up more than 70% compared to the beginning of the year, before closing the year with an increase of about 65% – still the strongest year-on-year increase since 1979.

Many analysts believe that this correction momentum is technical as many investors take advantage of realizing profits after a prolonged hot streak.

Compared to gold, silver is under significantly stronger adjustment pressure. The deep decrease is said to be amplified by the decision of the Chicago Mercantile Exchange (CME) to raise overnight deposit requirements to $25,000 - the second increase adjustment in just one month.

Margin raising has triggered sell-offs from traders using high leverage, forcing them to close positions even though they have not changed their long-term views on the silver market.

In addition to technical factors, geopolitical developments also contribute to creating selling pressure. Initial optimistic signals about the possibility of peace talks between the US, Ukraine and Russia were quickly overshadowed by new tough statements from Moscow, increasing instability in the context of the market already volatile.

In addition, gold prices are also negatively affected by US economic data. According to the US National Association of Realtors (NAR), the home price index in November increased by 3.3% compared to the previous month, more than three times higher than forecast. This positive data reduces safe haven demand.

Despite the plummeting gold price, commodity strategists at UBS - a Swiss multinational financial and banking group, one of the largest in the world, believe that gold prices could reach the 5,000 USD/ounce mark in the third quarter of 2026, and in the scenario of political or economic instability surrounding the escalation of the US midterm election, this precious metal could even increase to 5,400 USD/ounce.

UBS believes that gold demand will increase steadily in 2026, supported by low real interest rates, prolonged global economic concerns, and domestic policy instability in the US - especially related to midterm elections and increased fiscal pressure.

If political or financial risks increase, gold prices could climb to 5,400 USD/ounce (previously forecast at 4,900 USD/ounce)" - UBS strategists wrote.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...