US major stock indices closed near record highs in a quiet trading session after Christmas on Friday, mostly unchanged compared to the beginning of the session.

Meanwhile, expectations that the US Federal Reserve (Fed) would cut interest rates along with the need for safe havens pushed the price of precious metals to the highest level of all time.

Due to the holidays, markets in Australia, Hong Kong (China) and most of Europe closed. However, open-ended exchanges are aiming to close the year with positive results; Asian stocks previously had risen to their highest level in many weeks.

The S&P 500 benchmark index ended the session in New York down 0.03% compared to the beginning of the day; the Dow Jones Industrial Average index fell 0.04% and the Nasdaq Composite fell 0.09%. These slight declines ended the three-session winning streak, but all three indices still increased in the week and are heading towards a two-digit increase for the whole year.

Large-cap technology companies have led the S&P 500's upward momentum in 2025. Recently, investors have begun to expand to cyclical industry groups such as finance and materials, helping the upward momentum spread wider and pushing the US main indices towards a third consecutive year of gains.

Data shows that the US economy remains stable, along with the possibility that the new chairman of the central bank replacing Jerome Powell may cut interest rates next year, which is supporting the market. Recent pressure on AI stocks due to concerns about high valuations and large investment costs eroding profits has also eased.

Traders are following the possibility of a "Santa Claus rally", the term used when the S&P 500 rose in the last five trading sessions of the current year and the first two sessions of January. This is often considered a positive signal for the stock market in 2026 after a year of volatility.

Geopolitical tensions have increased the shelter appeal of the precious metal, one day after the US conducted airstrikes targeting militants of the Islamic State organization in northwestern Nigeria.

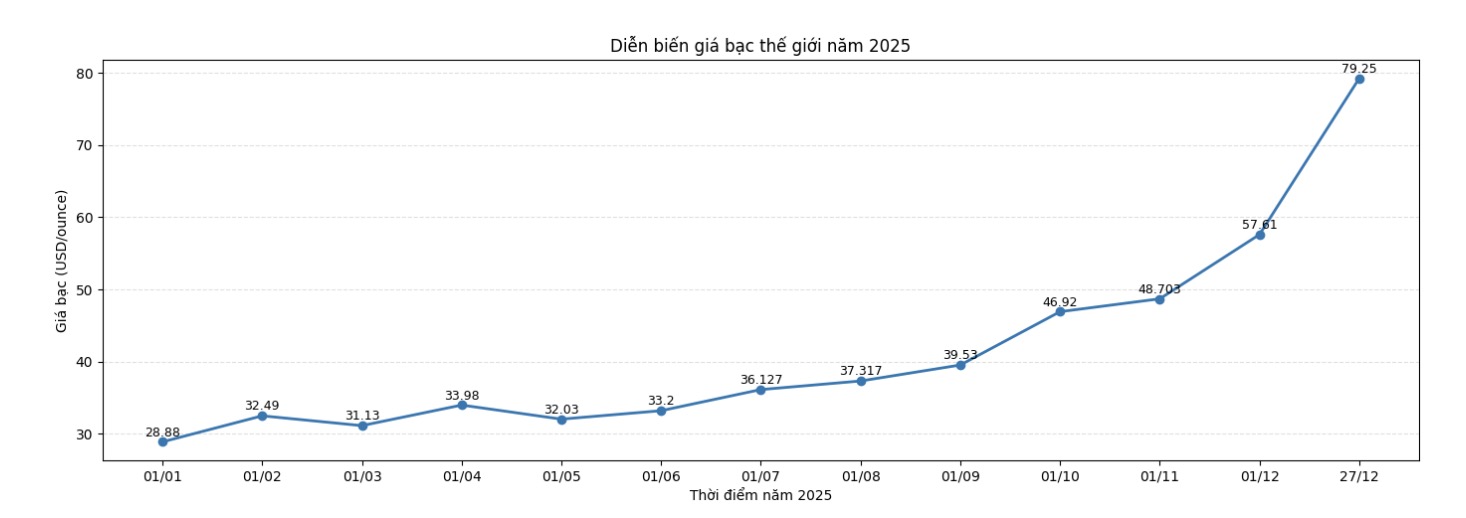

Silver prices hit a record 79.25 USD/ounce, up about 174.4% from the beginning of the year, thanks to supply shortages and silver being classified as an important US mineral.

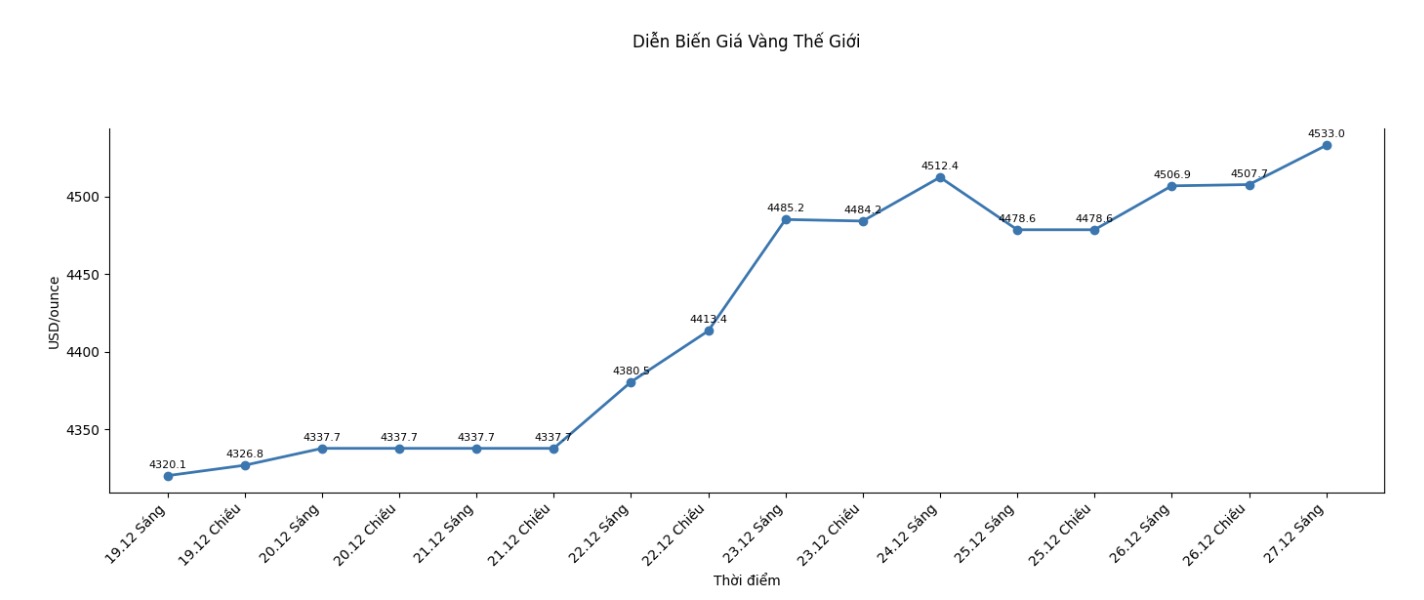

Meanwhile, world gold prices also surged strongly. The weakening USD further increased the attractiveness of gold valued in USD to foreign investors, helping this metal jump to a record level of 4,549 USD/ounce.

At the time of writing (12:15 PM on December 27 - Vietnam time), gold prices slightly cooled down to the threshold of 4,533 USD/ounce. However, compared to the beginning of the year, gold prices have increased by about 73.76%.

Ms. Soojin Kim - commodity analyst at MUFG, said in a report that the upward momentum may continue, thanks to "large banks forecasting prices to continue to rise in 2026, strong material demand and prolonged geopolitical and monetary uncertainties".

Oil prices closed down more than 2%, under pressure from global surplus prospects and the possibility of progress in peace talks in Ukraine.

Investors are preparing for 2026 with the focus on when the Fed will cut interest rates and the level of cuts. The market is valuing at least two interest rate cuts in the year, but does not expect the Fed to act before June.

The Fed is forecast to have another cut next year, but disagreements between policymakers are causing investors to worry about operating prospects.

The market is also waiting for US President Donald Trump to nominate the head of the Fed to replace Mr. Powell - who will end his term in May. Any signal about this decision next week could affect the market.

The USD was therefore under pressure, pushing the euro, British pound and Swiss franc to high levels. The USD index - measuring the strength of the greenback against six major currencies - increased slightly by 0.08% to 98.03 points on Friday.

The Japanese Yen weakened against the USD as investors followed the possibility of government intervention to support this currency. Analysts believe that the year-end trading period with thin liquidity is an opportunity for authorities to act.

The yen weakened even though the Bank of Japan increased interest rates last week, as the market predicted. Data released on Friday showed that core inflation in the Japanese capital fell in December but was still higher than the central bank's target of 2%, thereby reinforcing arguments for further interest rate hikes.