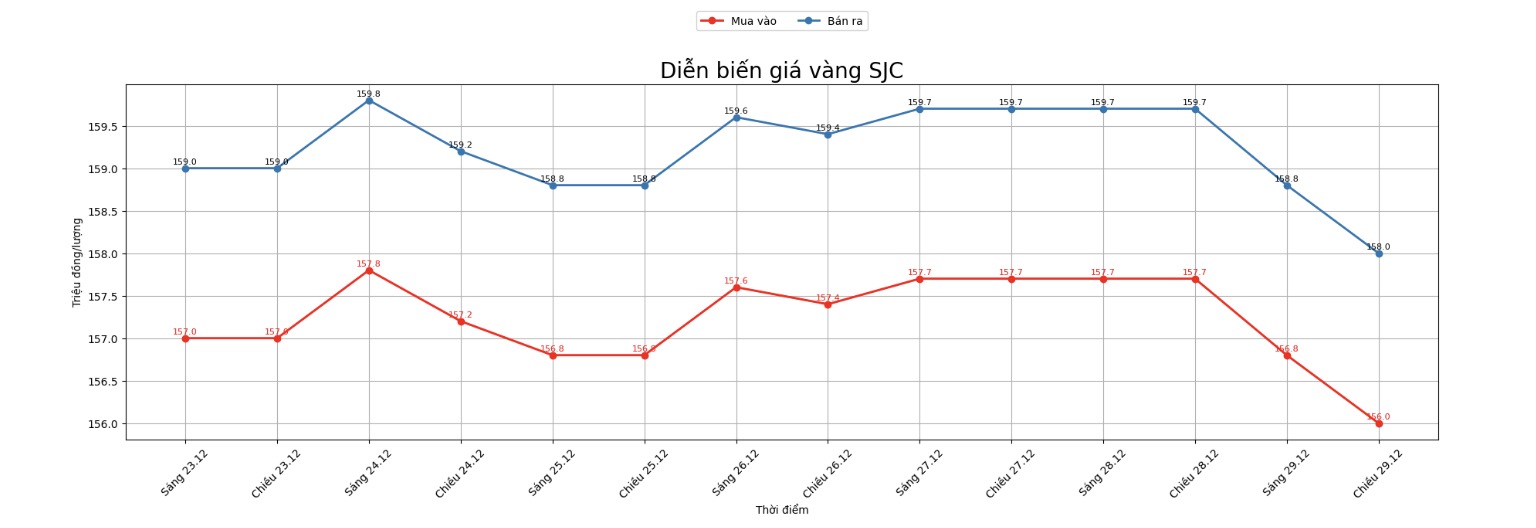

SJC gold bar price

As of 6:50 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 156-158 million VND/tael (buying - selling), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 156-158 million VND/tael (buying - selling), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 155-158 million VND/tael (buying - selling), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

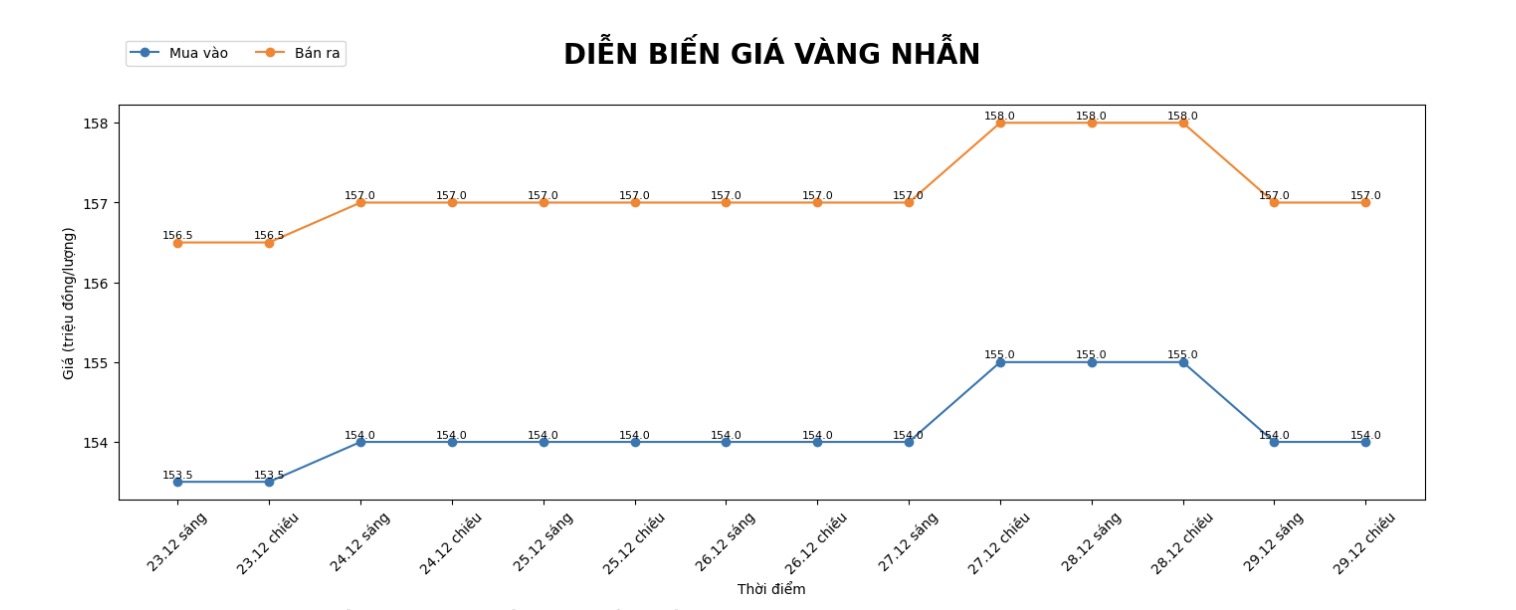

9999 gold ring price

As of 6:50 PM, DOJI Group listed the price of gold rings at the threshold of 154-157 million VND/tael (buying - selling), down 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buying - selling), down 1.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 154.5-157.5 million VND/tael (buying - selling), down 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

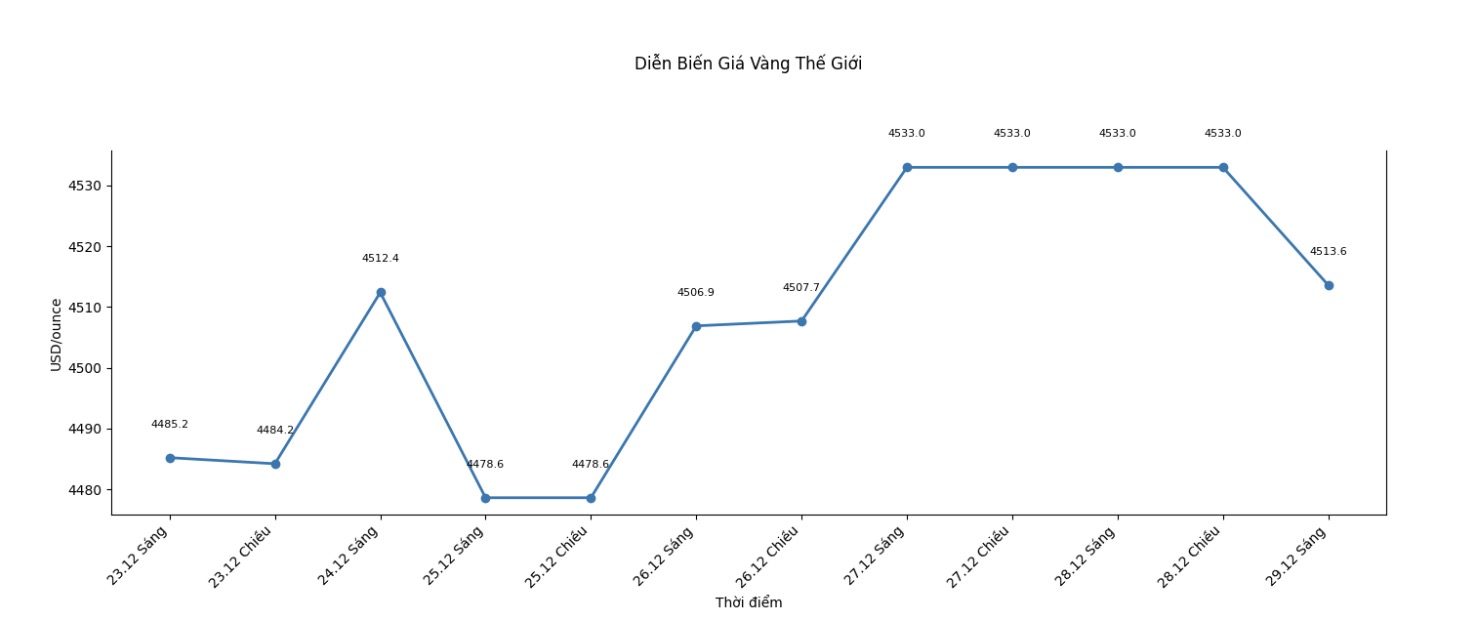

World gold price

World gold prices listed at 6:50 PM were at the threshold of 4,442.5 USD/ounce, down 90.5 USD compared to the previous day.

Gold price forecast

After a series of increases, gold prices turned to adjust. Precious metal prices turned around in the first trading session of the week, when investors took profits after a strong increase and geopolitical tensions showed signs of cooling down, weakening safe shelter demand.

Meanwhile, silver fell more sharply, losing 1.3% to 78.12 USD/ounce, after at one point jumping to a record high of 83.62 USD/ounce in the session.

Mr. Tim Waterer - Market Analysis Director at KCM Trade - said that the correction momentum stems from profit-taking activities and positive signals on the geopolitical front.

The fact that investors have realized profits, along with somewhat positive exchanges between Mr. Trump and Ukrainian President Volodymyr Zelensky about the possibility of reaching a peace agreement, has temporarily stagnated gold and silver," Mr. Waterer said.

Previously, US President Donald Trump declared that the two sides were "very close" to an agreement to end the conflict in Ukraine, thereby reducing the demand for shelter assets.

Despite short-term adjustments, silver remains the metal with the most impressive increase this year, with an increase of up to 181% since the beginning of the year, far exceeding gold. This increase is supported by the fact that silver is classified as a strategic mineral group of the US, tight supply, low inventory and strong increase in industrial-investment demand.

Gold also recorded a booming year, increasing by about 72% since the beginning of the year, continuously breaking historical records. The main driving force comes from expectations that the Fed will continue to cut interest rates, prolonged geopolitical tensions, strong demand for gold purchases from central banks and cash flow flow into gold ETF funds.

According to Mr. Waterer, the $5,000/ounce mark is entirely possible to be reached next year, if the next Fed Chairman pursues a more moderate monetary policy.

If interest rates continue to fall, while strong industrial demand remains strong and supply is limited, silver could completely reach the 100 USD/ounce mark by 2026," he added.

The market is currently still expecting the US Federal Reserve (Fed) to have at least two interest rate cuts next year, a factor that often strongly supports non-profit assets such as gold and silver.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...