Experts say the FED does not put pressure on gold prices

Although the USD index has maintained an important long-term support level above 103 points, experts say this is not a major threat to gold price increase. The reason for this argument is that US interest rates will not strongly support the USD.

In an interview with Kitco News, George Milling-Stanley, chief gold strategist at State Street Global Advisors, said he does not expect the current neutral stance of the US Federal Reserve (FED) to create a major threat to gold prices for the rest of the year.

He made this comment after the FED kept interest rates unchanged last week. In its latest economic forecasts, the US central bank has revised down its growth forecast and increased its inflation forecast. The Fed forecasts the US economy to grow 1.7% this year and inflation to 2.7%, higher than previous forecasts of 2.1% and 2.5%.

The USD is recording a bit of buying momentum when forecasting the FED's interest rates, also known as the spot chart, unchanged, signaling that there will be two interest rate cuts this year. After weak economic data and a sharp decline in the stock market, markets have begun to calculate that there will be three interest rate cuts this year.

However, Milling-Stanley believes that the uncertainty and uncertainty surrounding potential US tariffs will have a greater impact on the USD than the Fed's monetary policy.

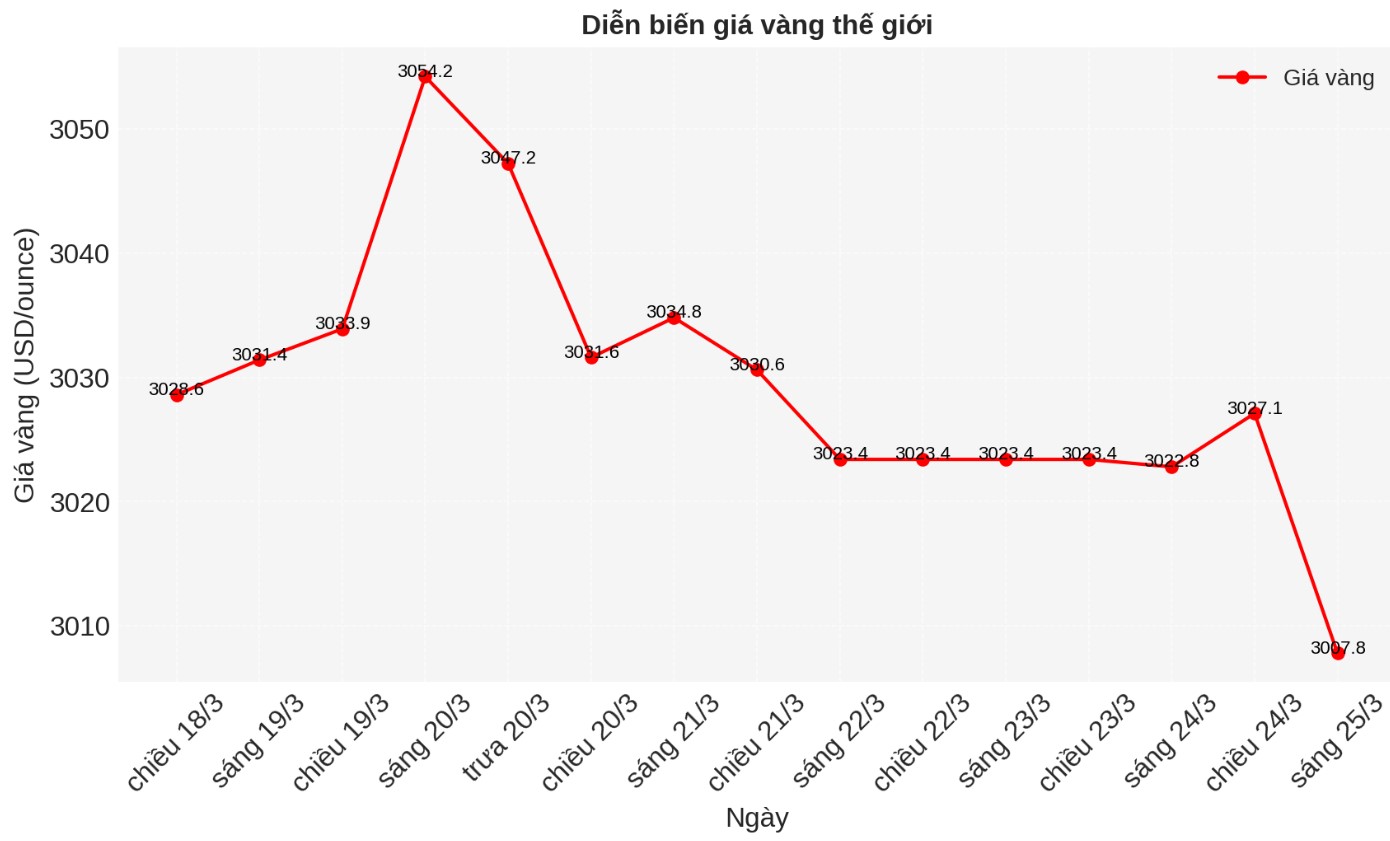

Milling-Stanley added that any clarity on US import tariffs could create selling pressure on gold as gold prices test support around $3,000/ounce. Media reports have begun to appear suggesting that Trump's tariffs could be narrower than expected, minimizing the risk of a global trade war.

This expert believes that the correction period could be a positive factor for the market: I would not be surprised if trading prices were around $3,000/ounce for a long time this year. I think this is completely possible," he said. I will be more confident in maintaining prices above $3,000 an ounce if we need a year to get above this level.

Although gold may temporarily hold prices, Milling-Stanley said he expects gold prices to continue to rise by the end of the year: I dont see a big barrier here. In my opinion, the Fed's neutrality may be the right thing to do at this time. And I don't expect this to put any pressure on gold."

Milling-Stanley said his team is currently holding an initial 2025 gold price forecast, with a 50% chance of trading between $2,600-2,900/ounce and a 30% chance of trading between $2,9:00-3,100/ounce. However, he said there is a possibility that they will adjust their price forecast after the price increase this year.

ETFs will be the main factor driving investment demand

One of the biggest reasons Milling-Stanley expects gold prices to remain at this high level is because investors have just begun to turn to gold ETFs to diversify away from the less attractive stock market.

We expect ETFs to be a key driver of investment demand for the rest of the year, he said.

According to data from the World Gold Council, global gold ETFs recorded capital flows of about 31 tons of gold last week, worth 3 billion USD. This is the eighth consecutive week of inflows, with North American funds accounting for the majority of profits.

SPDR Gold Shares (NYSE: GLD), the world's largest gold ETF, has seen strong growth in recent weeks. State Street is a marketer for GLD and the simulated ETF fund.

To date, the GLD has increased by 3.75 billion USD. GLDM increased by 1.25 billion USD, so the two funds have increased by 5.5 billion USD in total. I am delighted to see that ETFs are finally starting to catch up, as they are not really fully engaged in the major investment recovery in Western countries that we have seen over the past few years, he said.