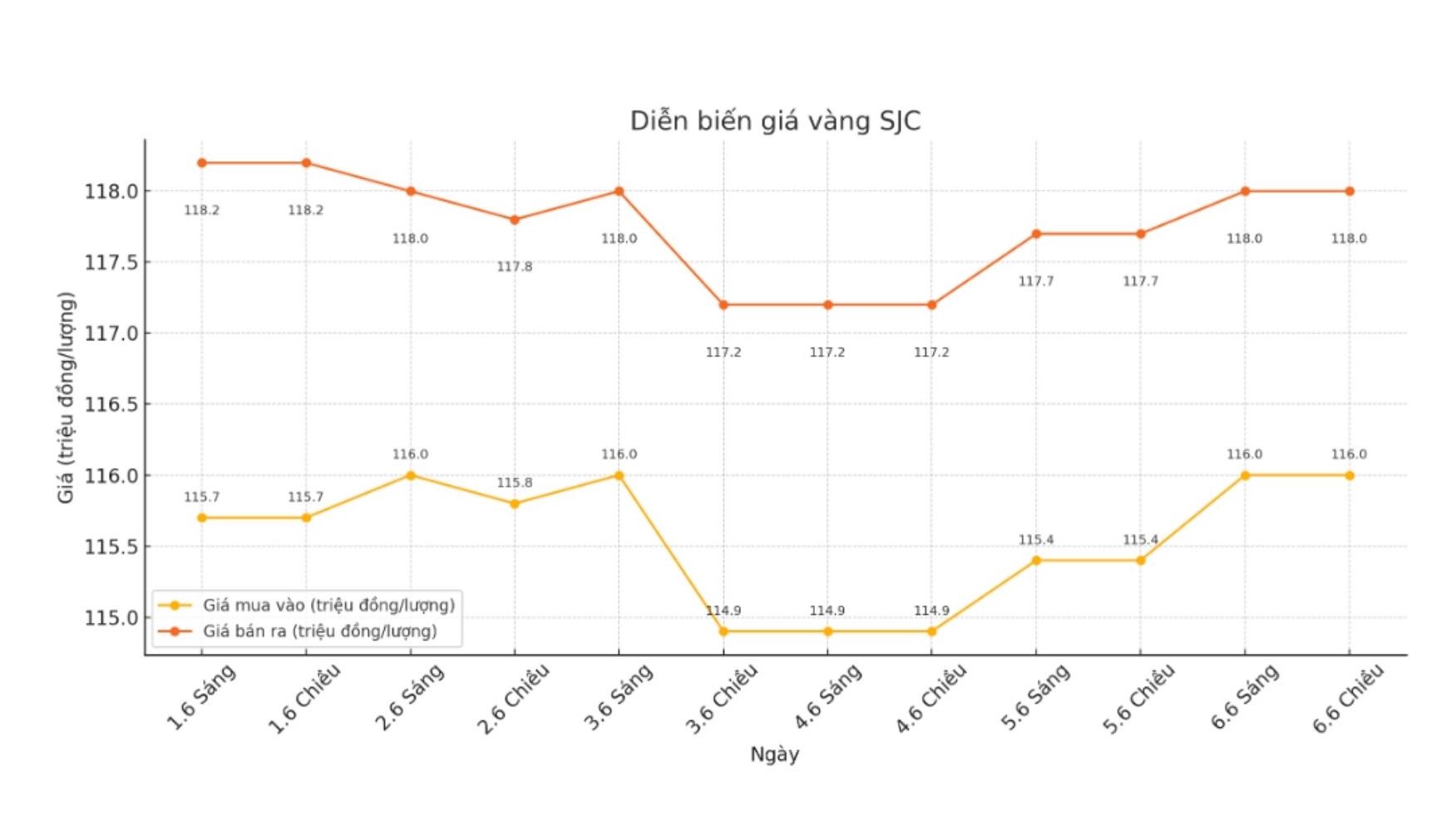

SJC gold bar price

As of 6:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116-118 million/tael (buy in - sell out); unchanged in both buying and selling directions compared to this morning. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 116-118 million VND/tael (buy - sell); an increase of 600,000 VND/tael for buying and an increase of 300,000 VND/tael for selling compared to this morning. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116-118 million VND/tael (buy in - sell out); unchanged in both buying and selling directions compared to this morning. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND115-118 million/tael (buy in - sell out); kept both buying and selling prices unchanged compared to this morning. The difference between buying and selling prices is at 3 million VND/tael.

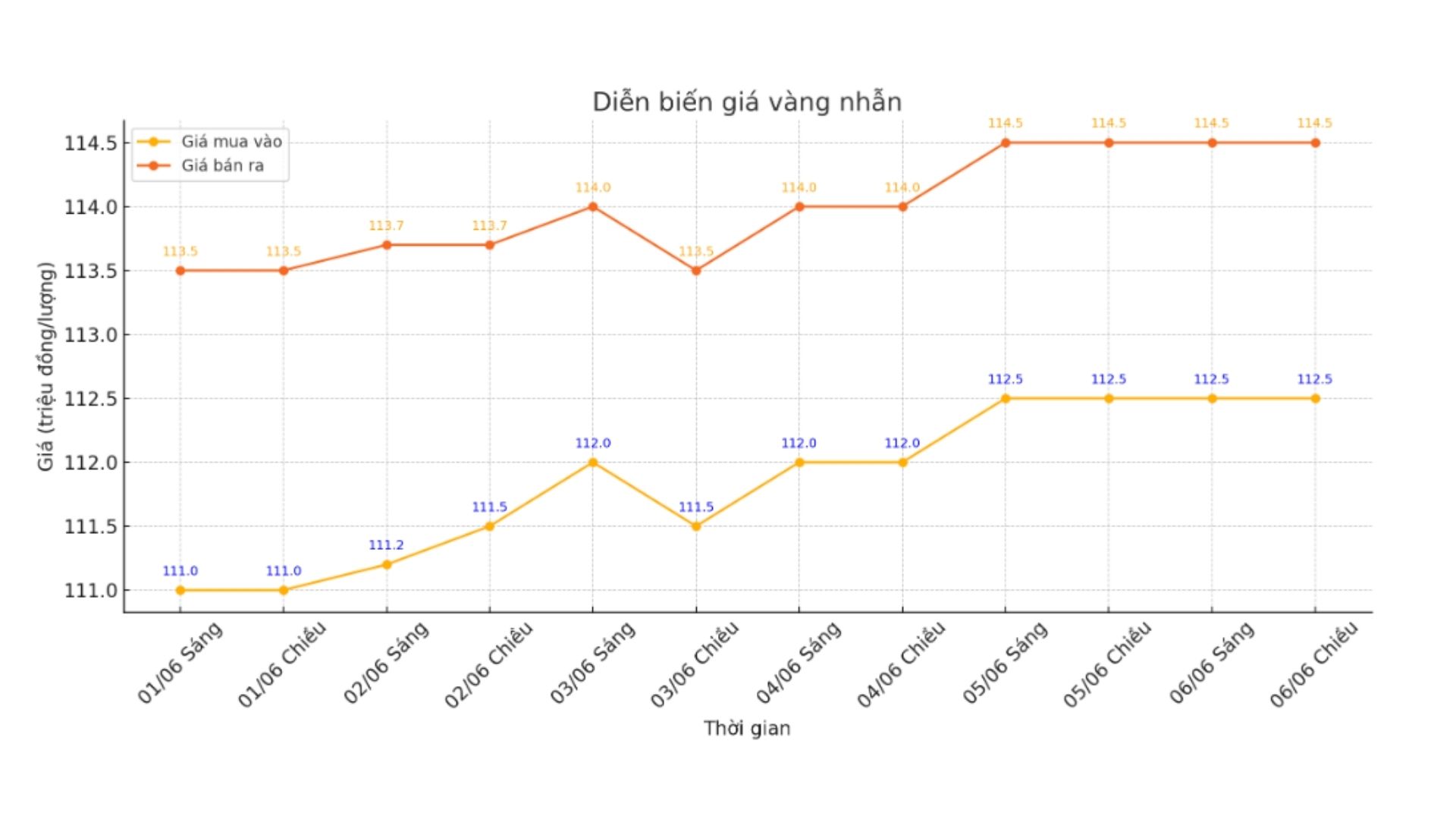

9999 gold ring price

As of 6:50 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

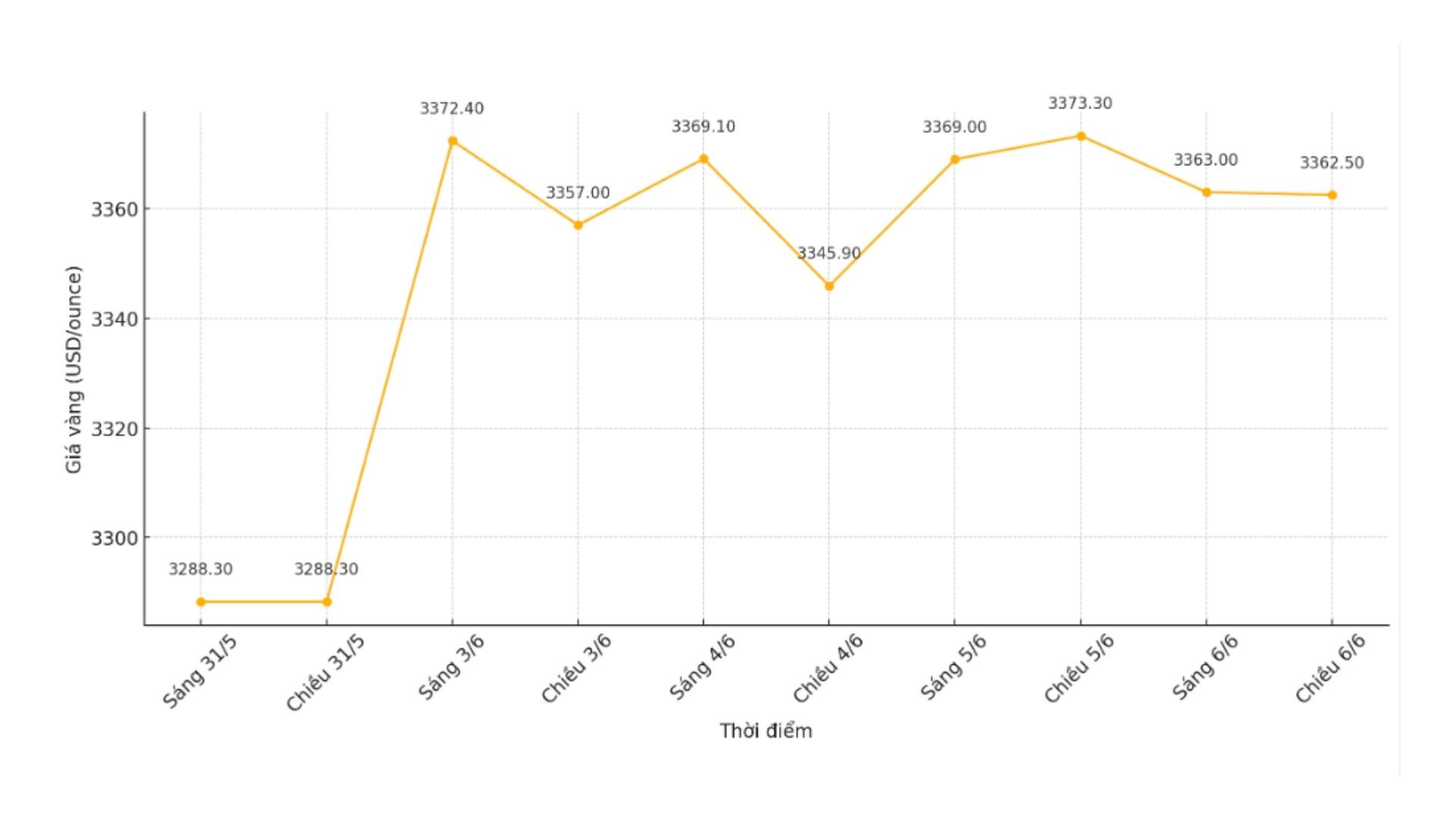

World gold price

The world gold price was listed at 19:00 at 3,362.5 USD/ounce.

Gold price forecast

Gold prices increased sharply on Friday and are expected to continue to increase next week, as data from the US this week raised hopes about the possibility of the US Federal Reserve (FED) cutting interest rates.

Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany, said: "Unemployment claims data fell short of expectations, showing the possibility of a weak labor market, which has had a greater impact on gold prices than optimism from the phone call between President Donald Trump and Chairman Xi Jinping."

According to the Department of Labor, the number of new unemployment claims has increased to a seven-month high last week. Investors are now focusing on the US non-farm payroll report, after this week's data pointed to a weakening of the labor market.

Zumpfe said that the weakening of the US labor market could put more pressure on the Federal Reserve, forcing it to loosen monetary policy, especially if the payroll does not meet expectations.

"This further reinforces the positive trend for gold - an asset often considered a safe haven during times of political and economic instability, especially developing strongly in a low interest rate environment" - Zumpfe assessed.

See more news related to gold prices HERE.