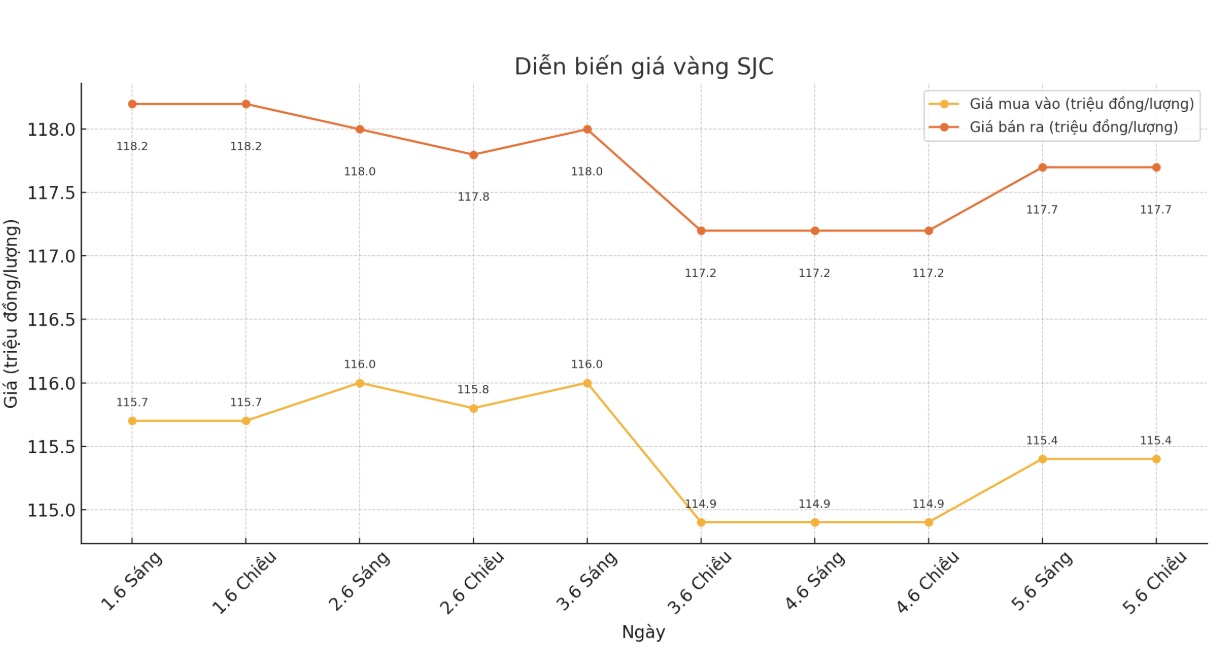

SJC gold bar price

As of 6:00 a.m. on June 6, the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.4-117.7 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.4-117.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 115.4-117.7 million/tael (buy - sell), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 114.9-117.7 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2.8 million VND/tael.

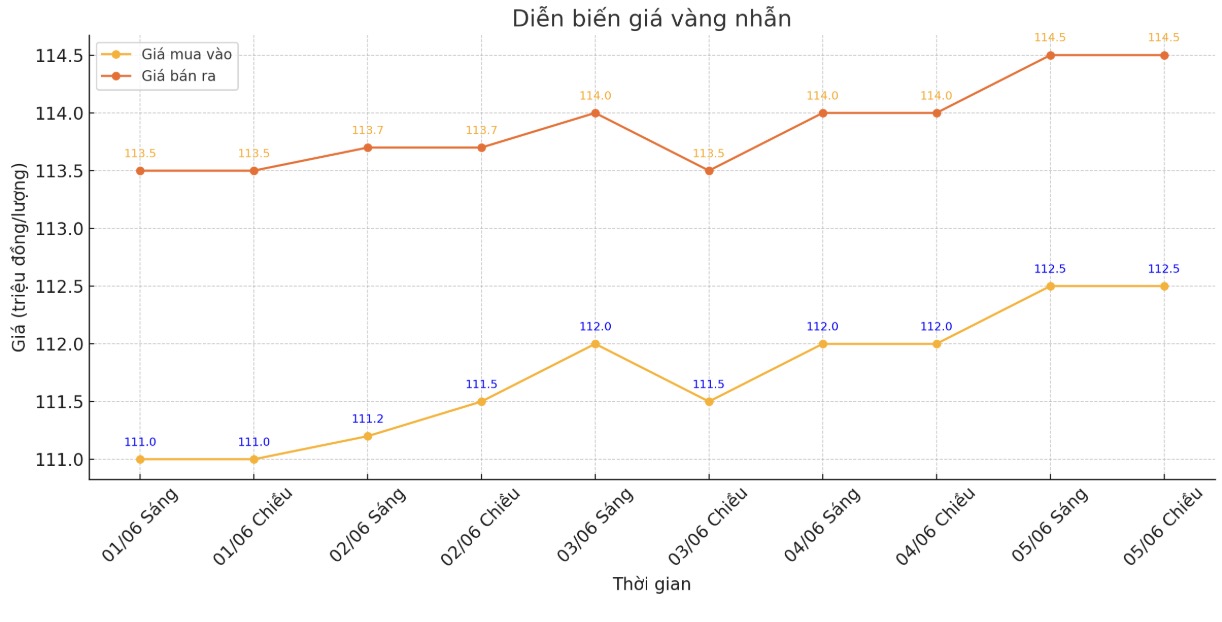

9999 gold ring price

As of 6:00 a.m. on June 6, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 112.5-124.5 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.5-116.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.8-114.8 million VND/tael (buy in - sell out), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

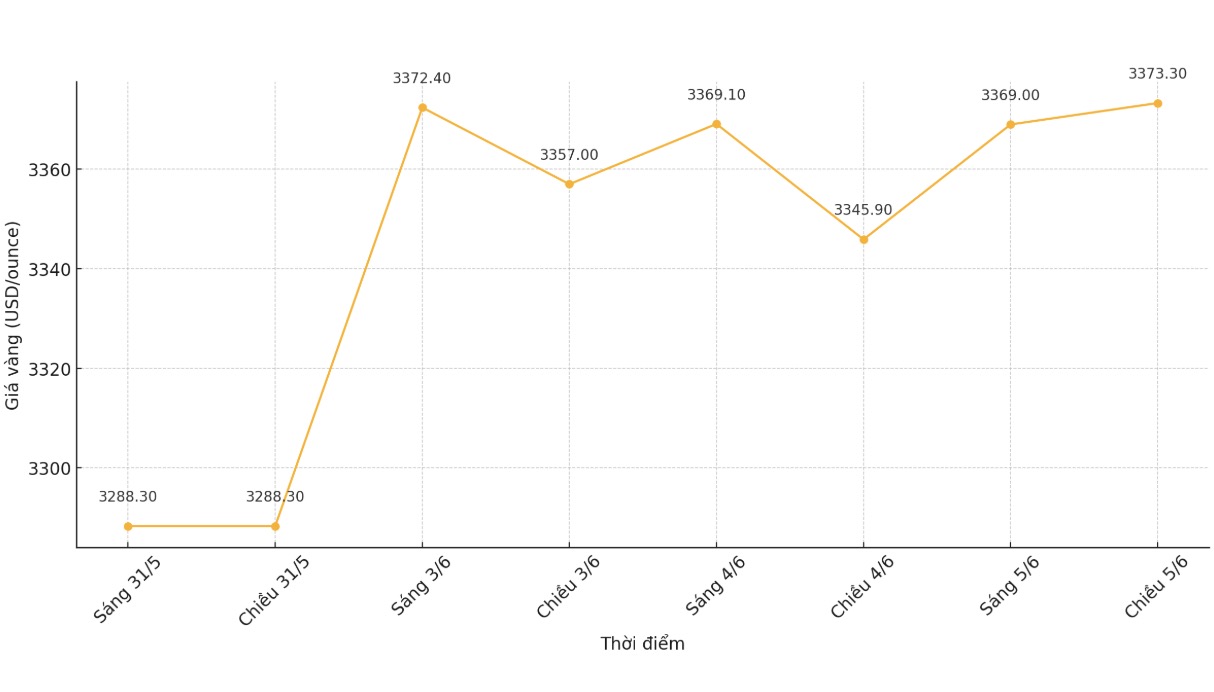

World gold price

At 9:40 p.m. on June 5, the world gold price was listed at 3,373.3 USD/ounce, up 1.1 USD.

Gold price forecast

Gold prices are anchored high as market risk sentiment is weak, boosting safe-haven demand for precious metals. Chart charts for both gold and silver have turned to an uptrend, which has also attracted technical traders to buy positions.

Gold prices in August are currently up $18.5 to $3,418.1 an ounce. July silver prices are currently up $1.437 to $16.08 an ounce.

Asian and European stocks diverged in the overnight trading session. US stock indexes are expected to open with a slight increase today in New York.

The European Central Bank cut its key interest rate by 0.25% today, which had been predicted.

Transactions and investors are waiting for one of the most important reports of the US month: Report on employment situation in May from the Ministry of Labor on Friday morning. The number of non -agricultural jobs will increase by 125,000 jobs, compared to an increase of 177,000 in the April report. The great decline in the National Employment Report of ADP on Wednesday has made many market participants worry that the job reporting on Friday will also have a significant shortage.

In overnight news, Swiss-Singapore-based commodity trading company Trafigura warned of short-term fluctuations in the commodity market due to geopolitical and macro-economic instability, as well as the risk of rising inflation. The company expects the high volatility to last for some time.

Technically, August gold futures are having a solid near-term technical advantage. The next target for buyers is to close above $3,477.30/ounce. The next downside target for the sellers is to push gold prices below $3,300/ounce.

Key outside markets today showed the US dollar index to be stable. Nymex crude oil prices are almost stable, trading around $63/barrel. The current 10-year US government bond yield is 4.37%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...