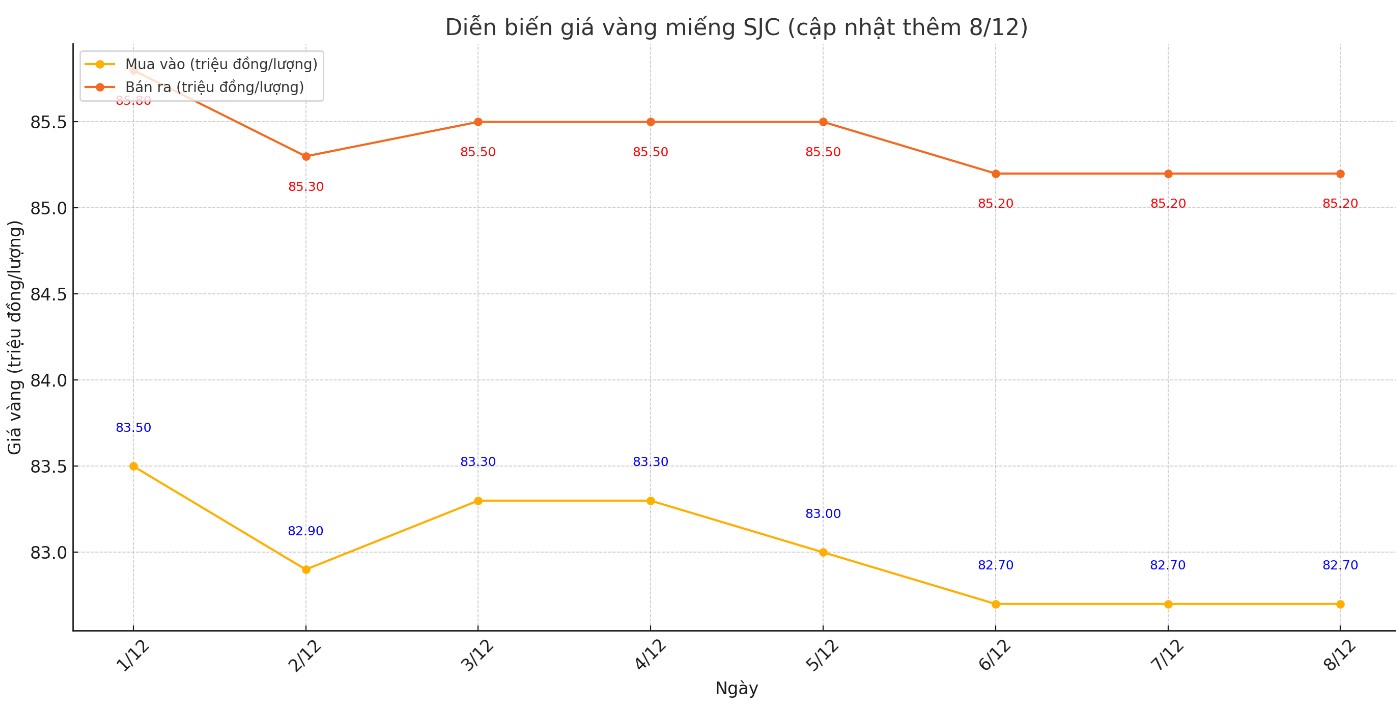

Update SJC gold price

As of 8:00 p.m., the price of SJC gold bars was listed by DOJI Group at 82.7-85.2 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI decreased by 600,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.7-85.2 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 600,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

If you buy SJC gold at DOJI Group on December 1 and sell it today (December 8), you will lose 3.1 million VND/tael. Similarly, those who buy gold at Saigon Jewelry Company SJC will also lose 3.1 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say this difference is very high, causing investors to face the risk of losing money when investing in the short term.

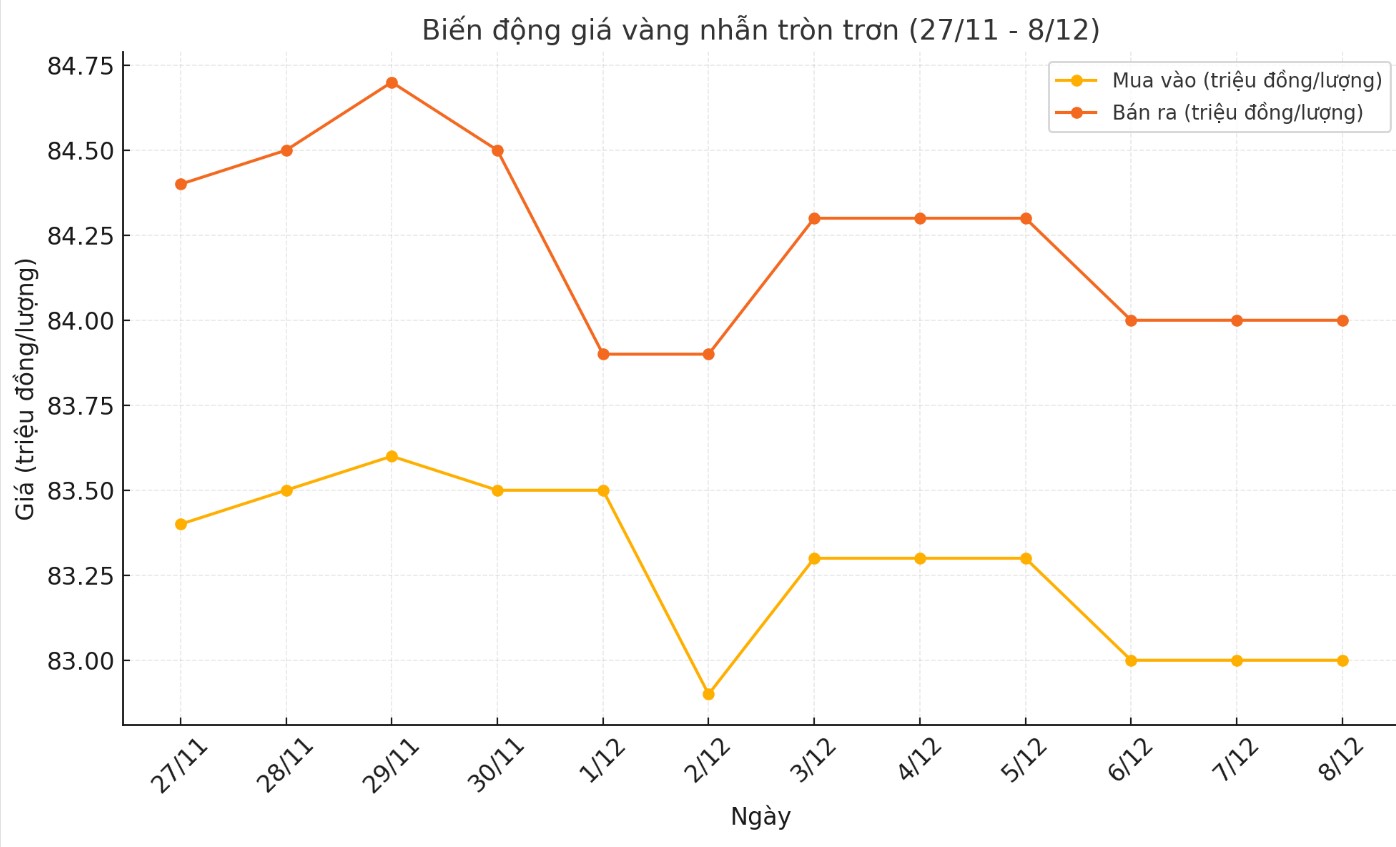

Price of round gold ring 9999

As of 8:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83-84 million VND/tael (buy - sell); down 500,000 VND/tael for both buying and selling compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.98-84.08 million VND/tael (buy - sell); down 700,000 VND/tael for both buying and selling compared to the closing price of last week's trading session.

After a week of decline, if you buy gold rings in the session of December 1 and sell them today (December 8), the loss that investors will have to accept when buying at DOJI and Bao Tin Minh Chau is 1.5 million VND/tael and 1.8 million VND/tael, respectively.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,633.3 USD/ounce, down 17 USD/ounce compared to the close of the previous week's trading session.

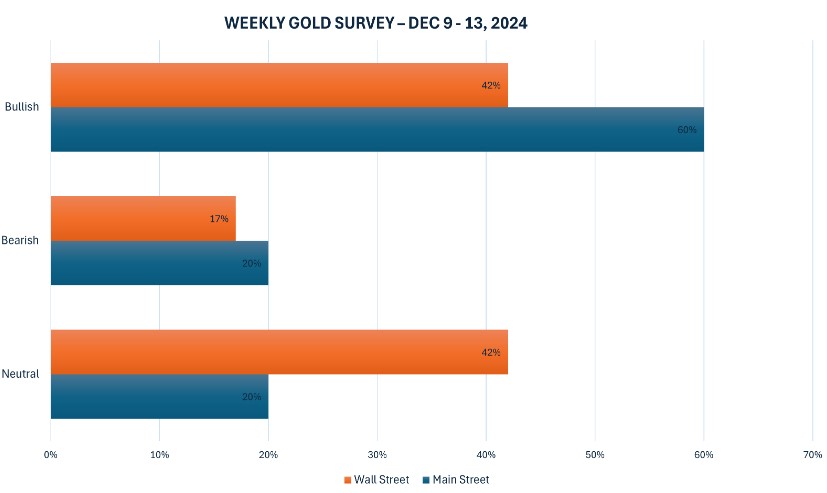

Gold Price Forecast

World gold prices were under pressure last week as the USD index increased. Recorded at 8:00 p.m. on December 8, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.040 points (up 0.32%).

This week, 12 analysts participated in the Kitco News gold survey. Five experts, or 42%, predicted that gold prices will rise next week. Another five experts, also 42%, predicted that gold prices will continue to move sideways. The remaining two experts, or 17% of the total, predicted that the precious metal will fall.

Meanwhile, there were 116 votes in Kitco's online poll, with retail investors again becoming bullish on gold after its solid performance this week.

70 traders (60%) expect gold prices to rise next week. Meanwhile, 23 others (20%) predict gold prices will fall. The remaining (20%) expect gold prices to continue moving sideways in the short term.

Next week, markets will focus on important US inflation data and interest rate decisions from other central banks:

Monday: Reserve Bank of Australia monetary policy announcement.

Wednesday: Bank of Canada interest rate decision and US CPI data.

Thursday: Interest rate decisions from the European Central Bank and Swiss National Bank, plus US PPI data.

Experts say the gold market will continue to fluctuate within a narrow range until there are clearer signals from economic data and policies of the US Federal Reserve (FED).

Kevin Grady, president of Phoenix Futures and Options, said the market is in a holding pattern as it awaits next week's inflation data and the transition of power in the US government.

Rich Checkan - president and COO of Asset Strategies International - commented that the NFP data should support the expected interest rate cut from the US Federal Reserve (FED), this information is positive for gold.

“Based on the positive labor data, the market will expect another 25 basis point rate cut when the FOMC meets on the 17th and 18th,” he said. “So I expect gold prices to rise slightly next week to take advantage of this positive news for the precious metal.”

See more news related to gold prices HERE...