Gold price developments last week

Despite the volatility, gold prices have consistently returned to $2,645 an ounce this week. The precious metal has been drawn to it like a magnet, reinforcing the view that the market is in a waiting phase before entering 2025.

Spot gold opened the week at $2,648.65 an ounce before falling sharply to $2,623 early Monday morning, a low it held until Thursday evening.

The Asian and European trading sessions then erased earlier losses by 9:00 a.m. EST, with spot gold reaching $2,650 an ounce. However, the peak was short-lived, with gold falling back to $2,635 an ounce several times.

Gold prices again tested $2,650 an ounce at 1 a.m. EST on Tuesday. They then traded in a narrow range between $2,653 and $2,640 an ounce for the next two days.

On Thursday morning, a failed attempt to break the weekly high sent spot gold prices falling from $2,653 at 7:45 a.m. to $2,625 just after midday and hitting a weekly low of $2,615 an ounce by 8 p.m.

However, like last Sunday night, gold’s recovery was swift, with prices rising back above $2,642 an ounce by 11 p.m. A better-than-expected U.S. non-farm payrolls report only pushed gold down to $2,628 before quickly recovering to $2,640 by 11:45 a.m.

During Friday's trading session, gold prices mainly fluctuated within a narrow range of $9/ounce.

Expert predicts surprise

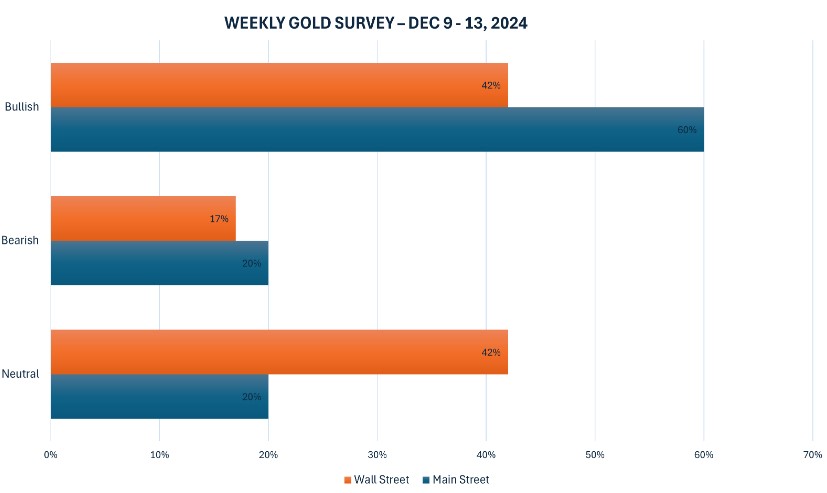

This week, 12 analysts participated in the Kitco News gold survey. Wall Street sentiment was once again divided between bullish and wait-and-see.

Five experts (42%) predict that gold prices will increase next week. Meanwhile, another five experts (also 42%) predict that gold prices will continue to move sideways. The remaining two experts (17%) predict that the price of this precious metal will decrease.

Meanwhile, there were 116 votes in Kitco's online poll, with Main Street investors again turning bullish on gold after its solid performance this week.

70 traders (60%) expect gold prices to rise next week. Meanwhile, 23 others (20%) predict gold prices will fall. The remaining (20%) expect gold prices to continue moving sideways in the short term.

Factors affecting gold prices next week

Next week, markets will focus on important US inflation data and interest rate decisions from other central banks:

Monday: Reserve Bank of Australia monetary policy announcement.

Wednesday: Bank of Canada interest rate decision and US CPI data.

Thursday: Interest rate decisions from the European Central Bank and Swiss National Bank, plus US PPI data.

Experts say the gold market will continue to fluctuate within a narrow range until there are clearer signals from economic data and policies of the US Federal Reserve (FED).

See more news related to gold prices HERE...