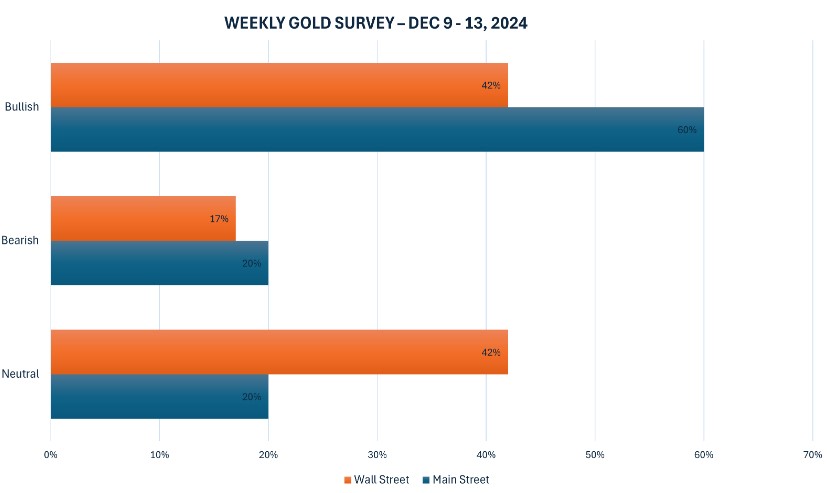

“I expect gold to rise next week as long as $2,600/oz holds. Three G10 central banks are cutting rates, and the market is expecting two (the Bank of Canada and the Swiss National Bank) to cut by 25 basis points,” said Marc Chandler, managing director at Bannockburn Global Forex.

“The downtrend line from the late October record high will be near $2,680 an ounce on Monday and drop to around $2,660 an ounce by the end of next week,” he added.

Christopher Vecchio, head of futures and FX strategy at Tastylive.com, is bearish on gold in the short term, noting that risks remain due to profit-taking after a very strong year for the precious metal.

“I am bullish on gold next week,” said Colin Cieszynski, chief strategist at SIA Wealth Management, after changing his view from neutral last week.

Rich Checkan - president and COO of Asset Strategies International - commented that the NFP data should support the expected interest rate cut from the US Federal Reserve (FED), this information is positive for gold.

“Based on the positive labor data, the market will expect another 25 basis point rate cut when the FOMC meets on the 17th and 18th,” he said. “Therefore, I expect gold prices to rise slightly next week to take advantage of this ‘positive’ news for the precious metal.”

“Increasing tensions in the Middle East and issues in France also support the case for gold prices to rise,” Checkan added.

Jesse Colombo, founder of the BubbleBubble Report, is neutral on gold next week, but notes that the market remains in an uptrend.

“Sideways,” said Darin Newsom, senior market analyst at Barchart.com. “February gold futures are trading between $2,642.60 an ounce as of Nov. 25 and $2,681 an ounce as of Nov. 29.”

“Given the potential for increased global turmoil, I don’t see gold falling much in the short term. However, the weekly close of the February contract shows a medium-term downtrend, so I expect a downside breakout on the daily chart eventually,” Newsom said.

Kevin Grady, president of Phoenix Futures and Options, said the market is in a holding pattern as it awaits next week's inflation data and the transition of power in the US government.

Looking at the long term, the expert said: “I am optimistic about next year. I think we will see $3,000/ounce next year. The environment will be very favorable for that."

Grady also said that Bitcoin's recent surge — it broke $100,000 for the first time this week — is actually a positive for gold. "When you look at Bitcoin, it's a global commodity and it represents a demand for an independent currency. I think that's good for gold as well."

Key US inflation data and interest rate decisions from central banks outside the US will dominate economic news next week. The Reserve Bank of Australia will make its monetary policy decision on Monday, while the Bank of Canada, the European Central Bank and the Swiss National Bank will announce their decisions mid-week and later in the week.

See more news related to gold prices HERE...