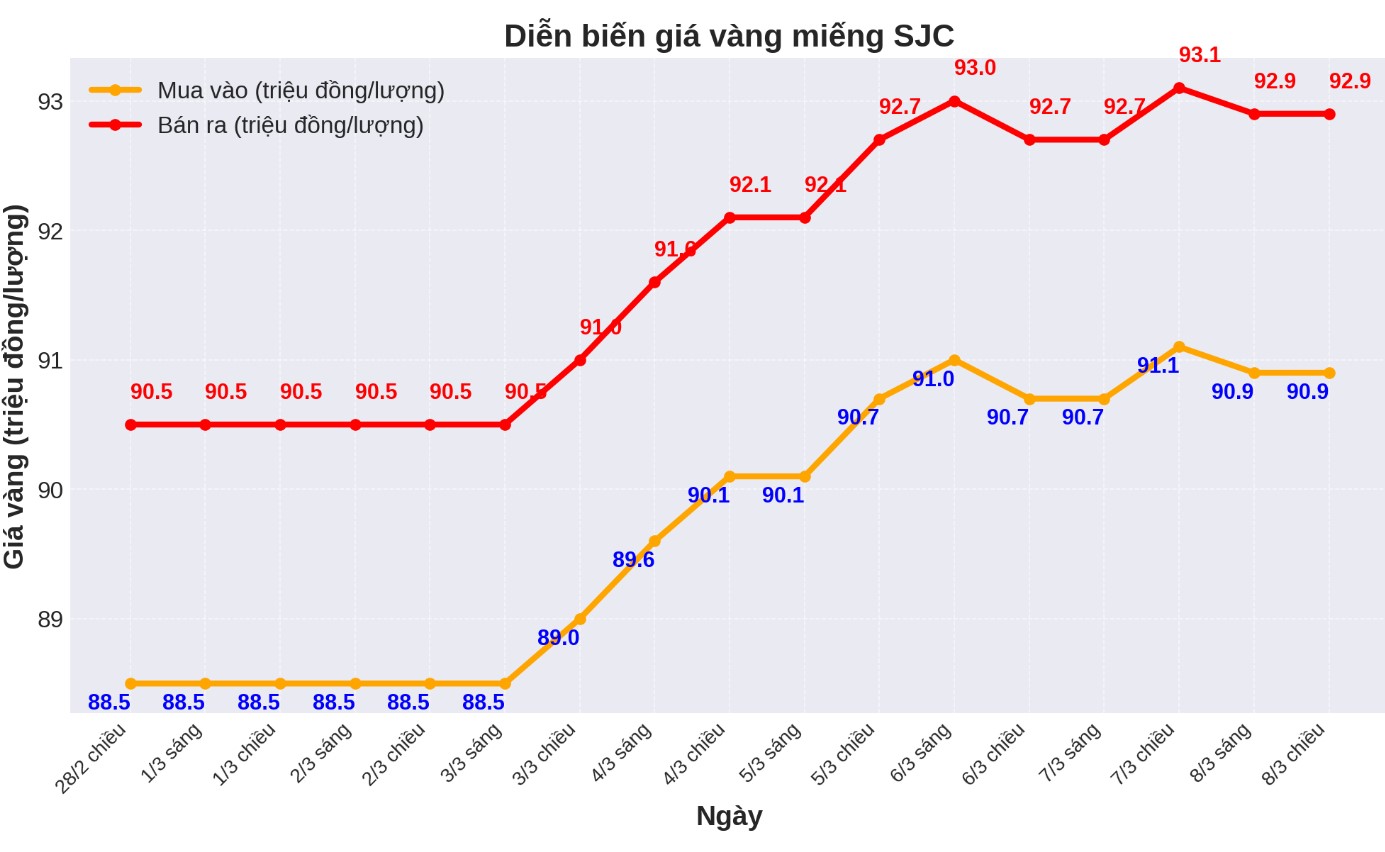

Updated SJC gold price

As of 6:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 90.9-92.9 million VND/tael (buy - sell), down 200,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Saigon Jewelry Company at VND2 million/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 90.9-92.9 million VND/tael (buy - sell), down 200,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 90.9-92.9 million VND/tael (buy - sell), down 200,000 VND/tael for both buying and selling.

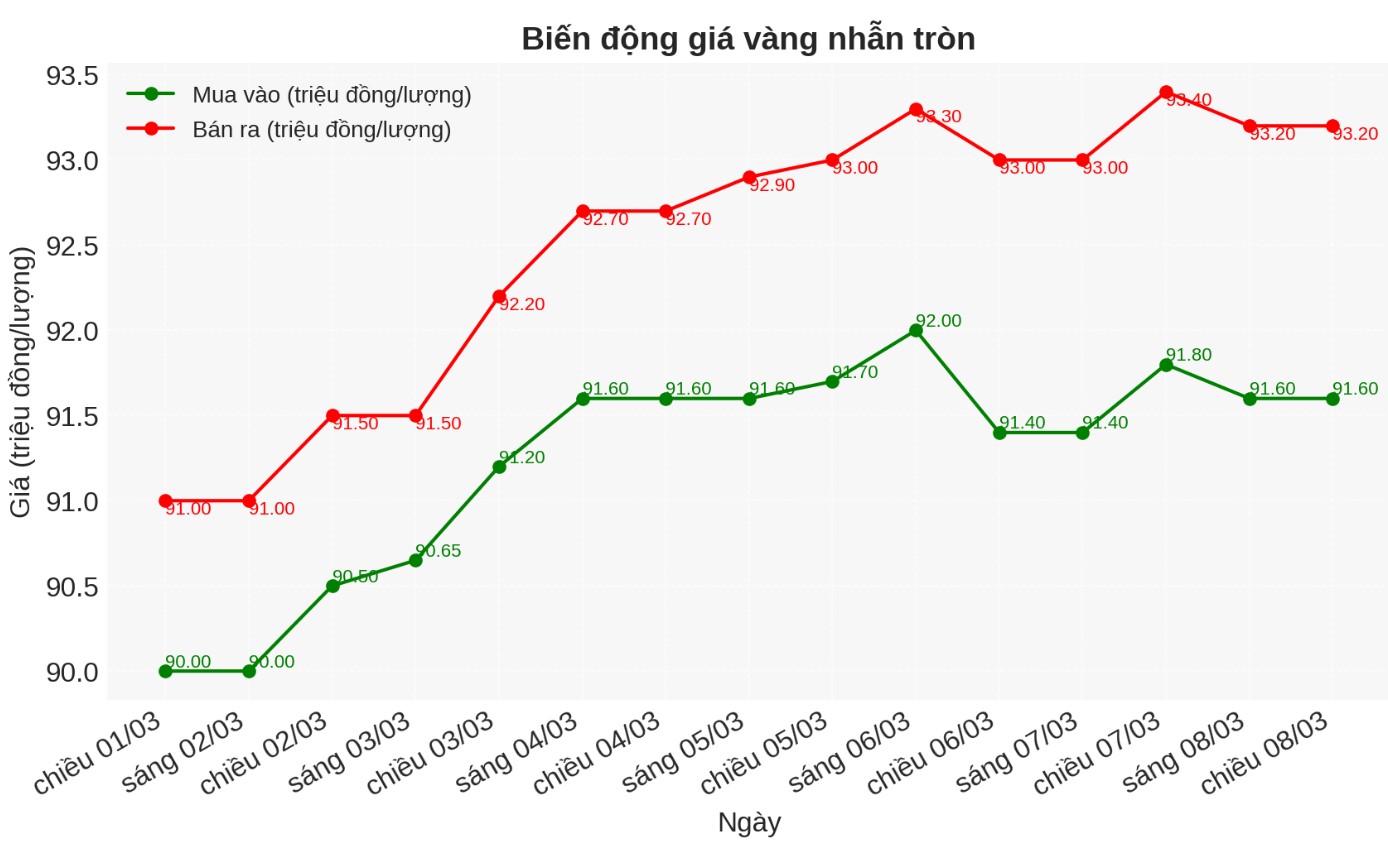

9999 round gold ring price

As of 6:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.6-93.2 million/tael (buy in - sell out); down VND200,000/tael for both buying and selling. The difference between buying and selling is listed at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.7-93.3 million VND/tael (buy - sell); down 300,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

World gold price

As of 6:30 p.m., the world gold price listed on Kitco was at 2,909.5 USD/ounce USD/ounce, down 8.7 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices cooled down despite the decline of the USD. Recorded at 6:30 p.m. on March 8, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.810 points (down 0.21%).

Gold prices fell but hovered above $2,900/ounce despite the Federal Reserve Chairman maintaining a neutral stance on monetary policy.

Mr. Jerome Powell - Chairman of the FED said that this unit is not in a hurry to cut interest rates, because the US economy and the labor market are still stable, while inflation is still facing many risks.

"If the economy remains strong but inflation does not continue to fall to 2% sustainably, we can maintain a tightening policy for longer.

If the labor market suddenly weakens or inflation falls faster than expected, we will adjust policy accordingly," Mr. Powell said at the 2025 US monetary Policy Forum of Booth School of Business, University of Chicago.

This week, market sentiment has changed significantly compared to last week, especially from the group of Wall Street experts. In the previous survey, only 21% of experts predicted gold prices would increase, while up to 64% thought prices would decrease.

However, this week, the experts' expectation of gold increasing has skyrocketed to 67%, while only 5% predicted a decrease - a significant change reflecting the reversal in analysts' assessment.

The group of individual investors (Main Street) also recorded a clear change. The proportion of investors who predict gold prices to increase has increased from 45% to 67%, while those who expect prices to decrease from 28% to 18%.

Notably, the number of participants this week's survey reached 251 - the highest in 2025, showing greater investor interest in the gold market.

The change in market sentiment may reflect the weakening of the USD, concerns about economic and political instability, as well as expectations that gold prices may continue to head towards new record highs.

With strong consensus from both experts and individual investors, gold prices may continue to increase in the coming time.

Jim Wyckoff - senior analyst at Kitco, affirmed that gold prices will continue to maintain an upward trend thanks to increased geopolitical instability. "The gold price trend is still steadily increasing, thanks to positive technical indicators and increasing geopolitical instability, especially the impact of the US presidential administration Donald Trump".

Adrian Day - chairman of Adrian Day Asset Management commented: "Gold prices will increase. It seems that the correction I predicted is over. Gold's resilience to any decline since the election is really impressive. The reasons why people are buying gold are still intact, and we expect a new rally to hit an all-time high very soon."

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...