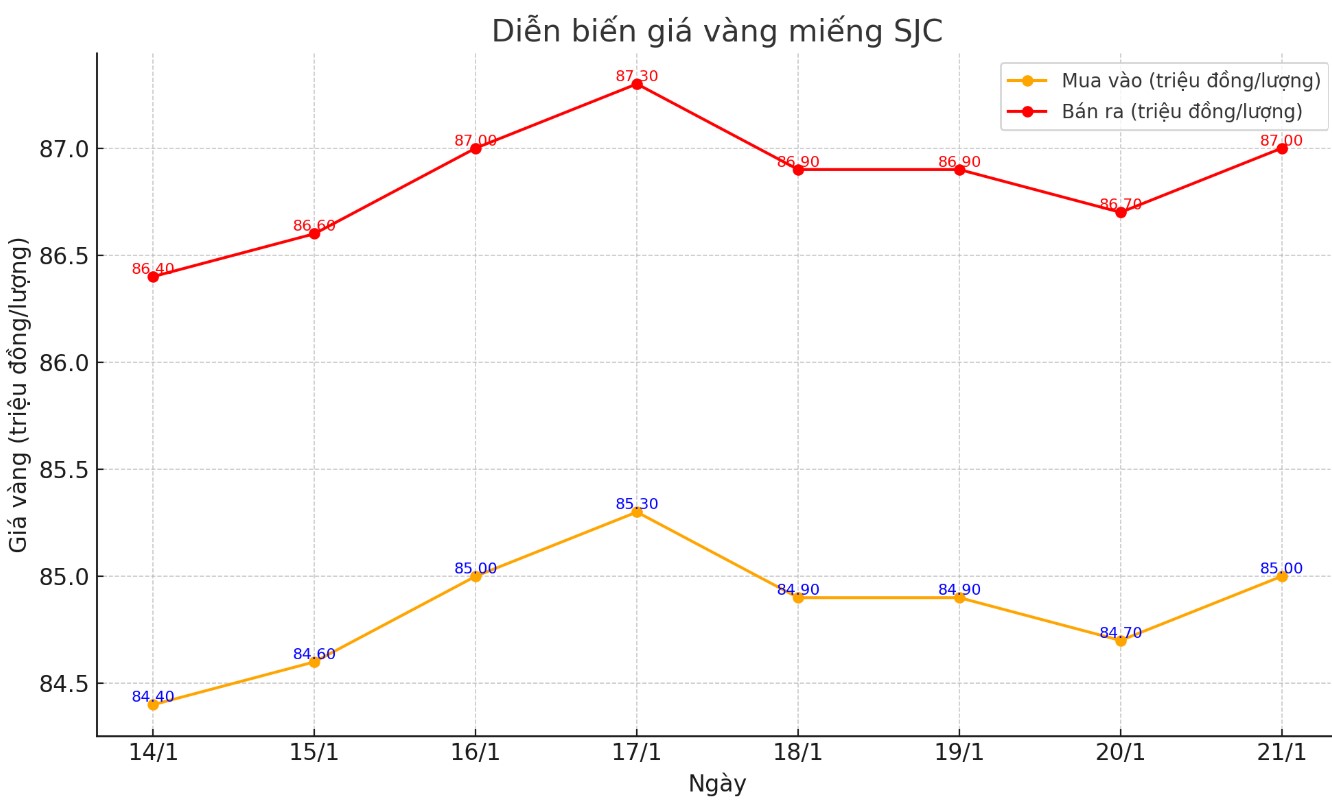

Update SJC gold price

As of 11:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND85.2-87.2 million/tael (buy - sell); an increase of VND300,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 85-87 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85-87 million VND/tael (buy - sell); increased 300,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

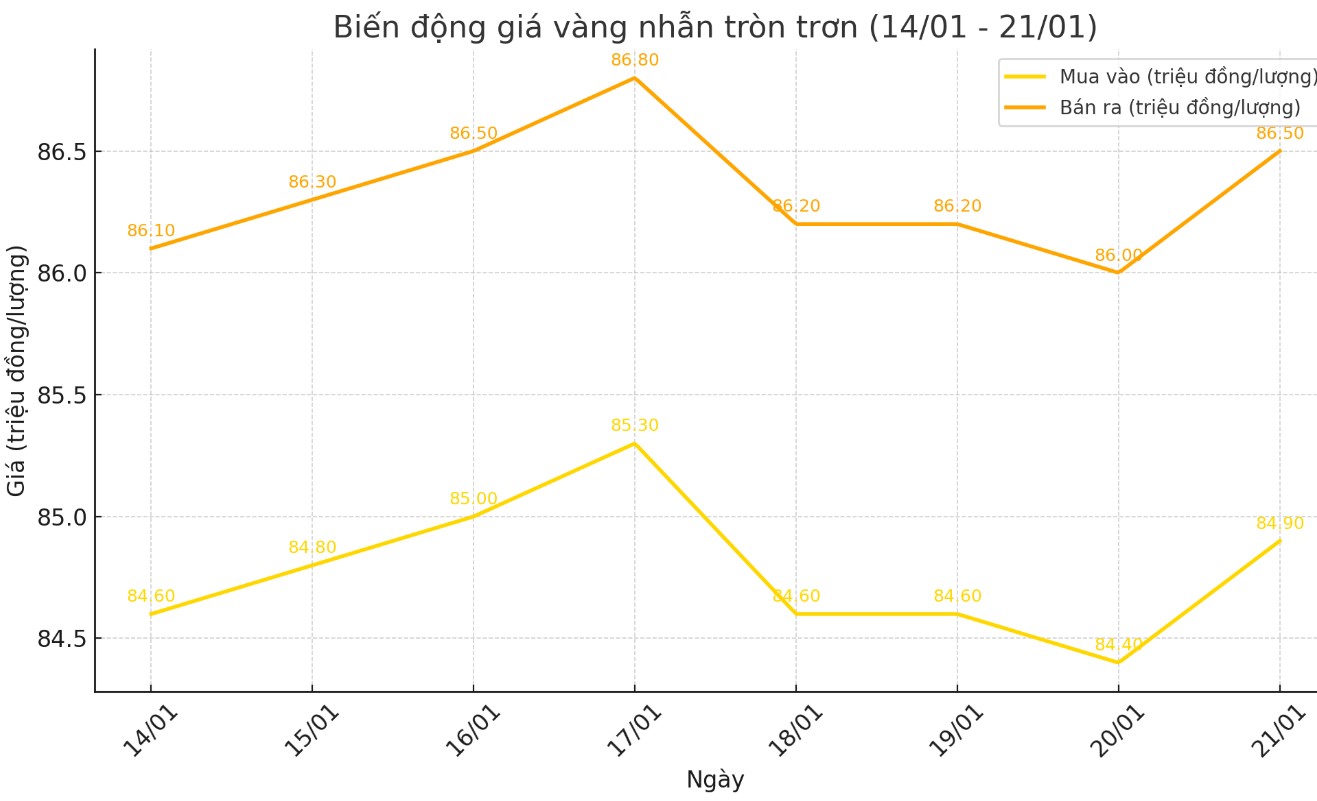

Price of round gold ring 9999

As of 9:25 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.9-86.5 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.8-87.15 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and 300,000 VND/tael for selling compared to early this morning.

World gold price

As of 9:30 a.m., the world gold price listed on Kitco was at 2,721.8 USD/ounce, up 28.8 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased sharply despite the increase of the USD. Recorded at 9:30 a.m. on January 21, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 108.190 points (up 0.3%).

According to Kitco - Gold prices recovered last night when Mr. Donald Trump may delay the imposition of tariffs.

Donald Trump was sworn in as the 47th president of the United States on Monday, and gold and silver were already experiencing sharp volatility on concerns that he would immediately impose large tariffs to support domestic U.S. manufacturing on his first day in office.

However, according to the Wall Street Journal, Mr. Trump issued a presidential memorandum directing federal agencies to investigate trade deficits and address unfair trade and currency policies from other countries. However, this directive does not include the imposition of new tariffs on the first day of his inauguration, which many countries have feared.

Concerns about tariffs and a global trade war have had a significant impact on the precious metals market. Last week, gold prices surged above $2,700 an ounce, while silver prices returned above $30 an ounce, reflecting the urgency in the market.

Some analysts have attributed the rise in gold and silver prices to disruptions in the global supply chain as the precious metals are moved from London to New York. Donald Trump’s tariff threats have created huge volatility in the futures and physical asset swaps market, as banks have moved large amounts of metals to the US to avoid the risk of potential tariffs.

UBS analyst Giovanni Staunovo said markets could see more volatility in the coming period as some of President Donald Trump’s policies could lead to higher inflation for longer, which would continue to support safe-haven assets like gold.

Although used as an inflation hedge, Mr. Trump’s inflationary tariff policies could force the US Federal Reserve to maintain high interest rates for longer, reducing the appeal of this non-interest-bearing precious metal.

Mr Trump has talked about high tariffs on imports. However, gold is a financial asset that is likely to be largely exempt from tariffs, according to Goldman Sachs. The bank only forecasts a 10% chance of a 10% tariff on gold in the next 12 months.

Economic Data to Watch This Week

Thursday: US weekly jobless claims report

Friday: S&P Flash PMI, US Existing Home Sales

See more news related to gold prices HERE...