Low profit despite sharp increase in gold prices

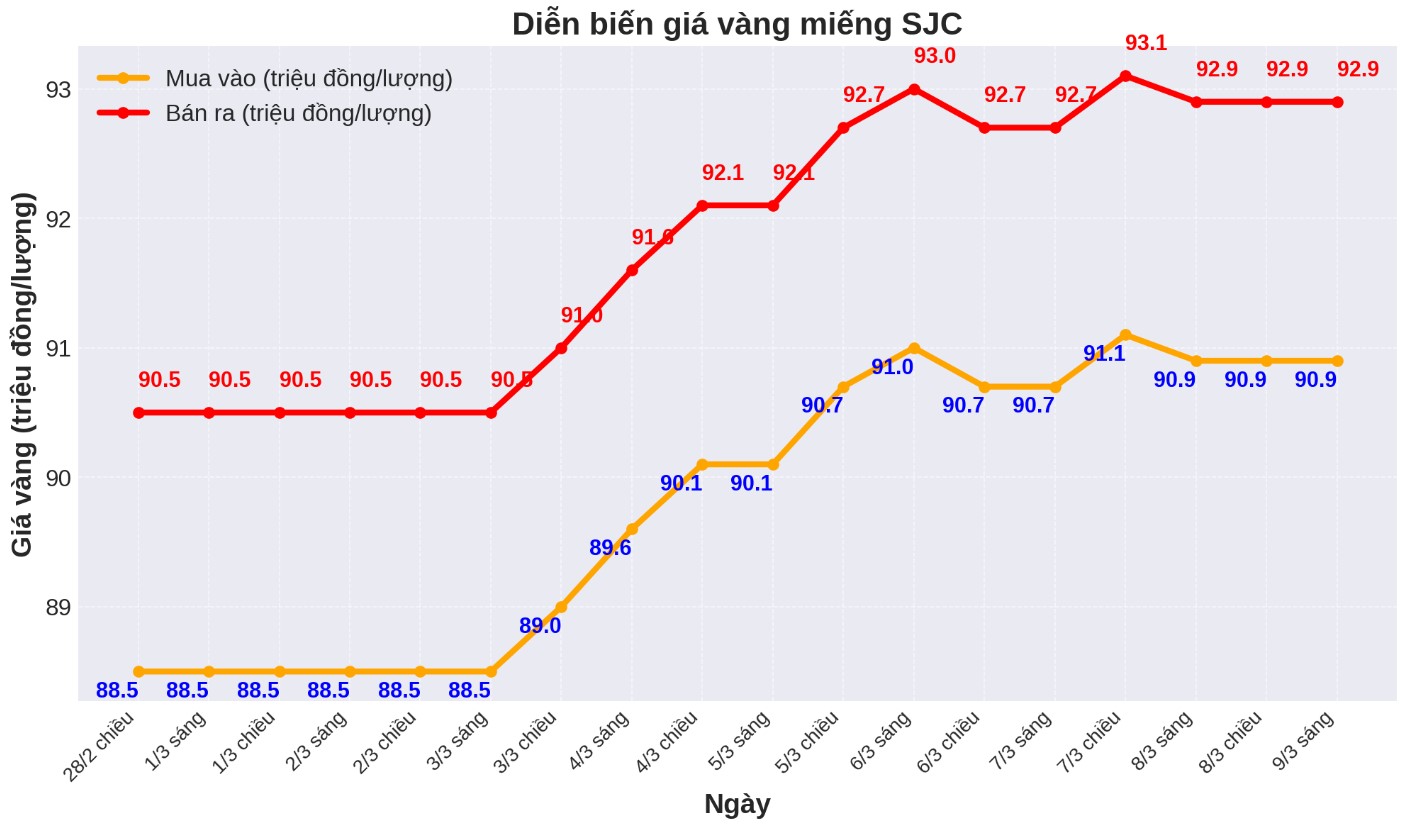

At the end of the trading session of the week, the price of SJC gold bars at DOJI Group and Saigon Jewelry Company SJC was listed at 90.9 million VND/tael (buy) and 92.9 million VND/tael (sell).

Compared to last weekend, the price of gold bars at these two units increased by 2.4 million VND/tael for both buying and selling. However, due to the difference between buying and selling prices remaining at 2 million VND/tael, gold buyers from last week and selling in today's session only made a profit of 400,000 VND/tael.

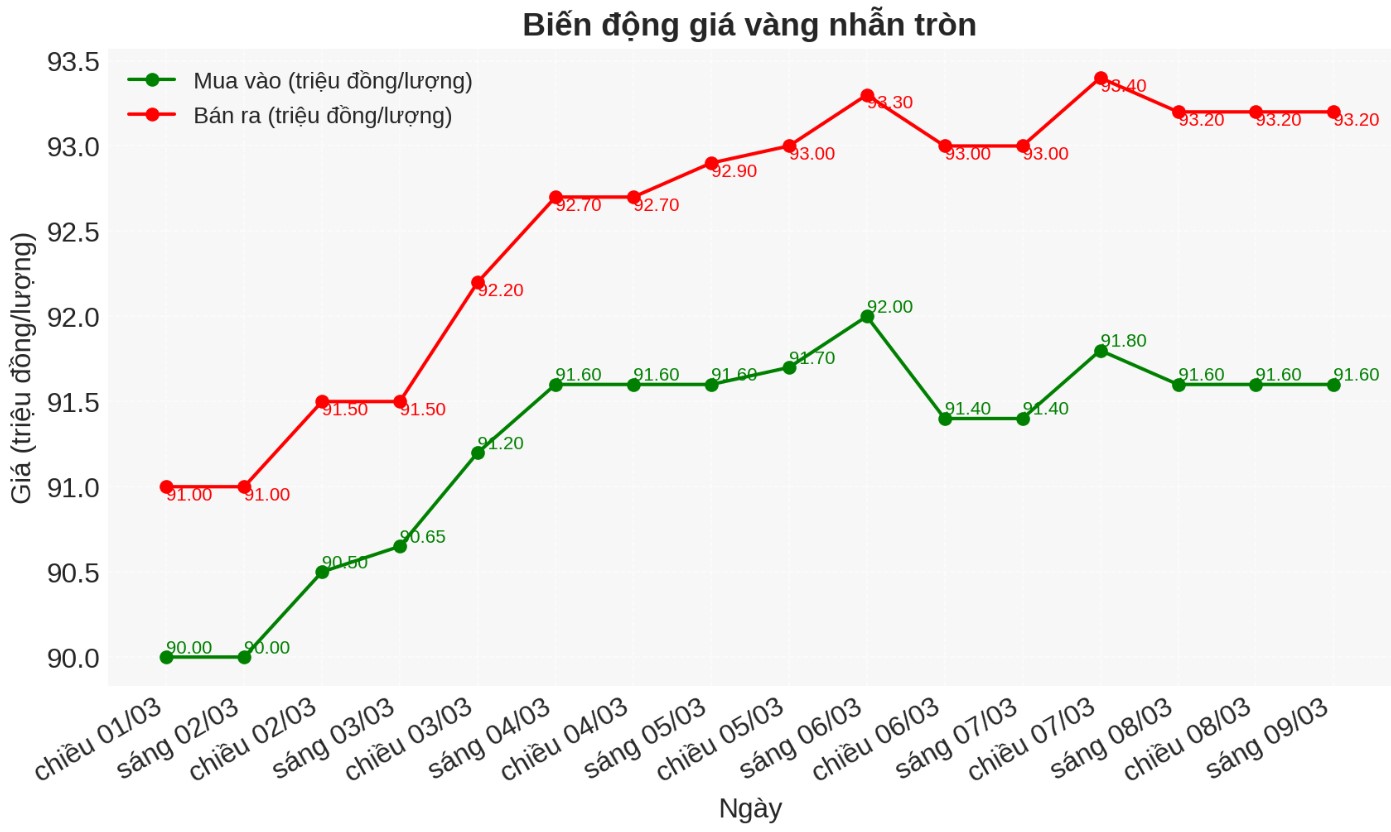

The price of 9999 gold rings last week also recorded a significant increase. Hung Thinh Vuong 9999 round gold rings at DOJI were listed at VND91.6 million/tael (buy) and VND93.2 million/tael (sell), up VND1.6 million and VND2.2 million respectively compared to last week.

At Bao Tin Minh Chau, the price of gold rings is listed at 91.7 million VND/tael (buy) and 93.3 million VND/tael (sell), with the corresponding increases of 1.6 million VND and 2 million VND/tael.

Although the price of gold rings has increased, due to the difference between buying and selling prices at 1.6 million VND/tael, buyers of DOJI gold rings only earn 600,000 VND/tael, while at Bao Tin Minh Chau it is 400,000 VND/tael.

Why?

The difference between buying and selling prices of gold remains high, which is the main reason for investors' profits to narrow.

For SJC gold bars, the price difference at DOJI and Saigon Jewelry Company SJC is 2 million VND/tael. For 9999 gold rings, the price gap between buying and selling at DOJI and Bao Tin Minh Chau is 1.6 million VND/tael. This is why buyers only earned a profit of 400,000 - 600,000 VND/tael even though gold prices have increased sharply this week.

The fluctuations in international gold prices also affect domestic gold prices. World gold prices are on the rise due to investors' need to take precautions against global economic fluctuations. However, domestic gold prices are often behind the world and affected by supply-demand regulation policies, causing the increase at some times to not really reflect the developments of the international market.

In addition, the psychology of hoarding gold as a safe investment channel has kept domestic demand for gold high. However, the majority of investors buy gold for long-term holding purposes, leading to low liquidity in the market. This contributes to a large gap between buying and selling prices, making it difficult for those who want to invest in the short term.

Although gold is a safe store, short-term investment needs to be carefully calculated due to price fluctuations and high differences, which can affect the actual profits of investors.

See more news related to gold prices HERE...