Updated SJC gold price

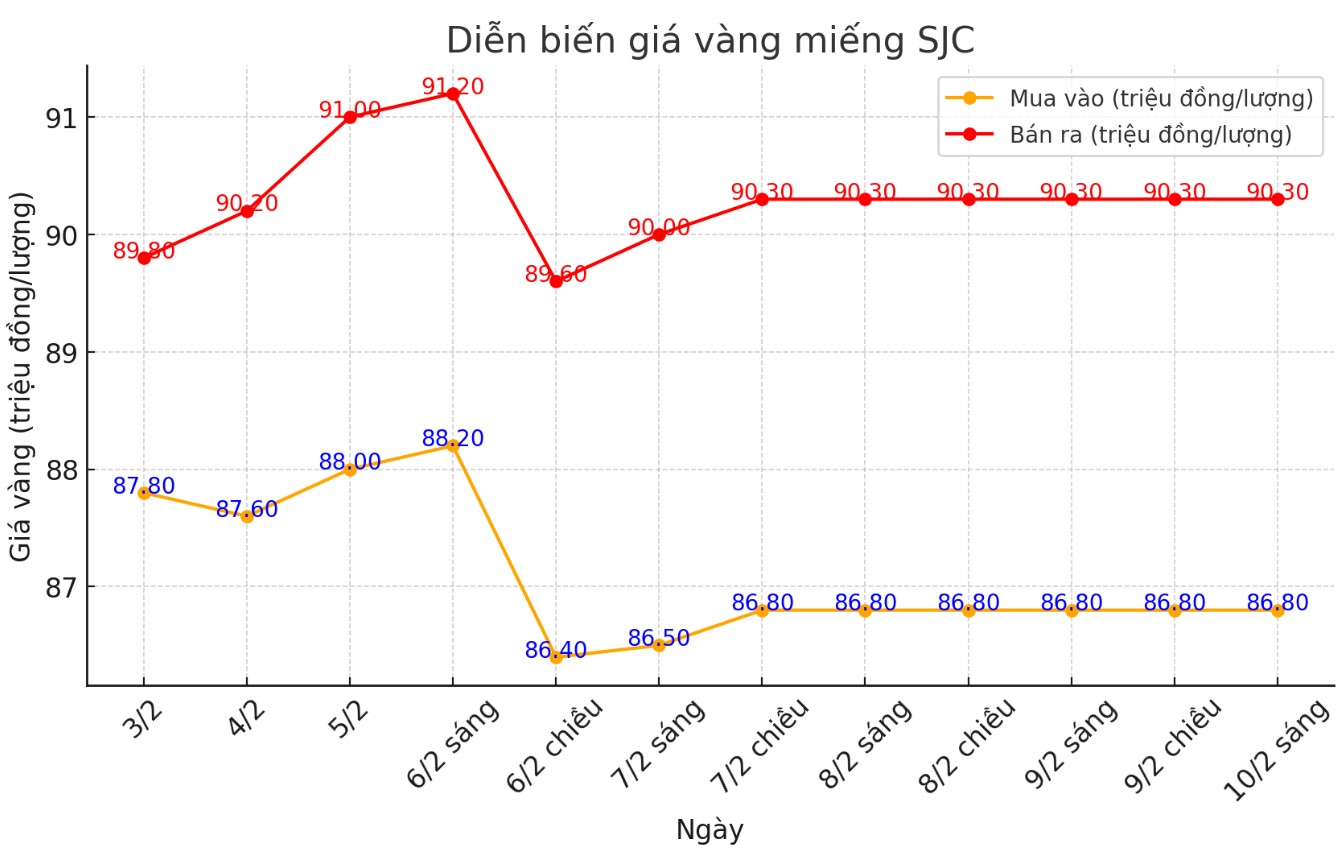

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company SJC at 86.8 - 90.3 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to the closing price of the previous trading session.

SJC gold price difference at Saigon SJC VBD Company at 3.5 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by Bao Tin Minh Chau at 86.8-90.3 million VND/tael (buy in - sell out); unchanged in both directions compared to the beginning of the previous trading session.

The difference between buying and selling prices of SJC gold at Bao Tin Minh Chau is at 3.5 million VND/tael.

The price of SJC gold bars was listed by DOJI Group at 86.8-90.3 million VND/tael (buy - sell); unchanged in both directions compared to the beginning of the previous trading session.

The difference between buying and selling prices of SJC gold at DOJI Group is 3.5 million VND/tael.

9999 round gold ring price

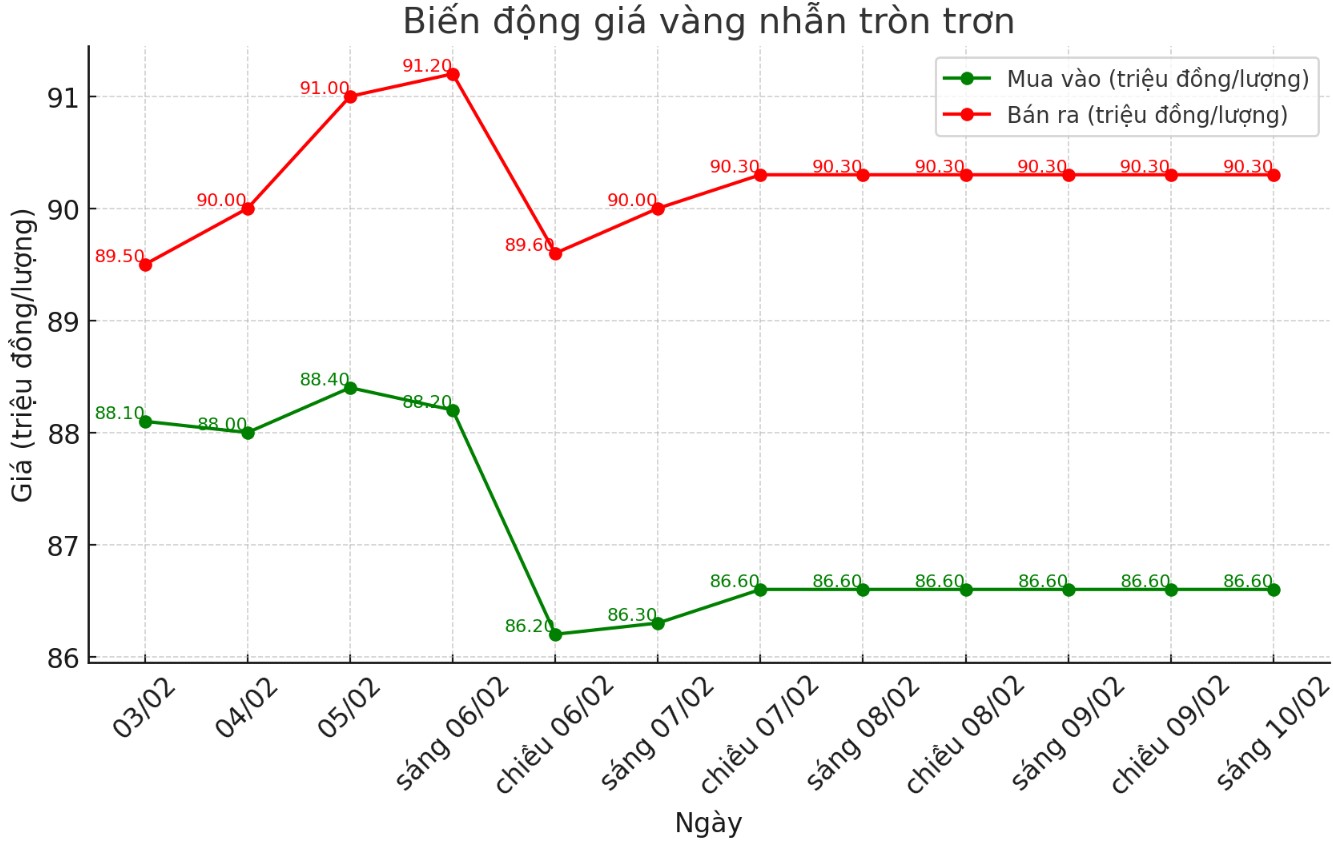

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 86.6-90.3 million VND/tael (buy in - sell out); both buying and selling prices remained unchanged compared to the beginning of yesterday's trading session.

The difference between buying and selling prices of Hung Thinh Vuong 9999 round gold rings at DOJI is 3.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 86.8-90.25 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to the beginning of yesterday's trading session. The difference between buying and selling is at 3.45 million VND/tael.

World gold price

As of 6:00 am on 10.2, the world gold price listed on Kitco is at the threshold of 2,861.2 USD/ounce, keeping the first session.

Gold Price Forecast

World gold prices are high despite the increase in the USD index. Recorded at 7:00 a.m. on February 10, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.930 points (up 0.35%).

Gold prices continued to rise due to safe-haven demand, hitting a record high. In addition to concerns about economics and geopoliticals, some experts warn that the gold market may fluctuate strongly when trading prices are at the peak, especially in the context that the US Federal Reserve (FED) is expected to keep interest rates unchanged until at least half this year.

Data released last Friday showed that the US economy created 143,000 jobs last month. Although the figure was lower than expected, the report also showed that wages increased more than expected and the unemployment rate decreased to 4.0%.

Preliminary data from the University of Michigan showed a sharp decrease in consumer belief, while the expectation of inflation in the next year increased by 1 percentage point to 4.3%.

At the first monetary policy meeting of the year, the Fed affirmed that it was not in a hurry to cut interest rates due to high inflationary pressures and the labor market remained healthy.

Naeem Aslam, chief investment officer at Zaye Capital Markets, predicts that gold prices will continue to rise as fears continue to increase.

“In fact, wage growth shows that the Fed’s fight against inflation has not ended, and gold is the perfect protective asset. This is strongly supporting gold prices.

In addition, US President Donald Trump's taxation plan is still being considered, and many believe that within the next month, there is no specific solution. Therefore, the motivation to increase the price of gold is still very strong and is likely to continue pushing the price high ” - he said.

Alex Kupsikevich - Head of Market Analysis at FXPro - said that the gain momentum of gold has just begun and the goal of 3,000 USD is only the beginning.

“The global rally began in October 2023 after the US Federal Reserve (FED) signaled to ease monetary policy and reduce interest rate growth. From October to November 2024, after an increase of 55% to $2,790/ounce, gold experienced a strong profit-taking, causing prices to fall to $2,550/oz, corresponding to an adjustment of 76.4% compared to the previous increase.

After weeks of struggling between buyers and sellers, steady buying momentum returned at the end of December. The fact that gold surpassed $2,800/ounce by the end of January 2025 has opened up expectations for a new wave of growth. If this trend continues, gold prices could reach 3,400 USD/ounce from August to October this year,” he said.

See more news related to gold price here ...