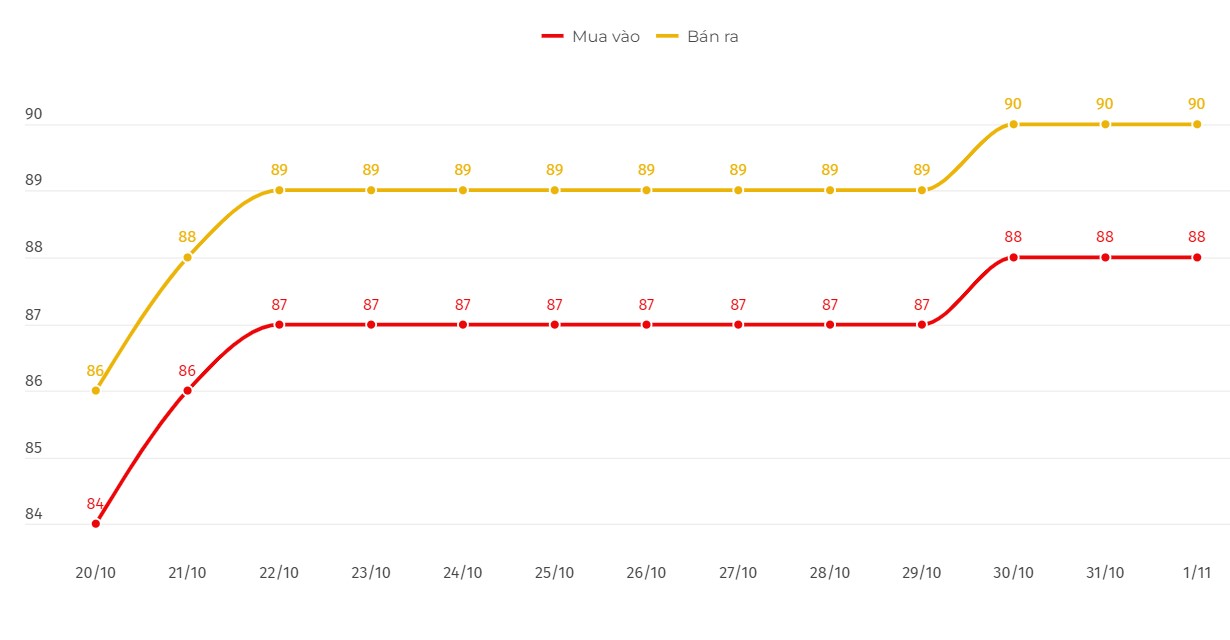

SJC gold bar price

As of 6:00 a.m. on November 1, the price of SJC gold bars listed by DOJI Group was at 88-90 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 88-90 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

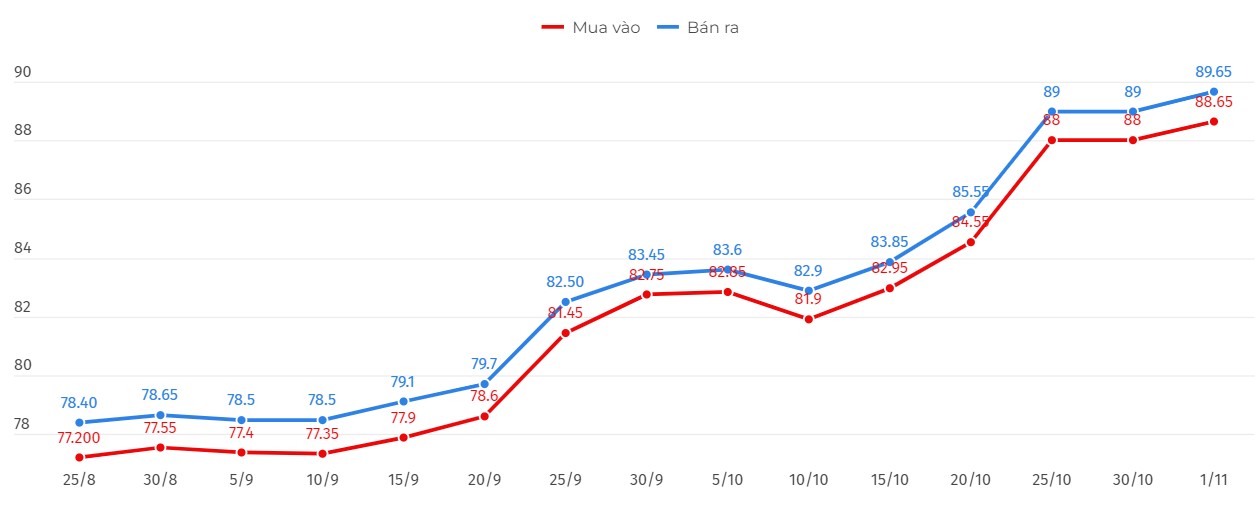

9999 gold ring price

As of 6:00 a.m. on November 1, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at VND 88.65-89.65 million/tael (buy - sell); an increase of VND 50,000/tael in both directions compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 88.63-89.63 million VND/tael (buy - sell); an increase of 50,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

This is the highest price ever for gold rings. However, in recent sessions, gold ring prices have often fluctuated in the same direction as the world market. In the context of a sharp decline in world gold prices, domestic gold rings are facing the risk of falling as well.

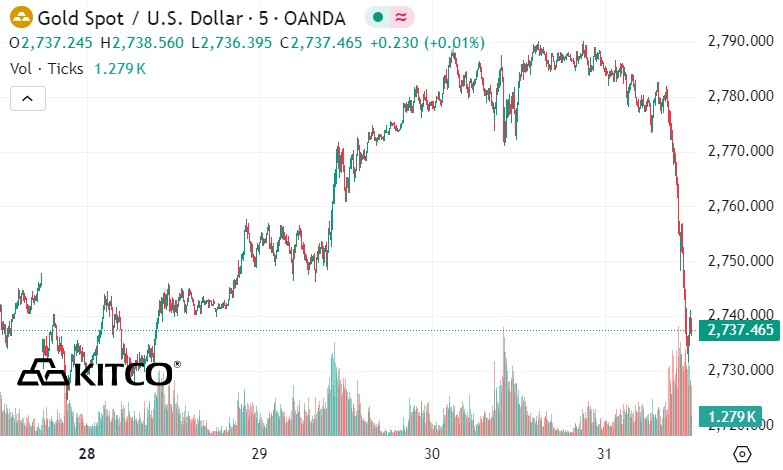

World gold price

As of 10:38 p.m. on October 31, the world gold price listed on Kitco was at 2,737.4 USD/ounce, down 50.6 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell sharply amid a sharp increase in the USD index. Recorded at 22:40 on October 31, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 104.245 points (up 0.16%).

The U.S. economy continues to inch closer to a soft landing as the labor market continues to maintain its resilience, with the number of Americans filing for unemployment benefits falling unexpectedly, according to Kitco News analyst Neils Christensen.

Initial state unemployment claims fell to a seasonally adjusted 216,000 for the week ended Oct. 26, the Labor Department said Thursday.

Claims fell 12,000 from the previous week's estimate of 228,000. The data beat expectations, with the consensus estimate showing claims of 229,000.

The gold market reacted strongly to the US labor market data. The market immediately came under technical selling pressure. December gold futures last traded at 2,784.10 USD an ounce, down 0.59% on the day.

The gold sell-off has intensified as the US economy remains resilient and inflationary pressures have remained steady over the past three months.

In fact, some experts have predicted the decline in gold. In an interview with Kitco News, prominent commodities investor Dennis Gartman expressed some concerns about the amount of attention gold has attracted in the past few weeks. New investment demand has pushed prices up significantly.

“I remain bullish on gold in the long term, but in the short term I am a little concerned. Gold could fall another 50 USD an ounce in the coming period as investors adjust their inflation expectations,” he said last week.

A potential correction in the stock market could also contribute to gold's short-term risk, potentially triggering a liquidity event, he added.

See more news related to gold prices HERE...