Update SJC gold price

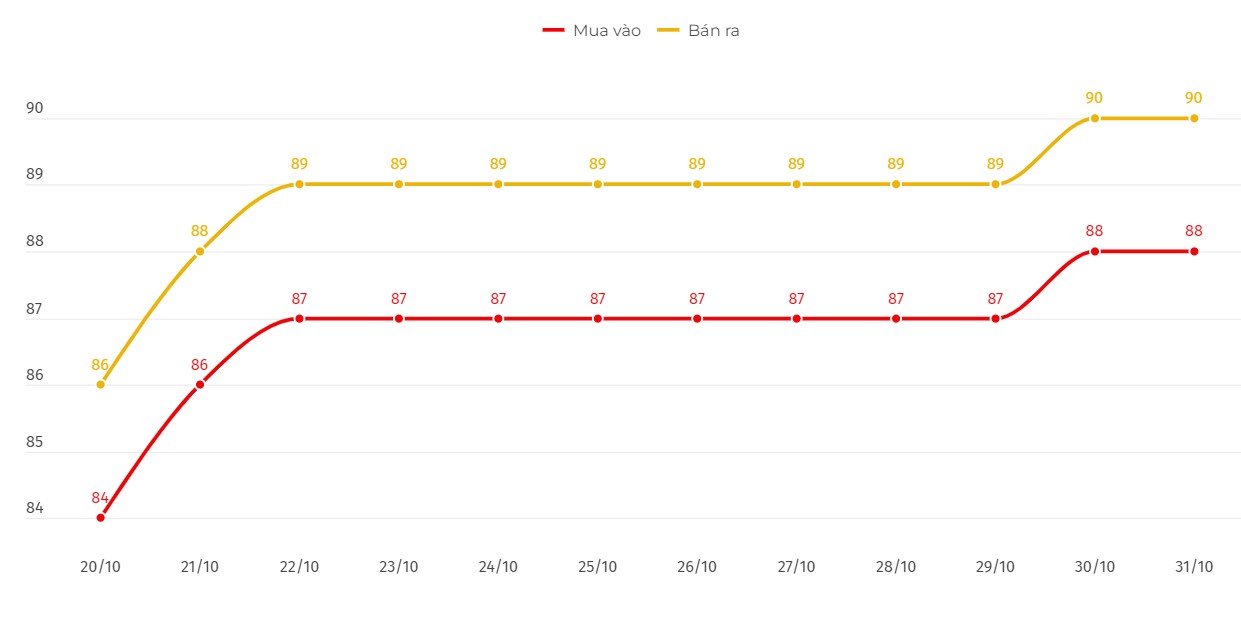

As of 5:45 p.m., the price of SJC gold bars was listed by DOJI Group at 88-90 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 88-90 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

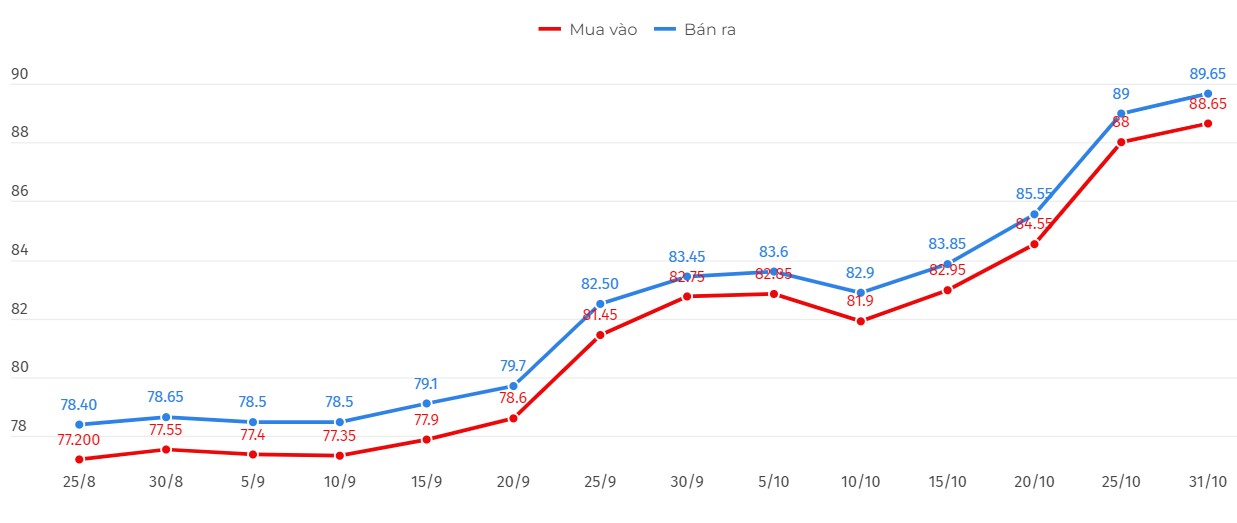

Price of round gold ring 9999

As of 5:45 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.65-89.65 million VND/tael (buy - sell); an increase of 50,000 VND/tael in both directions compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 88.63-89.63 million VND/tael (buy - sell); an increase of 50,000 VND/tael for both buying and selling compared to the close of the previous trading session.

World gold price

As of 5:45 p.m., the world gold price listed on Kitco was at $2,779/ounce, down $1.7/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell slightly as the USD index moved sideways. Recorded at 5:45 p.m. on October 31, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.850 points (down 0.01%).

News surrounding the US presidential election on November 5 is supporting gold prices. Considered a safe haven in times of geopolitical uncertainty, gold has gained 35% in value this year and is on track for its strongest year since 1979.

Strategist Daniel Pavilonis at brokerage firm RJO Futures said factors such as the upcoming election and political uncertainty, the US Federal Reserve (FED) cutting interest rates and the Russia-Ukraine conflict... are pushing gold prices to continue to rise. According to Mr. Pavilonis, gold prices could soon reach $2,850/ounce.

Meanwhile, Dominik Sperzel, head of trading at Heraeus Metals Germany, said gold could hit $3,000 an ounce by 2025, driven by inflows into gold ETFs and a post-election market correction.

New data showed the US private sector added 233,000 jobs in October, higher than expected, despite concerns about temporary disruptions due to hurricanes and strikes.

Fed policymakers are expected to cut interest rates by another 0.25 percentage points at their next meeting.Markets are also awaiting data on personal consumption expenditure and employment, due on November 30 and November 1.

Investors are looking ahead to Friday's U.S. nonfarm payrolls and manufacturing PMI data for more insight into Fed policy.