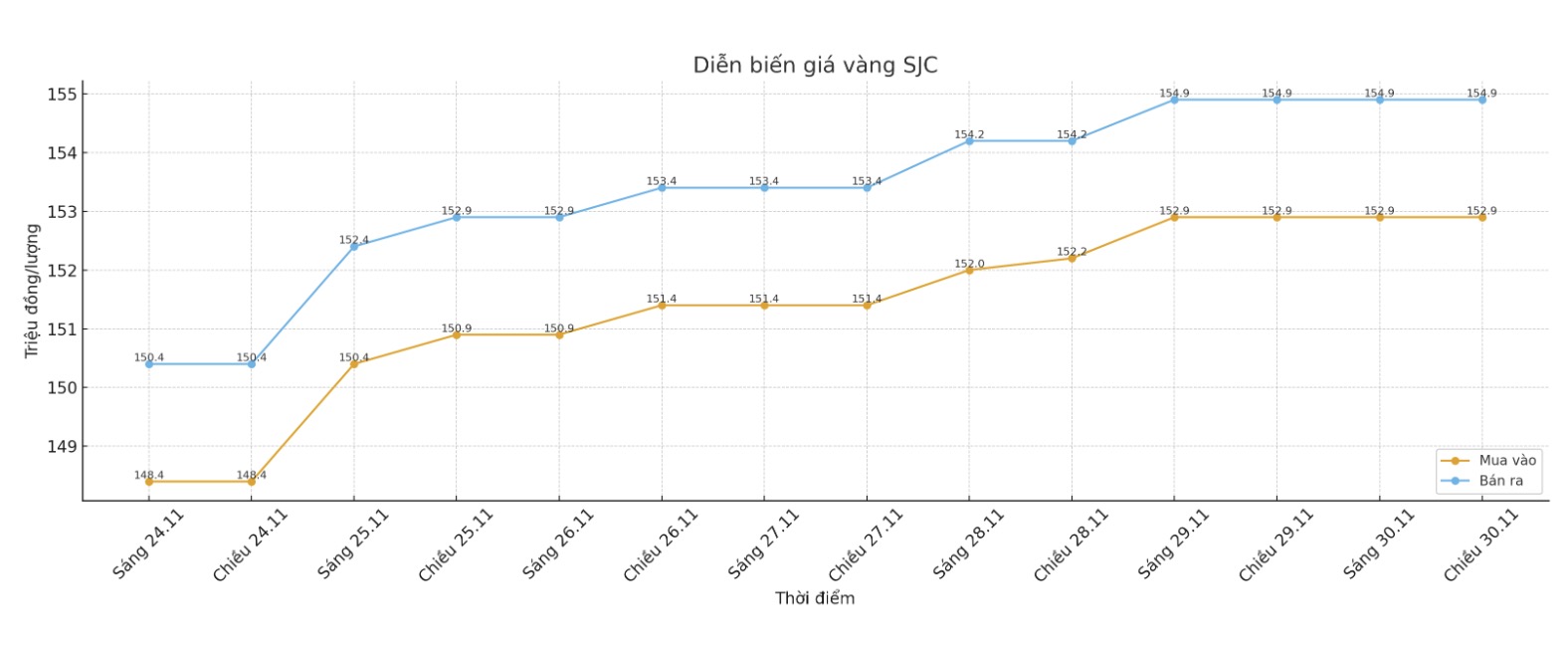

SJC gold bar price

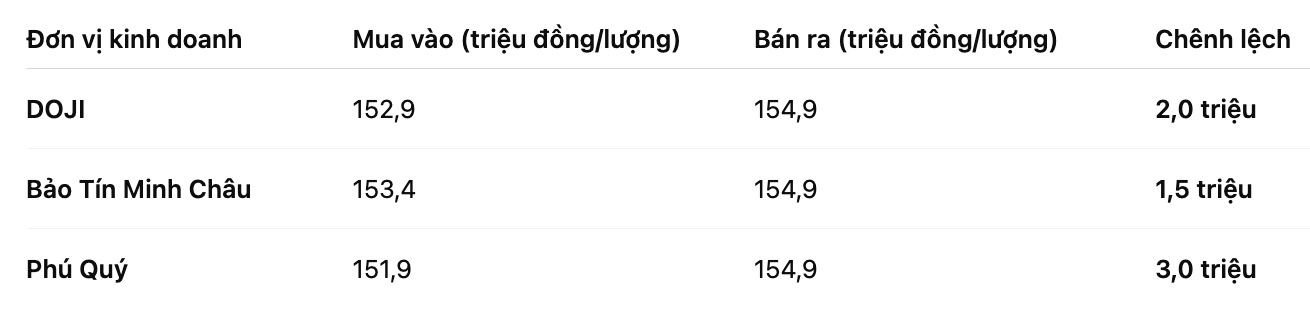

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 152.9-154.9 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.4-154.9 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.9-154.9 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

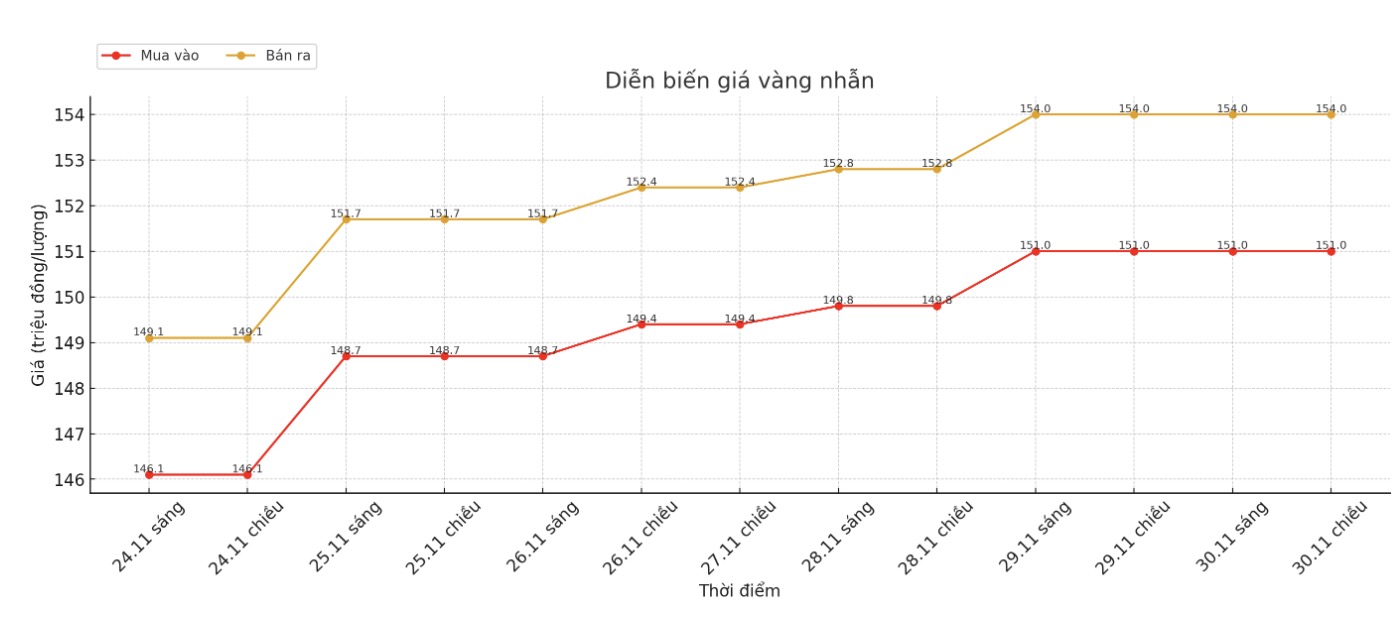

9999 gold ring price

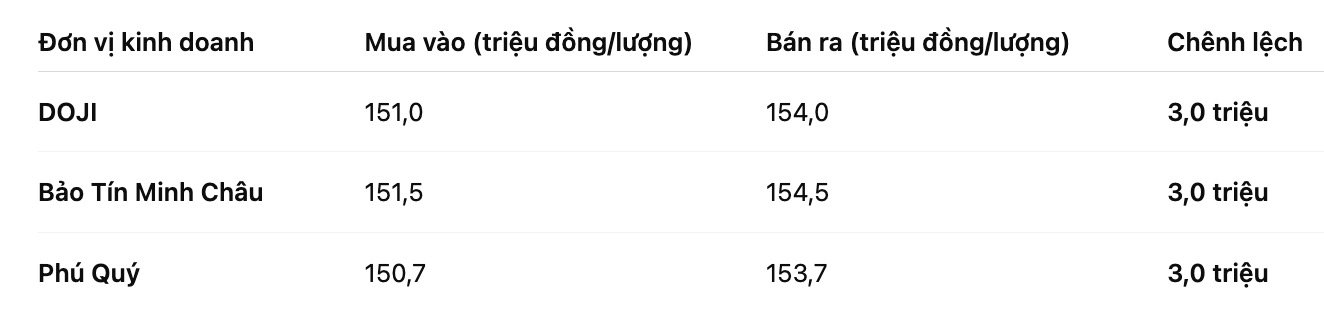

As of 6:00 a.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.5-154.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.7-153.7 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

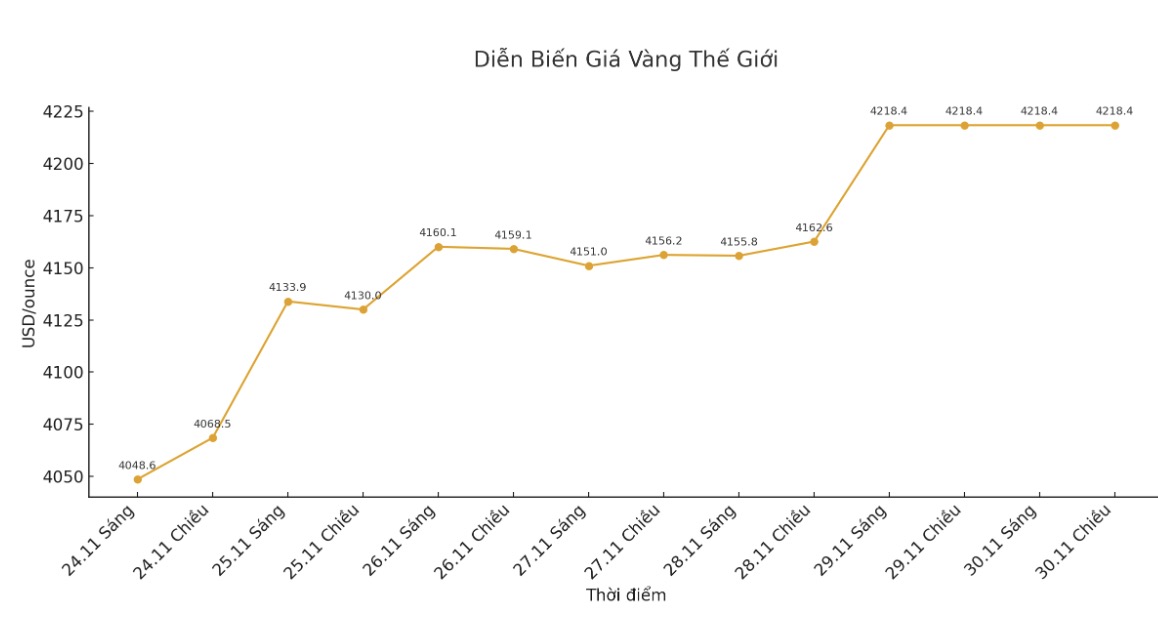

World gold price

The world gold price was listed at 6:00 a.m., at 4,218.4 USD/ounce.

Gold price forecast

The latest weekly gold survey by an international financial information platform shows that the majority of Wall Street analysts have returned to their bullish view on the short-term outlook for the precious metal, while investor Main Street has also strengthened its uptrend-leaning ratio.

This week, there were 14 analysts participating in the survey. Up to 11 experts, equivalent to 79%, predict gold prices will increase during the week; only one person, equivalent to 7%, expects prices to decrease. The remaining two experts, accounting for 14% of the total, believe that the precious metal will return to a sideways state during the week.

Meanwhile, Kitco's online poll recorded 260 votes, and Main Street investors' optimism also increased after gold prices jumped away from the $4,000/ounce support zone.

There are 183 individual traders, equivalent to 70%, predicting gold prices will increase during the week; 29 people, accounting for 11%, said the precious metal will decrease in price. The remaining 48 investors, or 19, expect prices to move sideways and accumulate this trading week.

A survey of more than 900 customers held on Goldman Sachs' Marquee platform shows that 36% of participants - the largest group - predict gold will surpass 5,000 USD/ounce by the end of next year. Another 90% expect gold to fluctuate in the 4,500 - 5,000 USD/ounce range, reflecting strong confidence in the uptrend.

US economic data to watch this week

Some important economic data for the market to digest will appear next week, although key reports such as the non-farm payrolls (NFP) for October and Q3 GDP will not be among them.

On Monday, the market will monitor the ISM manufacturing PMI for November, followed by the ISM services PMI released on Wednesday, along with the October ADP private sector jobs report - which will be reviewed more closely than usual in the context of a lack of NFP data.

Thursday will see a weekly jobless claims report, and the trading week will end with the October core PCE index and a preliminary survey of University of Michigan Consumer Psychology for December.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...