SJC gold bar price

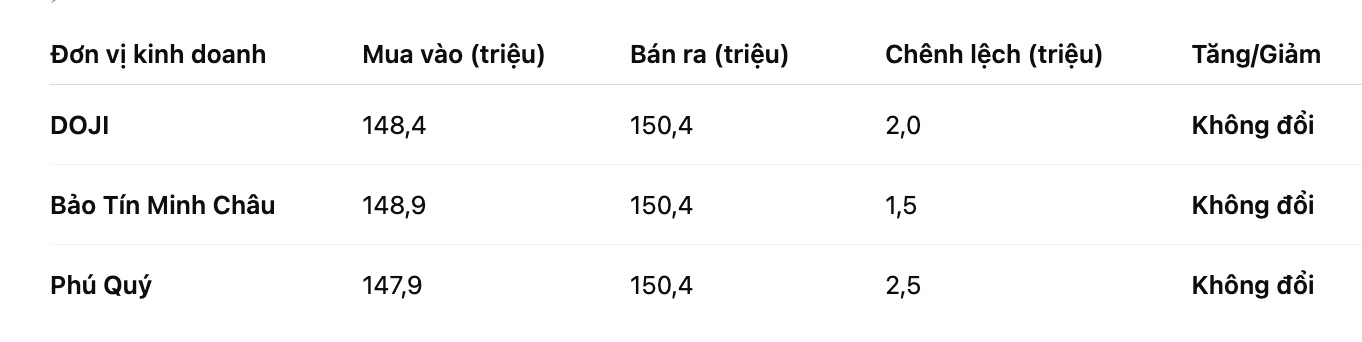

As of 6:40 p.m., DOJI Group listed the price of SJC gold bars at 148.4-150.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.9-150.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 147.9-150.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 6:40 p.m., DOJI Group listed the price of gold rings at 146.1-149.1 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.5-150.5 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.8-149.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 6:40 p.m., at 4,068.5 USD/ounce, up 4.3 USD compared to a day ago.

Gold price forecast

The USD Index (DXY) maintained its nearly six-month high set last Friday, making gold - valued in greenback - more expensive for holders of other currencies.

Gold is moving sideways as investors assess the prospect of another interest rate cut by the US Federal Reserve (FED), after New York Fed Chairman John Williams hinted that there could be room to lower borrowing costs in the context of a weakening labor market, although some other officials are still cautious, said Ole Hansen, head of commodity strategy at Saxo Bank.

Last Friday, Williams said that US interest rates could fall without affecting the Fed's inflation target, while helping to prevent the risk of weakness in the job market.

According to CME's FedWatch tool, betting on a Fed rate cut next month has skyrocketed to 76% from 40% on Friday, following Williams' somewhat dovish comments.

Gold is having difficulty creating momentum as the possibility of the Fed cutting interest rates may be delayed, demand in China causes concern, and trade risks reduce. In the supportive direction, central banks remain net buyers and concerns remain around the Supreme Court's ruling (on Donald Trump's tariffs)," Standard Chartered (a British-based multinational bank) wrote in a note.

"The direction of interest rate policy is currently very unpredictable. Gold is likely to fluctuate around the current price range," said Mr. Ahmad Assiri, strategist at Pepperstone Group. I dont expect there to be any big fluctuations coming, this is an ideal period for two-way transactions in a less volatile environment.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...