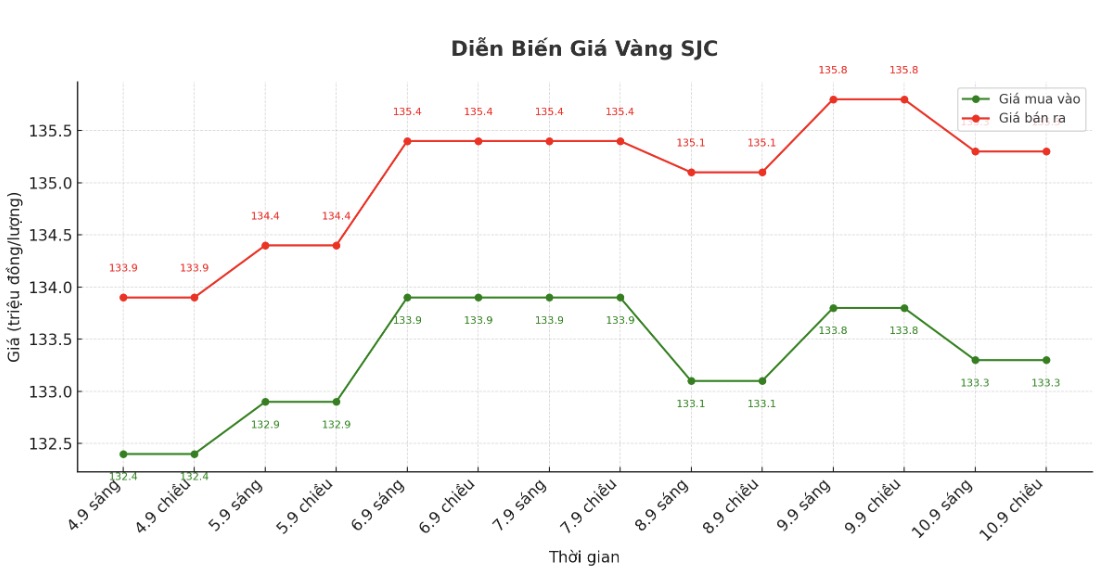

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 133.3-135.3 million VND/tael (buy in - sell out), down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 133.3-135.3 million VND/tael (buy - sell), down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.5-135.3 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.8 million VND/tael.

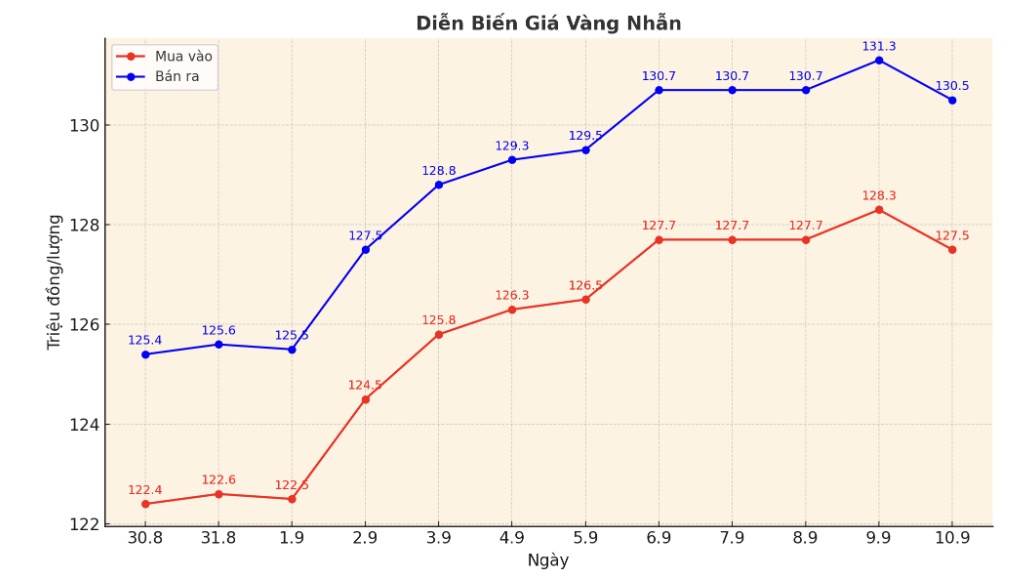

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 127.5-130.5 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 128.2-131.2 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127.7-130.7 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

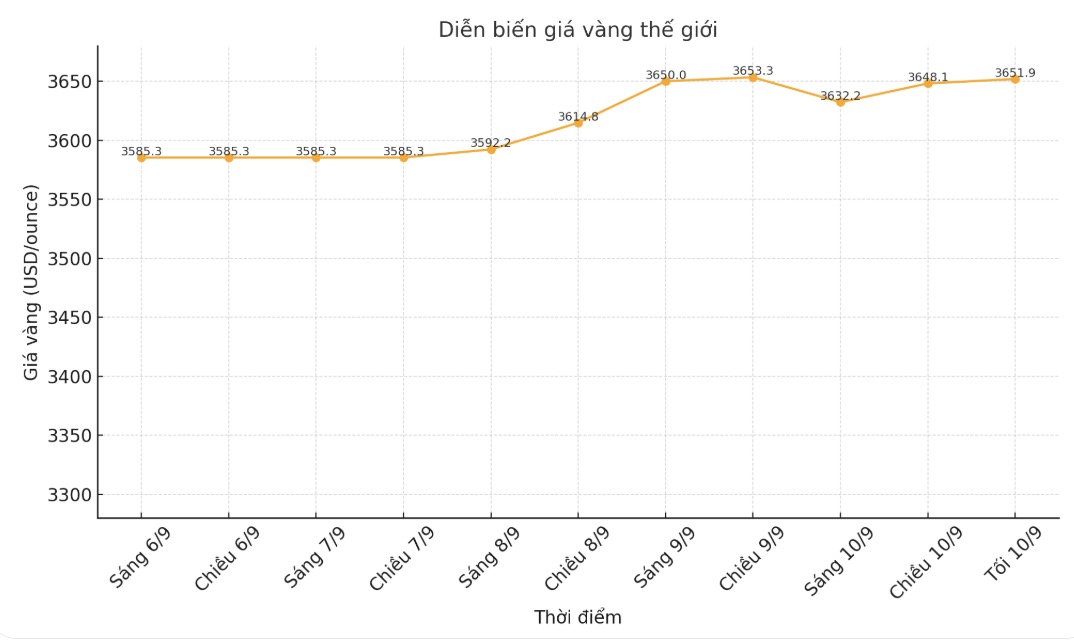

World gold price

The world gold price was listed at 9:10 p.m. on September 10 at 3,651.9 USD/ounce.

Gold price forecast

Gold prices are firmer and just below the record high on Tuesday in the US trading session on Wednesday morning. Investors are waiting for the US's key inflation report to be released in the morning.

December gold futures rose $10.1 to $3,692 an ounce. December silver futures also rose $0.284 to $41.625 an ounce.

US stock indexes are expected to open up today in New York, while global stocks last night fluctuated in different directions.

In geopolitics, tensions returned, supporting gold and silver prices as safe havens. Poland shot down Russian drones that entered the territory in the latest major airstrike on Ukraine.

Polish Prime Minister Donald Tusk told the Polish National Assembly on September 10 that NATO's Early Warning and Air Control System (AWACS) has been put in a state of alert after reports of a major attack by Russian missiles and drones on Ukraine on the night of September 9.

Polish Prime Minister Donald Tusk said that there were 19 airstrikes in Poland overnight, many of which were drones entering from Belarus.

The first air violation occurred at around 11:30 p.m. on September 9, local time, and lasted until around 6:30 a.m. on September 10.

The shooting down of these drones, which pose a security threat, has changed the political situation. Therefore, the consultations of the allies have been conducted in the form of a requirement to officially activate Article 4 of the NATO Treaty, said Mr. Tusk.

In another development, US Treasury Secretary Scott Bessent called on the Federal Reserve (FED) to change monetary policy after adjusted employment data showed weaker recruitment numbers for the year as of March.

On X, the Treasury Secretary wrote: prnhm Donald Trump inherited a much worse economy than reported, and he was right to say the Fed was holding back growth with high interest rates.

The US Energy Information Administration (EIA) warned that global oil supply has begun, with inventories expected to increase by an average of more than 2 million barrels/day in the current quarter to the first quarter of 2026.

Excess oil will put downward pressure in early 2026, which could prompt OPEC+ and some OPEC countries to cut supply afterwards. However, the EIA still forecasts that US crude oil production will decline in 2026 - the first decrease since 2021.

Overseas markets showed the USD index moving sideways, with crude oil futures rising, currently around $63.25/barrel. The yield on the 10-year US Treasury note was at 4.08%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...