SJC gold bar price

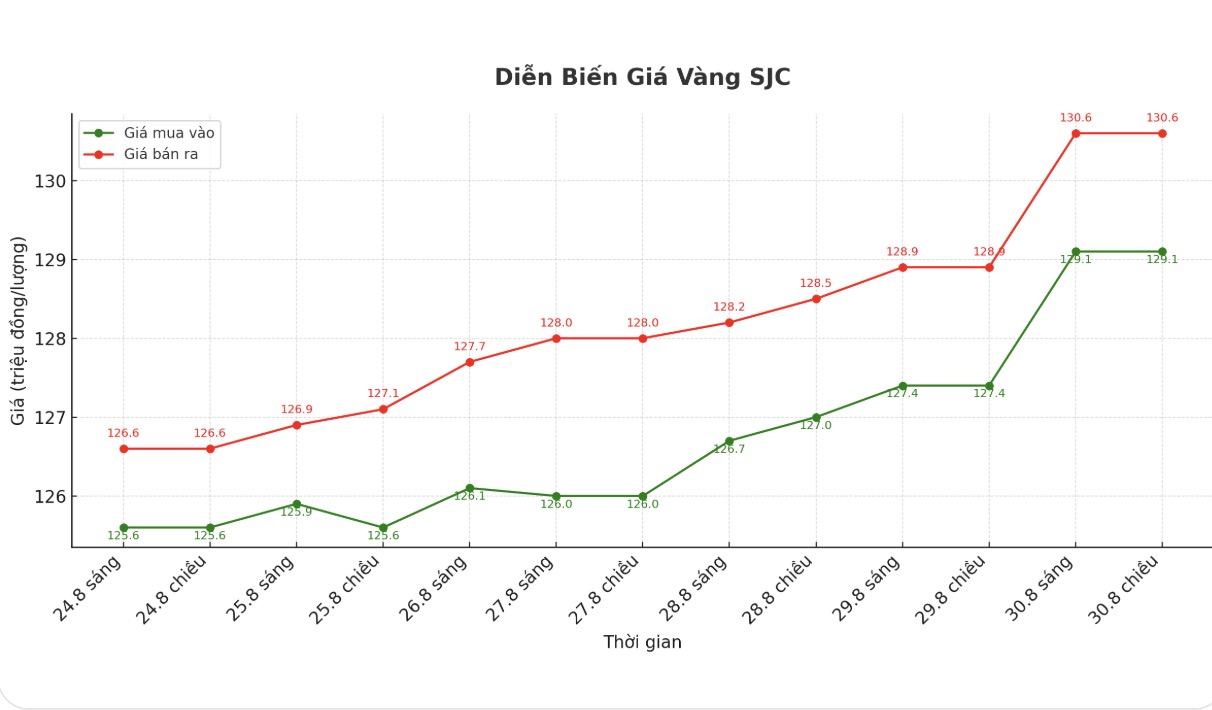

As of 5:00 p.m., DOJI Group listed the price of SJC gold bars at 129.1-130.6 million VND/tael (buy in - sell out), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-130.6 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying and an increase of 1.7 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 128.1-130.6 million VND/tael (buy in - sell out), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 122.5-125.5 million VND/tael (buy in - sell out), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 122.6-125.6 million VND/tael (buy - sell), an increase of 1.4 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 122.2-125.2 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

World gold price

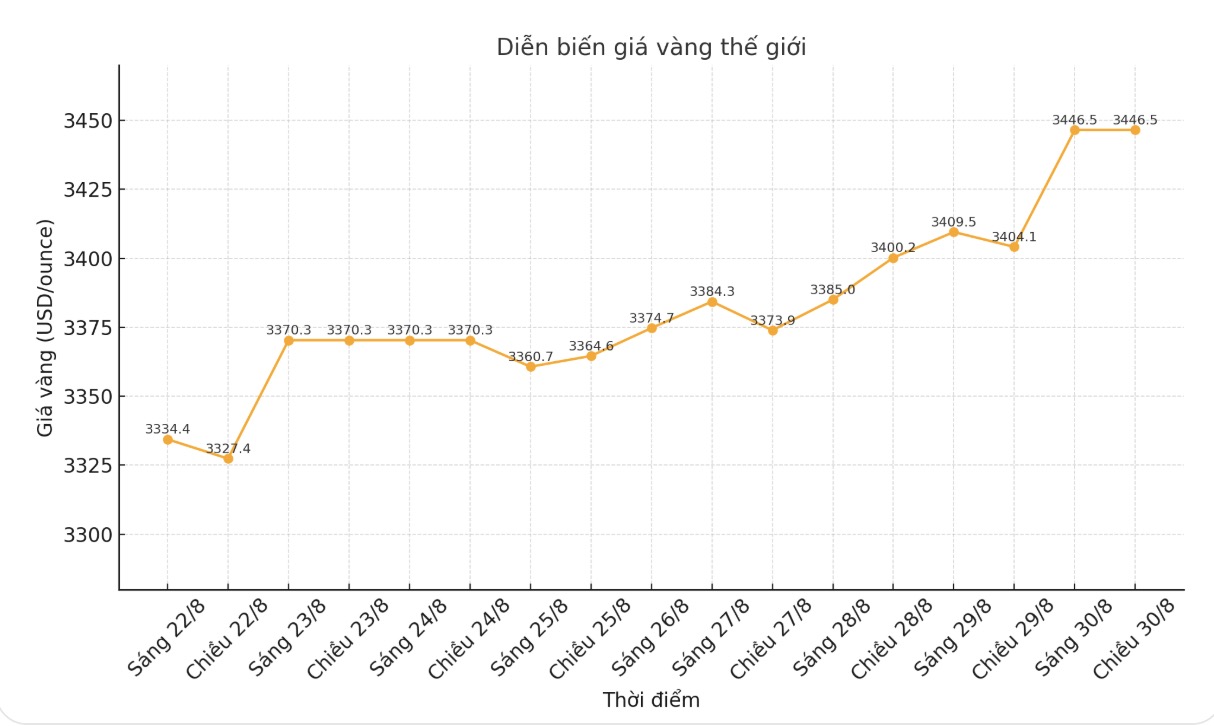

The world gold price was listed at 5:00 p.m. at 3,446.5 USD/ounce, up sharply by 42.4 USD.

Gold price forecast

Michele Schneider - Strategy Director of Market Gauge said that the gold buying signal was activated after the "harmony" speech of the Chairman of the US Federal Reserve (FED) - Mr. Jerome Powell at the annual conference in Jackson Hole.

Mr. Powell acknowledged that the change in the risk balance in the economy could lead to a policy adjustment, and expressed little concern about dragging inflation back to 2%, focusing more on slowing growth and a weakening labor market.

Data released by the US Commerce Department shows that the core personal consumption expenditure (PCE) price index - the FED's preferred inflation measure - increased by 2.9% over the past 12 months, as expected. Despite rising inflation, the market is almost certain that the Fed will cut interest rates in September.

Chris Zaccarelli - Investment Director of Northlight Asset Management commented that as long as the PPI and CPI report in early September did not suddenly increase, the FED would almost certainly cut by 0.25 percentage points.

Phillip Streible - Chief Strategist at Blue Line Futures predicts gold prices will continue to increase in the short term, but need to close above 3,500 USD/ounce to confirm the trend. December gold delivery contracts on the CME have risen to $3,511.50 an ounce, up more than 1% on the day and nearly 3% for the week. He said gold is rising because the market is starting to smell the risk of inflation.

Next week, the non-farm Payrolls data released on Friday is considered the biggest risk and also an important driver for gold.

Bill Adams - Chief Economist of Comerica Bank, forecast the August report to record 45,000 more jobs, the unemployment rate remains at 4.2%. If the data is weaker than expected, the pressure to cut interest rates by the FED will be even more evident.

In addition to the economy, political factors are also dominating the market. US President Donald Trump continues to pressure the Fed, weakening confidence in the USD as a reserve currency, thereby strengthening gold's position.

Recently, Mr. Trump changed the target from Mr. Powell to Fed Governor Lisa Cook, seeking to remove her from the monetary policy committee with the old accusation of violations.

Although Cook has not been prosecuted, analysts say the Fed's independent reputation has been affected. Mr. Trump controls the Fed story, which means interest rates will fall and gold prices will increase, said Naeem Aslam, Investment Director of Zaye Capital Markets.

Meanwhile, Chantelle Schieven - Head of Research at Capitalight Research - said that this confrontation will further weaken the USD, creating room for gold prices to set another historical peak.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...