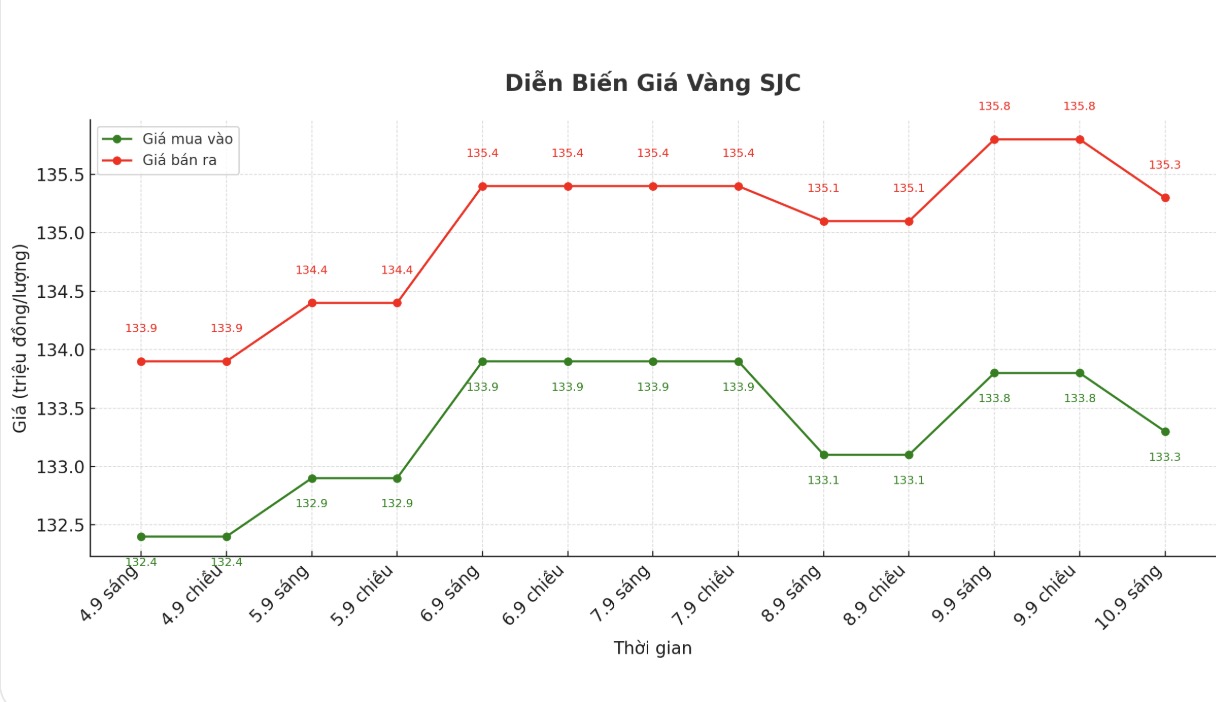

Updated SJC gold price

As of 9:20 a.m., DOJI Group listed the price of SJC gold bars at 133.3-135.3 million VND/tael (buy in - sell out), down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133.3-135.3 million VND/tael (buy - sell), down 500,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.5-135.3 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.8 million VND/tael.

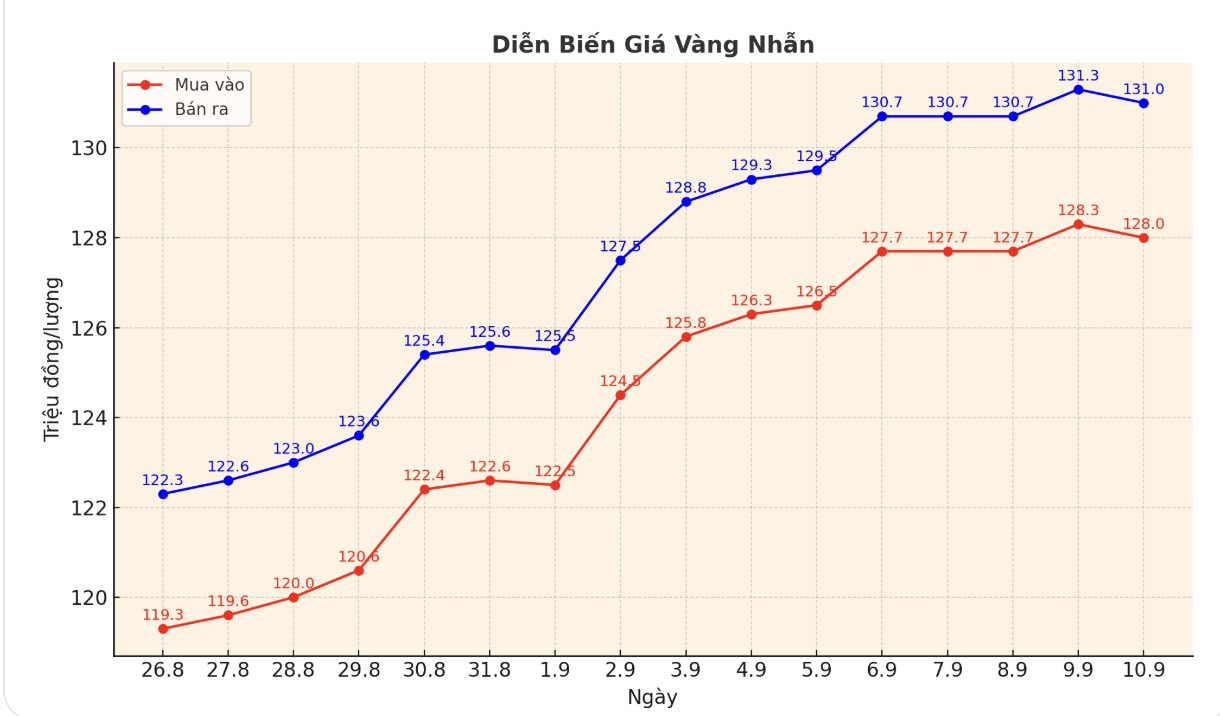

9999 round gold ring price

As of 9:20 a.m., DOJI Group listed the price of gold rings at 128-131 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 128.2-131.2 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127.7-130.7 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

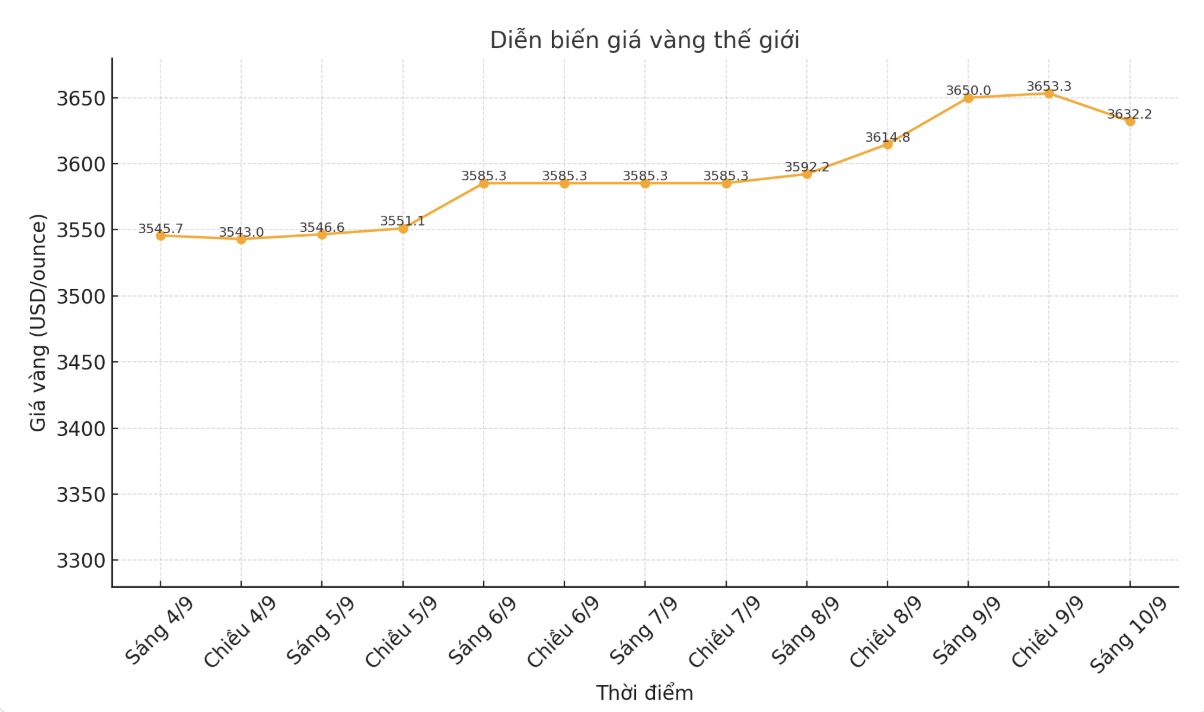

World gold price

At 9:20 a.m., the world gold price was listed around 3,632.2 USD/ounce, down 17.8 USD compared to a day ago.

Gold price forecast

Gold prices soared and quickly plummeted after the US Bureau of Labor Statistics (BLS) released preliminary adjustment data showing that US employment fell by nearly 1 million, three times higher than the 10-year average and the worst figure in history.

According to BLS, the preliminary estimate of the standard adjustment (benchmark revision) for the National Non-Farm Employment Statistics (CES) for March 2025 is -911,000 jobs (-0.6%).

The agency said the figure was 300% worse than the average over the past decade. In the last 10 years, the annual adjustment has an absolute value of only about 0.2% of total non-agricultural employment.

In another development, the People's Bank of China (PBoC) continued to boost gold purchases in August, marking a series of 10 consecutive months of hoarding this precious metal. The move is said to be aimed at diversifying reserves and reducing dependence on the US dollar, in the context of global gold prices continuously setting records.

This shows that China is steadfast in its goal of diversifying foreign exchange reserves, instead of relying too much on the USD.

The latest report from the World Gold Council (WGC) said that the gold buying rate of central banks around the world tends to slow down due to escalating prices. However, demand is still maintained by increasing geopolitical risks.

Technically, December gold futures still show buyers have a strong near-term technical advantage. The next upside target for buyers is to close above solid resistance at $3,750/ounce. On the contrary, the target for the sellers is to pull the price below the solid technical support zone at 3,550 USD/ounce.

We could see gold continue to rise from here as long as the US central bank acts as the market expects to cut rates several times, said Tim Waterer, chief analyst at KCM Trade.

According to CME Group's FedWatch tool, traders are pricing in an 89.4% chance of a 25 basis point cut at this month's meeting, and a 10.6% chance of a sharp cut of 50 basis points.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...