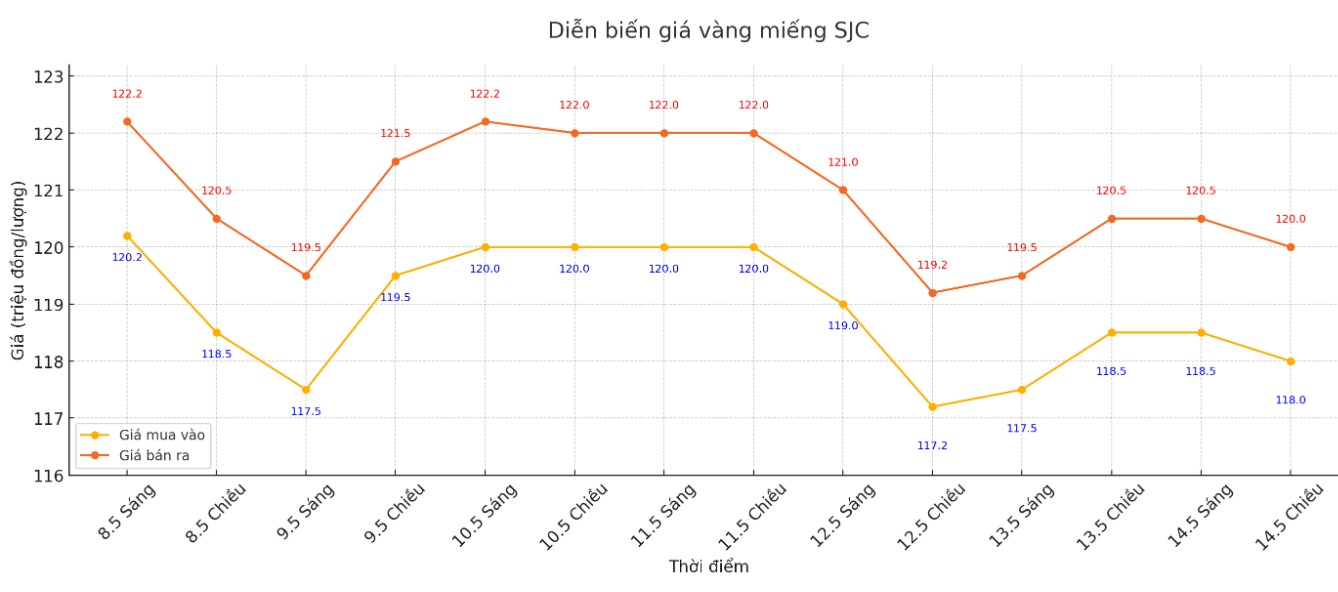

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND118-120 million/tael (buy in - sell out), down VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118-120 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-120 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

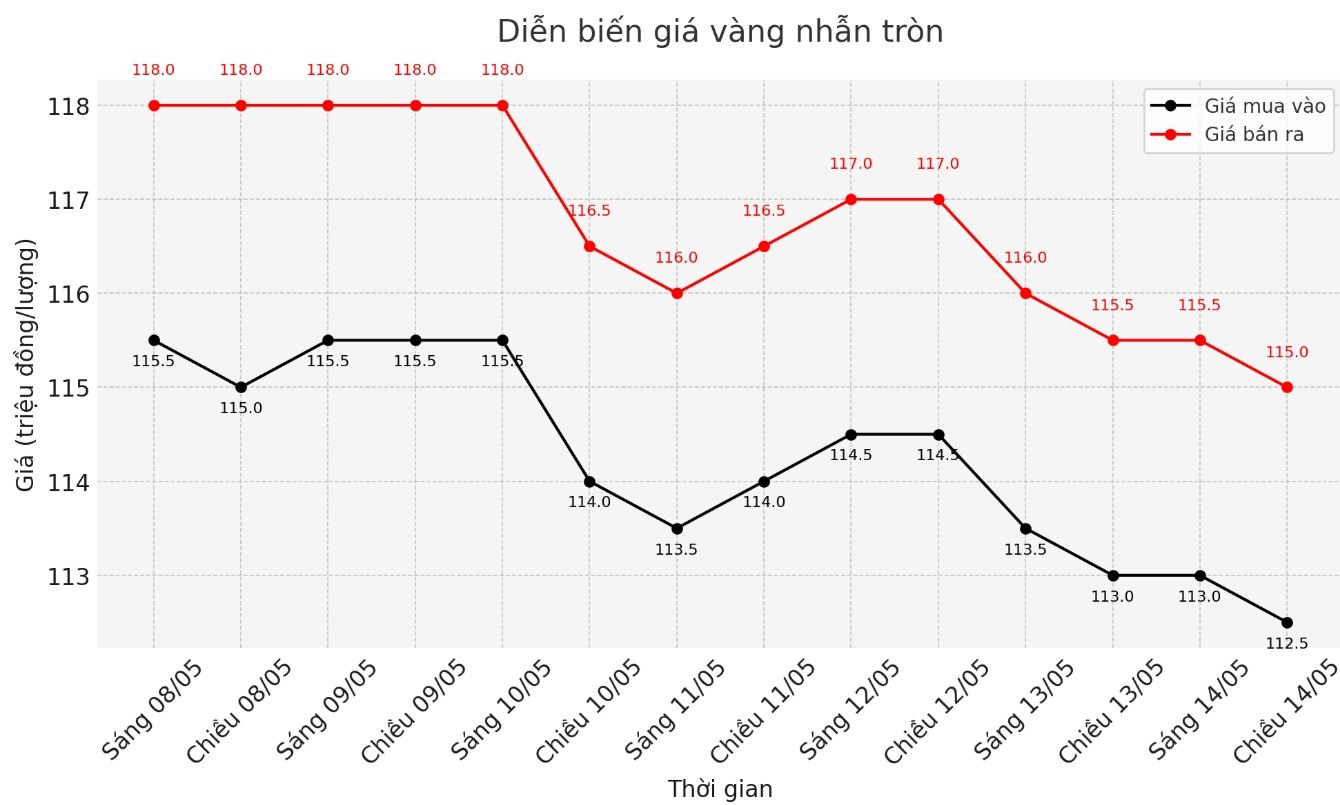

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-115 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

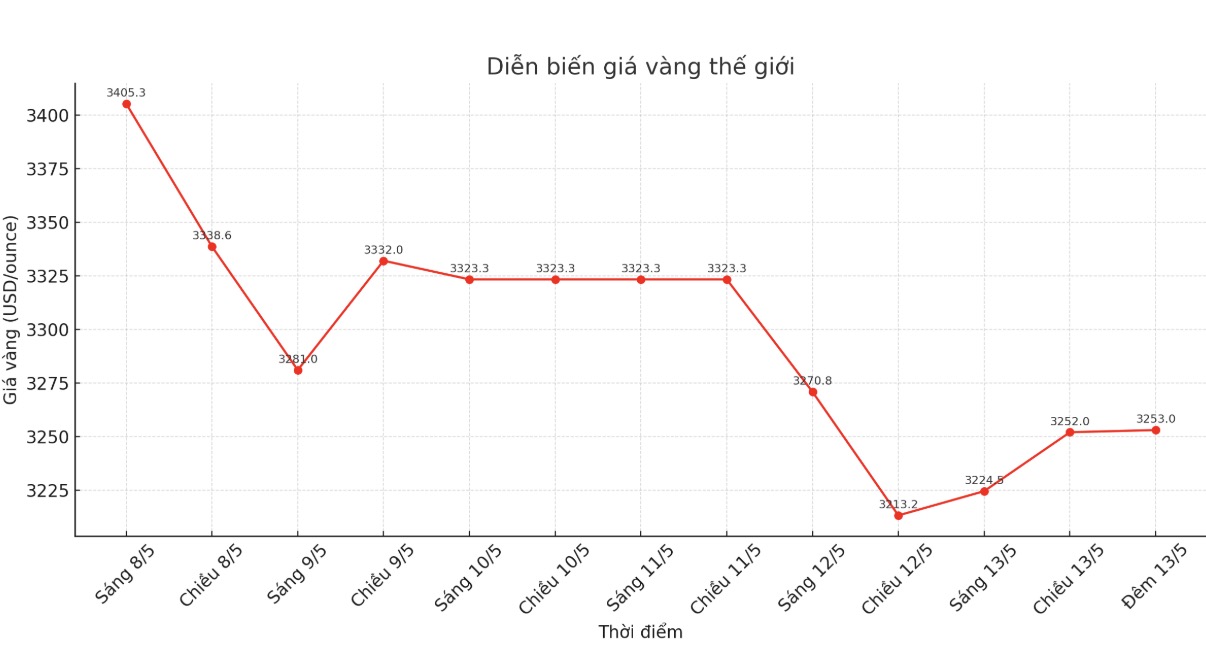

World gold price

At 0:00 on May 15, the world gold price listed on Kitco was around 3,188.9 USD/ounce, down sharply by 64.1 USD/ounce.

Gold price forecast

According to Kitco, world gold prices fell sharply last night, to a 5-week low. Silver prices are also falling. Profit-taking pressure and liquidation activities from investors holding weak positions in the futures market are outstanding factors this week.

In addition, improved risk-taking sentiment in the investment and trading world is also a negative factor for safe-haven metals such as gold.

June gold contract fell 60.9 USD to 3,187 USD/ounce. July silver contract decreased by 0.675 USD to 32.425 USD/ounce.

US stock indexes edged into the middle of the session after two strong increases, bringing prices to a 3-month high. Risk-taking sentiment has improved this week thanks to signs of cooling down in the commercial cold war between the US and China.

Both countries have eased some of their tariffs on each other this week. In addition, the US consumer price index (CPI) released on Tuesday at a "softer" level also helps reassure investors. The US producer price index (PPI) for April will be released on Thursday morning.

Technically, buyers and sellers of gold contracts for delivery in June are in a balanced position in the short term, but buyers are gradually weak. The next upside target for buyers is to close above $3,350/ounce. On the contrary, the near target for the sellers is to push the price below 3,100 USD/ounce.

The first resistance is today's high at $3,261.3, followed by $3,300/ounce. The first support is today's low at $3,178.30 an ounce, followed by $3,150 an ounce.

In the outside market, the USD index is currently decreasing slightly, although it has recovered from the low at the beginning of the session. Nymex crude oil futures fell slightly, trading around $63.5/barrel. The yield on the US 10-year Treasury note is currently around 4.45%.

See more news related to gold prices HERE...