Gold prices fell as tensions in US-China trade relations eased, weakening demand for safe-haven assets, while the market awaited the next set of inflation data to assess the policy of the US Federal Reserve (FED).

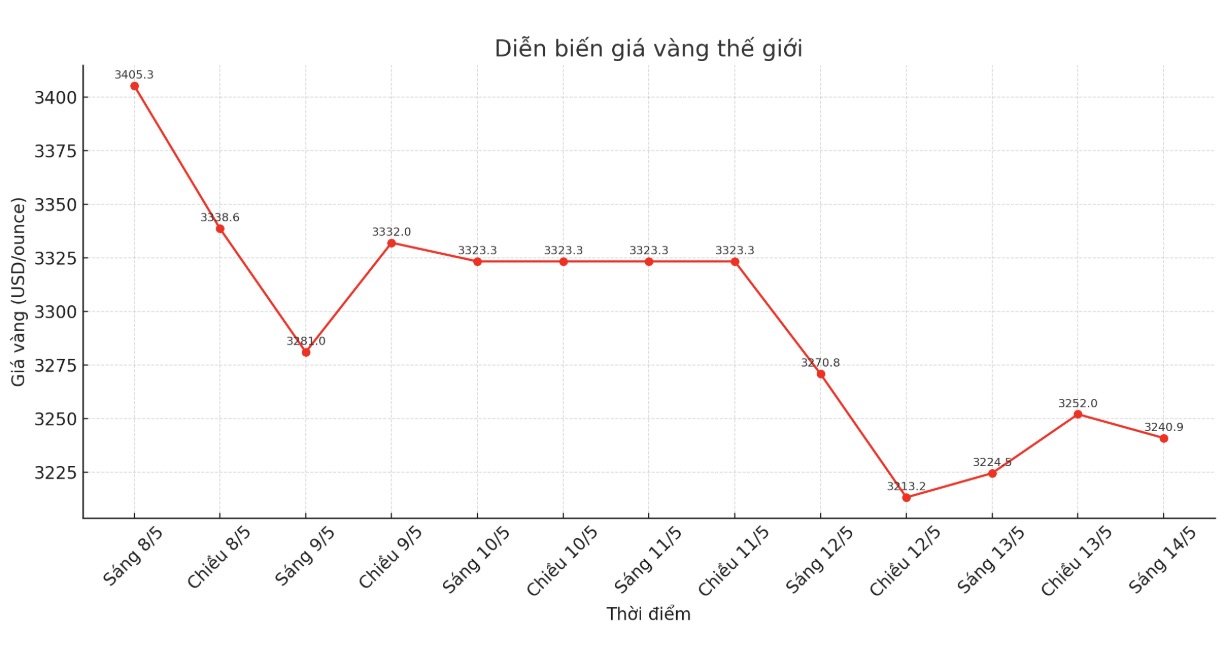

Spot gold prices fell 0.4% to $3,234.32 an ounce at 2:41 a.m. GMT (ie 9:31 a.m. Vietnam time). US gold futures fell 0.3% to $3,237/ounce.

Kyle Rodda - financial market analyst at Capital.com said: " Positive developments in US trade policy are reducing the attractiveness of gold in the short term.

I think that if the trade negotiation process continues and the agreements are signed between the US and its trading partners, gold prices could fall further. $3,200/ounce is a key support level."

The US will cut tax rates on low-value shipments from China to 30%, according to an executive order from the White House and industry experts, which helps reduce tensions in the trade war that could cause damage between the world's two largest economies.

On Monday, US President Donald Trump said he did not see the possibility of a Chinese goods tax rate returning to 145% after a 9-day postponement, while affirming that he believed that Washington and Beijing would reach an agreement.

Meanwhile, the US Department of Labor said the consumer price index (CPI) rose 0.2% in April, while economists surveyed by Reuters forecast a 0.3% increase after falling 0.1% in March.

Traders are awaiting the Producer Price Index (PPI) data, due out on Thursday, to seek signals on the Fed's interest rate path. The market expects a 53 basis point interest rate cut this year, starting from September.

Gold, which is seen as a hedge against inflation, also tends to thrive in a low-interest-rate environment.

On Tuesday, Mr. Trump continued to call on the Fed to lower interest rates, saying that gasoline, food prices and "most of all else" all fell.

Spot silver prices fell 0.8% to $32.63/ounce, platinum prices were stable at $987.85, and palladium fell 0.7% to $950.18.